https://www.energyexch.com/#detail=118722

Volatility is expected in about an hour as crude, distillates, and gasoline are coming off record builds/draws. Here's the recap of exactly what happened last week. Remember, crude/heating oil/gas will all take the same direction. Last week the markets shrugged off the build in crude in favor of the huge draws in the other two.

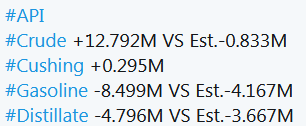

Forecasts are usually difficult to make after such extreme data. I expect some significant deviation from forecasts. API data historically has not been a good predictor of the EIA data but it's worth considering. Here's how it came in yesterday:

Extreme caution is advised. Wait for a direction, if one emerges. Otherwise, it never hurts to remain a spectator. Good luck!

Volatility is expected in about an hour as crude, distillates, and gasoline are coming off record builds/draws. Here's the recap of exactly what happened last week. Remember, crude/heating oil/gas will all take the same direction. Last week the markets shrugged off the build in crude in favor of the huge draws in the other two.

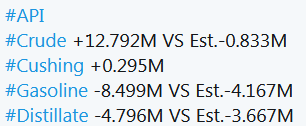

Forecasts are usually difficult to make after such extreme data. I expect some significant deviation from forecasts. API data historically has not been a good predictor of the EIA data but it's worth considering. Here's how it came in yesterday:

Attached Image

Extreme caution is advised. Wait for a direction, if one emerges. Otherwise, it never hurts to remain a spectator. Good luck!

Attached Image

We must learn who is gold, and who is gold plated

1