Wyckoff makes a distinction between tape reading and chart reading.

The ‘genuine chart player':

- Usually operates in one stock at a time

- Uses as a basis the past movements of that stock

- Follows a rigid set of rules

- Treats the market and his stock as a machine

- Uses no judgment (unfair?)

- Uses great discretion in regards to whether to play specific indications

The Tape Reader:

- Operates on what the tape shows now

- Not wedded to any particular issue

- Can work without pencil/paper or any memoranda

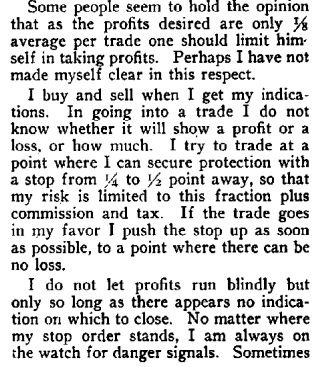

- Has a code of rules but more loosely defined than the chart player

- His intuition/second nature evolved by self-training serves for many different situations

- Do you follow a set of strict rules to cross a busy street? No, you use your judgment to tell you when to start and how fast to walk. That’s the position of the trained tape reader.

For Wyckoff the difference between the two is ‘as wide as day and night’. Not for me, but then I wish I had read this chapter when I was just starting out. However at this stage in my journey I think I understand the differences better than I would have when I started, and so maybe it's good that I'm reading it now. One mistake I have been making is to treat results of a system based on a single chart as the likely results that would be experienced trading on a diverse selection or selecting from market leaders, etc.

- Still, tape readers can use charts to ‘reinforce memory’.

- The figure chart is one of the best mechanical means of detecting accumulation/distribution. And it shows points of resistance on big swings.

- Despite this, Wyckoff says “I have yet to meet the man who has made money trading on a figure chart over an extended period.”

- The reason is that it seems easy but real conditions are much trickier.

- The chart gives the direction of coming moves. The tape says when.

- Stocks move in synchrony, but also, one stock may hold up the market or be the reason it’s getting clobbered.

The advantage of tape reading over chart playing is that the tape reader sees everything going on, while the chart player’s vision is limited. A single chart might give a buy indication, but if accumulation or distribution, concealed in other issues, is completed, his stock will break quickly and badly.

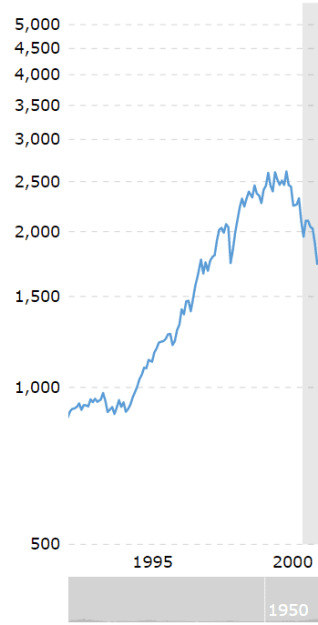

- If a tape reader wants a guide he should keep a chart of the average daily high and low of ten leading stocks. Wouldn’t this just be a daily chart of the S&P500/DJIA?

- Wyckoff refutes this saying it’s more reliable than the Dow averages which only consider the closing bid of each day, and don’t represent the day’s actual fluctuations. But futures/CFD charts show you every detail of the day’s average movements, surely? We have made some progress, however glacial, in the science of Finance.

- A composite chart (daily) is of no use to the tape reader who scalps and closes out everything each day. But it would benefit those who read the tape for 5-10 point moves. That trader will trade only with the trend as shown by the chart, because no individual stock trend can be ‘pushed to completion’ in the face of an adverse general market.

- When a stock sells ex-dividend, change the scale so the stock will show the same relative position as before the dividend. If a stock is 138 before the dividend which is 2 percent, and sells 136 ex-dividend, the 138 line becomes 136.

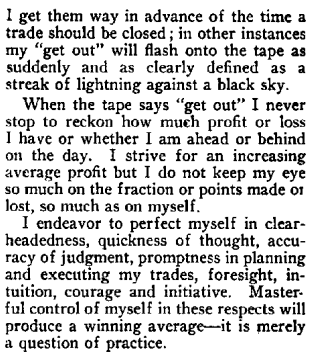

- The proficient tape reader will want to discard all mechanical assistance because it interferes with his ‘sensing the trend’. Also keeping charts distracts from attention that should be paid to the tape.

“The full tape cannot possibly be charted.”

I'm not sure. What do you think?