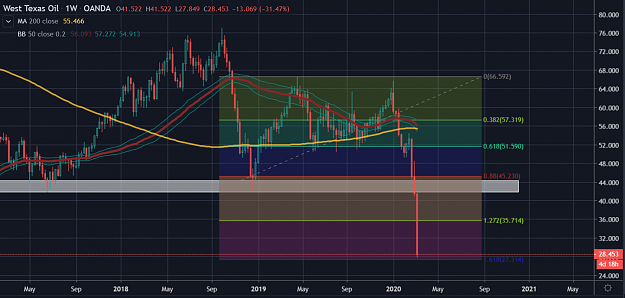

A huge gap down is coming. Anyone who is still in short is about to get paid $$$

- Post #6,601

- Quote

- Mar 8, 2020 5:06pm Mar 8, 2020 5:06pm

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #6,602

- Quote

- Mar 8, 2020 5:08pm Mar 8, 2020 5:08pm

- Joined Nov 2008 | Status: Full Time Trader | 10,519 Posts

Rule No.1: Never lose money. Rule No.2: Market is always right !

- Post #6,604

- Quote

- Mar 8, 2020 7:20pm Mar 8, 2020 7:20pm

- Joined Sep 2017 | Status: Still a total mystery | 3,575 Posts

Can you afford to take that chance?

- Post #6,605

- Quote

- Mar 8, 2020 9:24pm Mar 8, 2020 9:24pm

- Joined Sep 2018 | Status: Member | 456 Posts

- Post #6,606

- Quote

- Mar 8, 2020 10:46pm Mar 8, 2020 10:46pm

Self-sufficiency is the greatest of all wealth. - Epicurus

- Post #6,607

- Quote

- Mar 9, 2020 12:02am Mar 9, 2020 12:02am

- | Joined Jul 2015 | Status: Member | 23 Posts

- Post #6,608

- Quote

- Mar 9, 2020 1:32am Mar 9, 2020 1:32am

Self-sufficiency is the greatest of all wealth. - Epicurus

- Post #6,609

- Quote

- Mar 9, 2020 3:35am Mar 9, 2020 3:35am

- Joined Feb 2016 | Status: Full Time Trader. | 5,432 Posts

4&1 All Time Profit:

$37,496

- Post #6,610

- Quote

- Mar 9, 2020 4:09am Mar 9, 2020 4:09am

- Joined Apr 2018 | Status: Member | 1,732 Posts

All charts/ideas based on UK time zone

- Post #6,611

- Quote

- Mar 9, 2020 4:26am Mar 9, 2020 4:26am

- Joined Apr 2009 | Status: Live and learn. | 21,792 Posts

"If The Fool persists in his Folly he will become wise." - William Blake

- Post #6,613

- Quote

- Mar 9, 2020 6:30am Mar 9, 2020 6:30am

- | Joined Jul 2017 | Status: Member | 275 Posts

- Post #6,614

- Quote

- Mar 9, 2020 7:51am Mar 9, 2020 7:51am

- Joined Nov 2008 | Status: Full Time Trader | 10,519 Posts

Rule No.1: Never lose money. Rule No.2: Market is always right !

- Post #6,615

- Quote

- Mar 9, 2020 8:30am Mar 9, 2020 8:30am

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #6,616

- Quote

- Mar 9, 2020 11:34am Mar 9, 2020 11:34am

- Joined Sep 2017 | Status: Still a total mystery | 3,575 Posts

Can you afford to take that chance?

- Post #6,617

- Quote

- Mar 9, 2020 12:05pm Mar 9, 2020 12:05pm

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #6,618

- Quote

- Mar 9, 2020 12:09pm Mar 9, 2020 12:09pm

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #6,619

- Quote

- Mar 9, 2020 12:27pm Mar 9, 2020 12:27pm

- Joined Feb 2016 | Status: Full Time Trader. | 5,432 Posts

4&1 All Time Profit:

$37,496