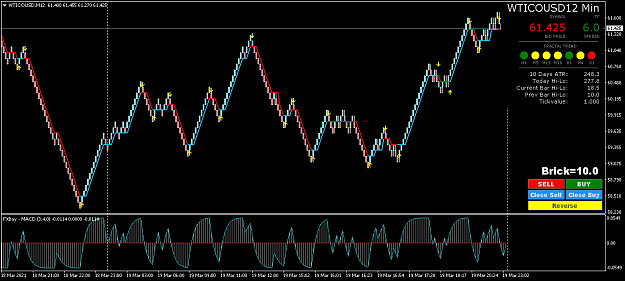

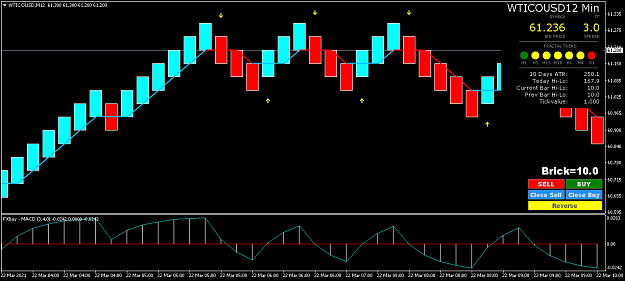

we did get a bounce $58 + but hard to tell if the move down is over

- Post #9,281

- Quote

- Mar 18, 2021 7:47pm Mar 18, 2021 7:47pm

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #9,282

- Quote

- Mar 19, 2021 12:44am Mar 19, 2021 12:44am

"Don't Shoot Me I'm Only the Piano Player"

- Post #9,283

- Quote

- Mar 19, 2021 10:55am Mar 19, 2021 10:55am

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #9,284

- Quote

- Mar 19, 2021 5:58pm Mar 19, 2021 5:58pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,286

- Quote

- Mar 22, 2021 6:01pm Mar 22, 2021 6:01pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,287

- Quote

- Mar 22, 2021 6:05pm Mar 22, 2021 6:05pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,288

- Quote

- Mar 23, 2021 5:17pm Mar 23, 2021 5:17pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,290

- Quote

- Mar 24, 2021 1:01pm Mar 24, 2021 1:01pm

- Joined May 2019 | Status: iTrade | 1,722 Posts

We must learn who is gold, and who is gold plated

- Post #9,293

- Quote

- Mar 24, 2021 1:47pm Mar 24, 2021 1:47pm

- Joined May 2019 | Status: iTrade | 1,722 Posts

We must learn who is gold, and who is gold plated

- Post #9,294

- Quote

- Mar 24, 2021 1:57pm Mar 24, 2021 1:57pm

- Joined Dec 2020 | Status: Member | 311 Posts

- Post #9,295

- Quote

- Mar 24, 2021 5:43pm Mar 24, 2021 5:43pm

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,296

- Quote

- Mar 24, 2021 9:29pm Mar 24, 2021 9:29pm

- Joined Jun 2011 | Status: Member | 743 Posts

- Post #9,297

- Quote

- Mar 25, 2021 1:10am Mar 25, 2021 1:10am

- | Joined May 2013 | Status: Full Member | 274 Posts

- Post #9,298

- Quote

- Mar 25, 2021 8:21am Mar 25, 2021 8:21am

- Joined Apr 2010 | Status: Lazy trader on D1 charts | 5,906 Posts

- Post #9,299

- Quote

- Mar 25, 2021 9:48am Mar 25, 2021 9:48am

- Joined May 2019 | Status: iTrade | 1,722 Posts

We must learn who is gold, and who is gold plated