Chapter 8 - The seven sins of fund management

This is a summary chapter where each topic is investigated in more detail and since Iím going to look at each one I will just list the sins here.

This is a summary chapter where each topic is investigated in more detail and since Iím going to look at each one I will just list the sins here.

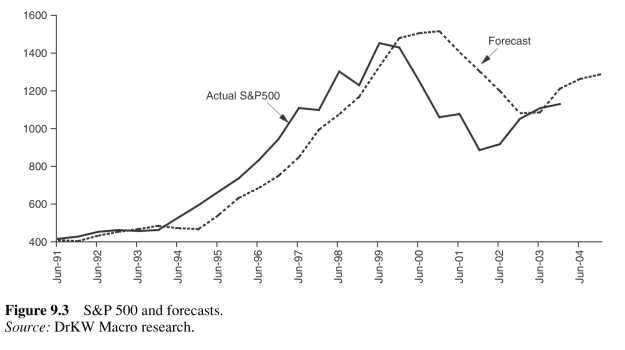

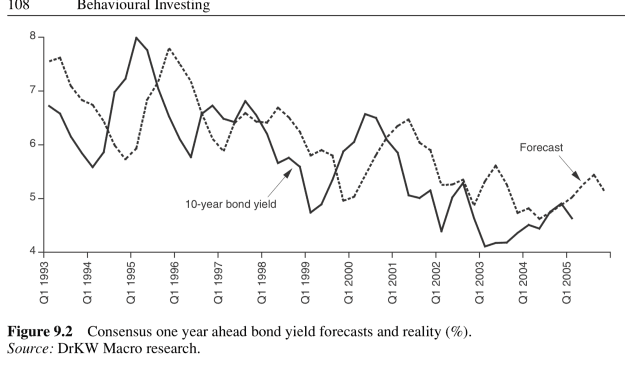

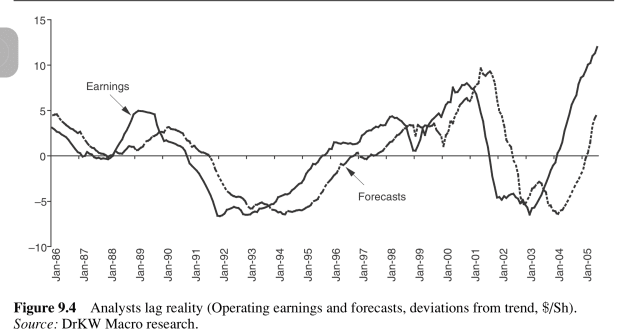

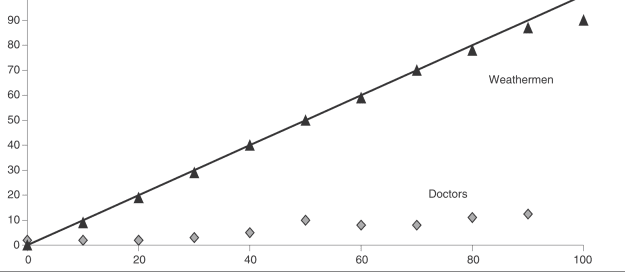

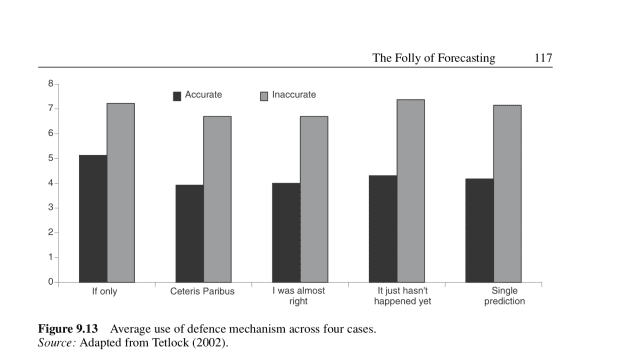

- Sin 1: Forecasting (Pride)

An enormous amount of evidence suggests that we simply cannot forecast. - Sin 2: The Illusion of Knowledge (Gluttony)

Information is not necessarily knowledge. - Sin 3: Meeting Companies (Lust)

We already know that people are easily fooled and susceptible to biases so why would meeting people in person make any difference? - Sin 4: Thinking You Can Outsmart Everyone Else (Envy)

Overoptimism and overconfidence - Sin 5: Short Time Horizons and Overtrading (Avarice)

Because so many investors end up confusing noise with news, and trying to outsmart each other, they end up with ridiculously short time horizons. - Sin 6: Believing Everything You Read (Sloth)

We all love a story. Maybe too much. - Sin 7: Group-Based Decisions (Wrath)

Even though psychologically we feel safer in herds, groups make the worst decisions.

4