Last month... ...

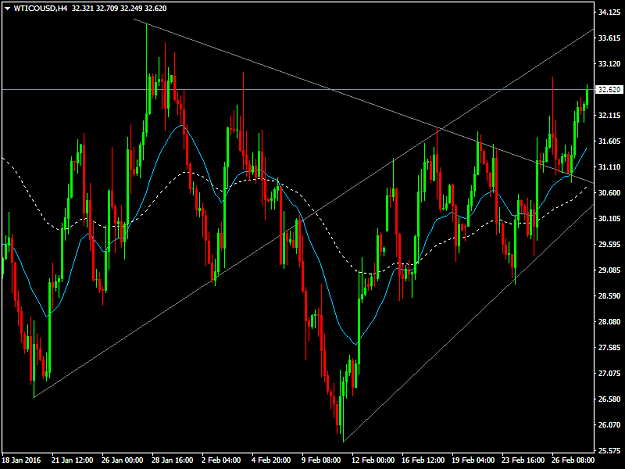

I blowed an 1K account again in two weeks on Jan. 20, SPX long positions were stopped out around 1820 and WTI long positions stopped out at 26.68. Yes! all of them are stopped at the bottom.

Am I newbie? Not at all. I knew risk control, I knew counter-trend trading like catching falling knives and non-productive, I knew money management, I almost knew everything about trading. But I just can't help myself.

I WAS A GAMBLER! A stupid gambler without self-control and decipline, but with getting-rich-fast greed!

Several days later,$300 wired to the account , lost again like a drop of water in desert. It was painful, really painful.

Asking why, I came back to FF and started to read posts and learn again. In one of the posts, I happend to find an introduction to a book -- Pit Bull by Marty Schaltz. I read it from a website. In fact, there is nothing about trading I learned, but the fact the author worked 16 hours every day including weekends, that impressed me! Remember, Marty was champions of American futures contest during 1980s, and he kept the championship for 10 years(?)! But he still worked so hard. At that time he made several millions every year, but he still worked so hard.

So I need to work hard also and be serious! Because I can not lose any more!! I have lost too much! The story? No, I won't tell. If I make it one day, finally, maybe I will tell the sad story about a pethetic speculator.

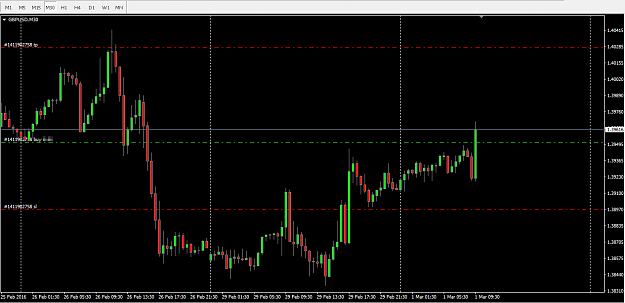

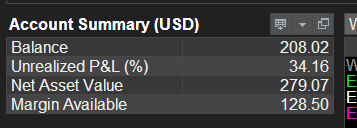

Transfer another $200 again two weeks ago, this time, I will make a difference, and I will strike back!

I have to be honest to myself. No more things like "oh, I have too many positions now, but this is the last time. Oh, I added more positions to average down the losses of bad trades, I know it is wrong and stupid, but, this is my last time.". These are just excuses to make the same mistakes over and over again!

Fortunately, there is a secritive place like trading journal in FF. I will take this place, start a thread to record my tradings, right or wrong, but be honest to me and the FF community if any one happenns to view this journal.

OK, time to work.

I blowed an 1K account again in two weeks on Jan. 20, SPX long positions were stopped out around 1820 and WTI long positions stopped out at 26.68. Yes! all of them are stopped at the bottom.

Am I newbie? Not at all. I knew risk control, I knew counter-trend trading like catching falling knives and non-productive, I knew money management, I almost knew everything about trading. But I just can't help myself.

I WAS A GAMBLER! A stupid gambler without self-control and decipline, but with getting-rich-fast greed!

Several days later,$300 wired to the account , lost again like a drop of water in desert. It was painful, really painful.

Asking why, I came back to FF and started to read posts and learn again. In one of the posts, I happend to find an introduction to a book -- Pit Bull by Marty Schaltz. I read it from a website. In fact, there is nothing about trading I learned, but the fact the author worked 16 hours every day including weekends, that impressed me! Remember, Marty was champions of American futures contest during 1980s, and he kept the championship for 10 years(?)! But he still worked so hard. At that time he made several millions every year, but he still worked so hard.

So I need to work hard also and be serious! Because I can not lose any more!! I have lost too much! The story? No, I won't tell. If I make it one day, finally, maybe I will tell the sad story about a pethetic speculator.

Transfer another $200 again two weeks ago, this time, I will make a difference, and I will strike back!

I have to be honest to myself. No more things like "oh, I have too many positions now, but this is the last time. Oh, I added more positions to average down the losses of bad trades, I know it is wrong and stupid, but, this is my last time.". These are just excuses to make the same mistakes over and over again!

Fortunately, there is a secritive place like trading journal in FF. I will take this place, start a thread to record my tradings, right or wrong, but be honest to me and the FF community if any one happenns to view this journal.

OK, time to work.