Chapter 21 - Contrarian or Conformist?

“It is impossible to produce a superior performance unless you do something different from the majority.” - Sir John Templeton

“It is impossible to produce a superior performance unless you do something different from the majority.” - Sir John Templeton

- According to Montier the consensus portfolio is small cap, low quality so he advises large cap, high quality

- ‘The central principle of investment is to go contrary to the general opinion, on the grounds that if everyone agreed about its merit, the investment is inevitably too dear and therefore unattractive.’ - Keynes

- Dasgupta et al. found that, on average, the stocks that fund managers had bought most over the last five quarters underperformed the stocks they had sold most, by 17%

- Montier mentions that 'almost everyone is bullish' which makes him nervous. Good call in 2007.

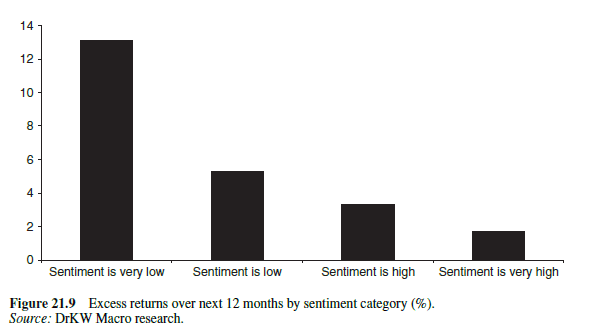

- Investors Intelligence survey shows nearly 60% bullish (a good contrarian indicator)

- "Buying large, old, low-risk, highly profitable, dividend payers [is] generally a good idea when optimism [is] exceedingly high"

- “To buy when others are despondently selling and to sell when others are greedily buying requires the greatest fortitude and pays the greatest rewards” - Templeton

- The consensus view is in the price

- "Even the perennially bearish Richard Bernstein of Merrill Lynch appears to have turned bullish!" (This is often one of the best contrarian indicators, a long-bearish pundit finally capitulating)

- Montier recommends being overweight cash

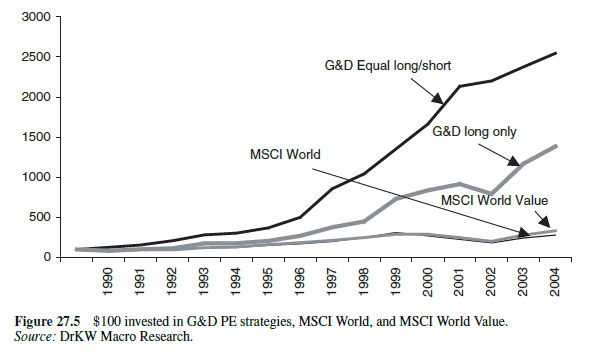

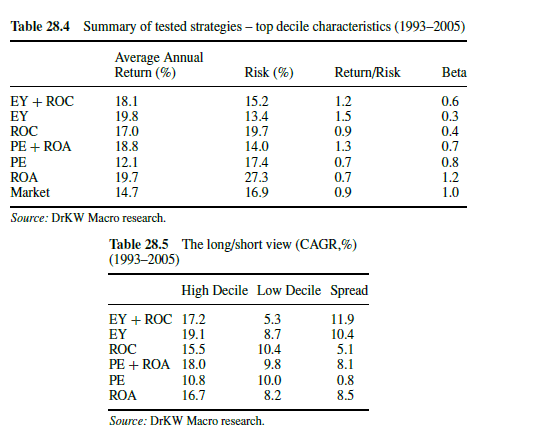

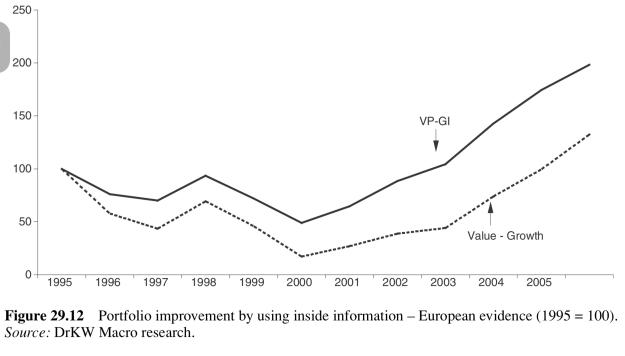

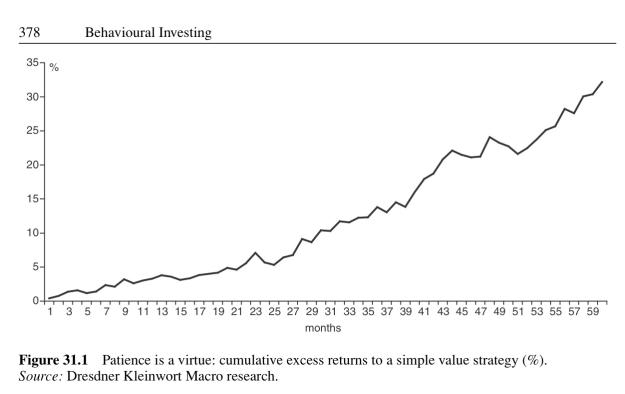

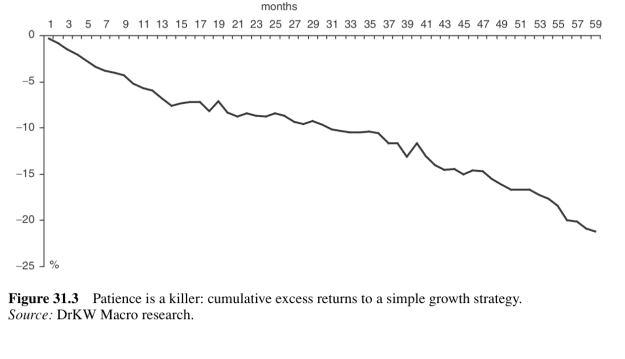

- Value over growth