Chapter 1

- When stockbrokers place shares with investors it is called the primary market.

- When shares are bought and sold in the stock market it is called the secondary market.

- Company profits are split and distributed regularly to shareholders as dividends.

- Stock markets also regulate publicly listed companies to protect investors’ interests.

- often people confuse ‘trading’ with ‘investing’ (Comparison to Buffett)

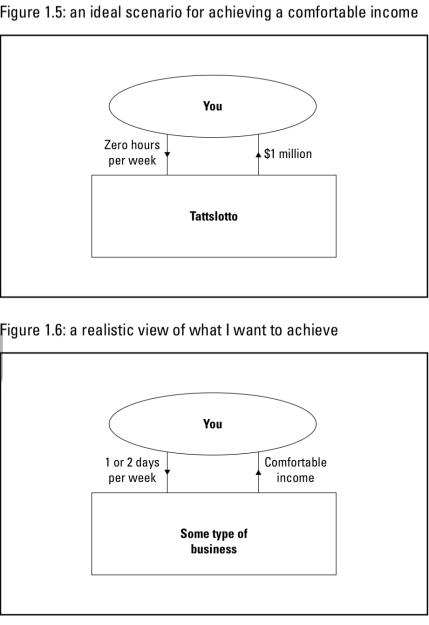

- ‘work hard and you’ll do well’ is true, but limited to the amount of hours in a day.

- we’re all selling our time, and the more your time is worth, the more you’ll get paid.

- a surgeon’s skill set is highly valued and therefore their time is very valuable

- AH’s problem with being a surgeon isn’t the pay, but the amount of time and effort to get the big pay packet.

“In fact, all I’m after is a comfortable income, but I want to achieve it without having to sacrifice very much of my time.”

- With capital base of $400 000 and if you can live comfortably on $100 000 per annum, you can make a living trading shares

- risk of ruin becomes proportionally greater with borrowed funds

- takes most people somewhere between three and five years to develop the skills and acquire the market experience to trade successfully.

- income from share trading isn’t linear.

- you may have years where you earn as little as 10 per cent, then years when you make as much as 100 per cent

- noobs need to have executed at least 50 trades.

- if you need immediate income get a job

“Here’s the bottom line: in nearly 30 years of being a trader I have never come across a trading system that will make money week in, week out. In fact, some of the best systems I know, and have used, can spend up to six months (!?) under water (that is, operating at a loss).”

- share trading can be very cyclical

- Register a business name and/or set up appropriate financial structure(s).

- Set up a bank account and find yourself a broker (full service or online).

- Have a dedicated work space and a set timetable for when you trade.

- Establish a business plan with goals and timelines. Include your share trading education.

- Create a review process where you analyse your results and update your strategy(s).

- nothing more dangerous for a share trader than to become distracted.

- AH strongly recommends to stick with trading shares and do not try to become an ‘everything’ trader

“Once you are up and running as a trader, it’s very easy to get distracted by all the different financial products and markets”

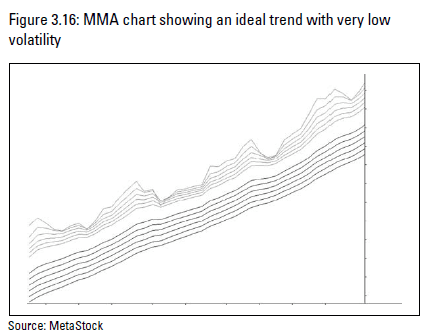

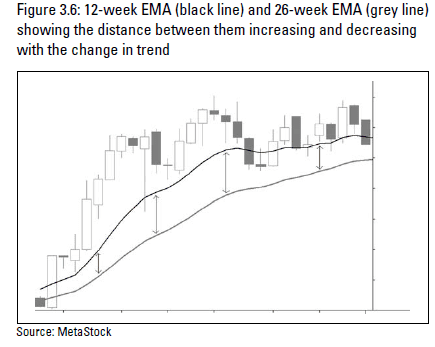

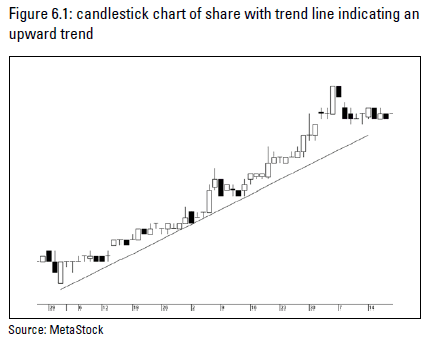

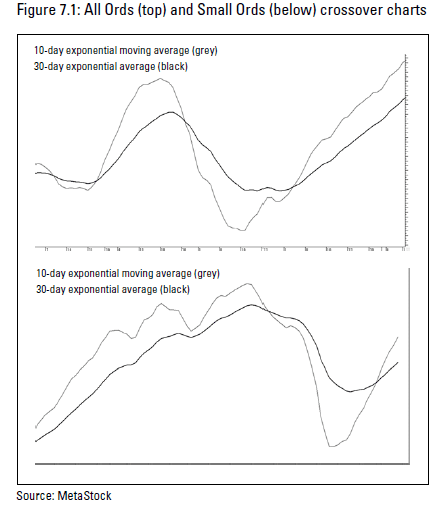

“A skill universal among successful traders is the ability to read charts. also known as technical analysis”

1