securitiesNfinances - mostly equity/bonds/Taxes/Investments talk 17 replies

Global Macro Strategy 10 replies

Let's talk about gold - XAUUSD 42 replies

DislikedLooking at my various indicators 80% of them are bearish I am still waiting for my main one to point south but but even that's not great. There is an interesting article in Reuters https://www.google.com/amp/s/uk.mobi.../idUKL8N27G47JIgnored

https://www.bloomberg.com/graphics/2...ve-inversions/

https://moneyandmarkets.com/recessio...ve-inversion-2

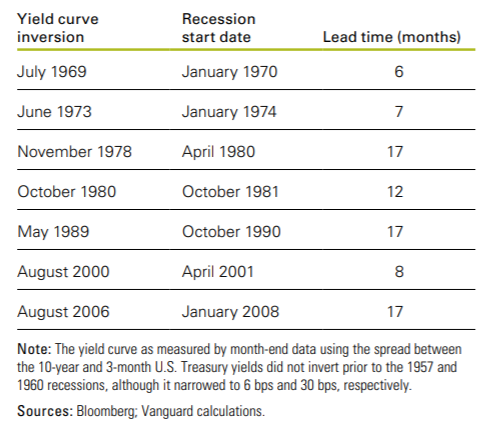

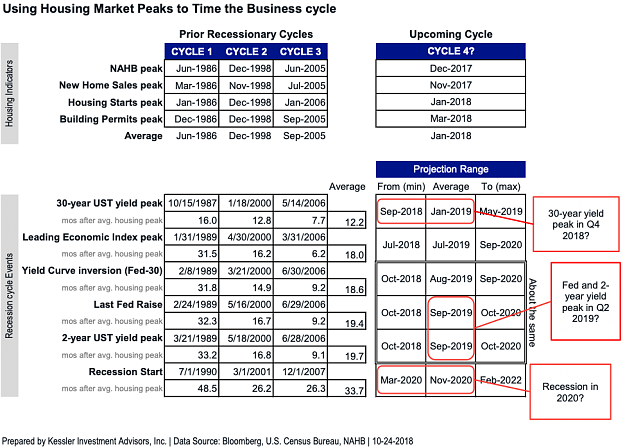

Using yield curves the estimate for the next recession is circa 2020.

However, I know that Goldman Sacks are talking about there being no recession and others have suggested that it will just be a slow down.

House prices appear to be affordable, GDP to household debt is still going in the right direction

I know that some areas have higher house price inflation in the US.

For me it all boils down to the Trump China issue.

The next election in the USA is November 2020.

Trump cannot afford for the US to be in recession during that time.

Let's see what happens

DislikedUnfortunately, I am not at liberty to disclose - due to signing an NDA. But it's related to related to risk and growth The issue with indicators they are just that and there are many things that drive the S&P But there are other indicators/data that I can talk about that are very useful. Obviously, yield curves (inversion) being one. These have been discussed elsewhere that have been used to predict recessions Looking at these directly; 3M and 10y - inverted for 5 months this year with the exception of about two weeks in July 3M and 5y has been...Ignored

Disliked{quote} The yield curves certainly paint a negative macro picture. A lot of people have rejoiced that they've turned positive, but historically turning positive hasn't been a good thing. I still don't fully trust the yield curve though, it's failed to forecast recessions in other nations and the sample size for US recessions is small. You make a good point about Trump and trying to avoid a recession. As it stands the US is already forecast to add a lot of fiscal stimulus next year so that could push back a recession. Right now my base case is recession,...Ignored

Hi EF5

According to the chap that discovered the yield curve inversion in 1986 he has said that its 7/7 in the US.

I believe he was looking at the 3mth -10 year curve as opposed to the 2s10s that is more commonly used.

Looking at the Feds position there is talk of QE lite and that it is the expansion of the balance sheet that has got traders attention.

In respect of the dollar index - its looks as though a further drop is not out of the question. This could make US equities more attractive

Obviously, timing of the recession is an issue but the implication of a 1 year gap between inversion and recession, QE lite, a cheaper dollar (for overseas investors), Trump going all out (we think) to avoid recession for the time being would put me off going short.

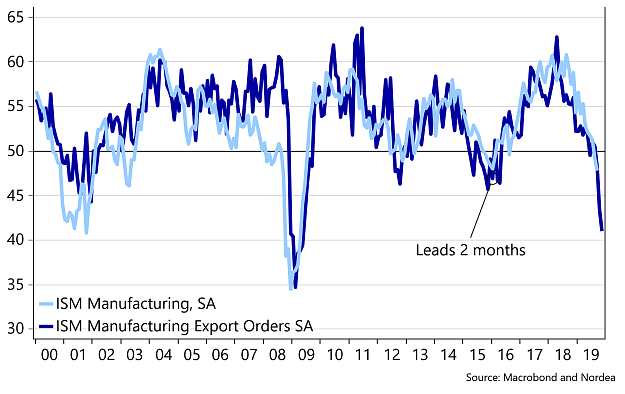

However, when these PMIs and yield curves play out - it should be fun

Totally agree with you on the Eurodollar.

Disliked{quote} Hi EF5 According to the chap that discovered the yield curve inversion in 1986 he has said that its 7/7 in the US. I believe he was looking at the 3mth -10 year curve as opposed to the 2s10s that is more commonly used. Looking at the Feds position there is talk of QE lite and that it is the expansion of the balance sheet that has got traders attention. In respect of the dollar index - its looks as though a further drop is not out of the question. This could make US equities more attractive Obviously, timing of the recession is an issue but...Ignored

In future posts, I'll explore the reasons I could be wrong in more detail.

DislikedReasons I may be wrong

- There is no solid case for a recession. There's no housing bubble or tech bubble about to collapse this time so what's the trigger? Does there need to be a trigger?

- Fed has cut the target Fed Funds Rate 3x and started QE lite.

- The US is expected to provide a fiscal stimulus in the near future.

- 2020 is an election year and Trump may do whatever it takes to postpone a recession.

- Housing may provide an economic tailwind if it makes a new leg higher. Higher prices could come as a result of lower mortgage

...

Ignored

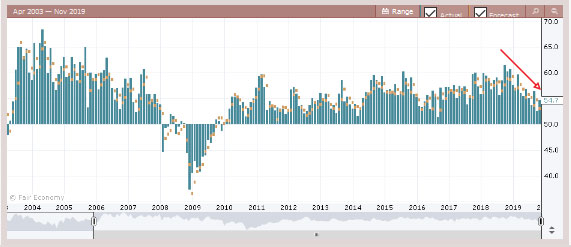

One thing I noticed after what seemed like some 'irrational exuberance' after today's ISM Non-Manufacturing PMI was the trend of the data. The highs keep getting lower and it's looking like we are trending towards contraction numbers.

DislikedThere is no solid case for a recession. But there's no solid case for continued growth either.Ignored

DislikedOne thing I noticed after what seemed like some 'irrational exuberance' after today's ISM Non-Manufacturing PMI was the trend of the data. The highs keep getting lower and it's looking like we are trending towards contraction numbers. {image}Ignored

DislikedIn economics, something called a "liquidity trap" was first imagined by a bloke whose name was Keynes. Much of his stuff has been utterly misused and misunderstood. Not for discussion. What he did say was "There is the possibility...that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest....Ignored

...money issuance must affect prices, else printing money will create infinite purchasing power. Suppose the Bank of Japan prints yen and uses them to acquire foreign assets. If the yen did not depreciate as a result, and if there were no reciprocal demand for Japanese goods or assets (which would drive up domestic prices), what in principle would prevent the BOJ from acquiring infinite quantities of foreign assets, leaving foreigners nothing to hold but idle yen balances? Obviously this will not happen in equilibrium. One reason it will not happen is the principle of portfolio balance: Because yen balances are not perfect substitutes for all other types of real and financial assets, foreigners will not greatly increase their holdings of yen unless the yen depreciates, increasing the expected return on yen assets.

DislikedYes, well, in the meantime, some prescient quotes from Powell found their way to my newsfeed. Kinda like, I was just sitting here, eating my muffin, drinking my coffee, when I had what alcoholics refer to as moment of clarity.... Powell: Connection Between Monetary Aggregate And Growth Has Gone Away 13 November 2019, 19:08 (MORE TO FOLLOW) Dow Jones Newswires November 13, 2019 12:08 ET (17:08 GMT) Copyright (c) 2019 Dow Jones & Company, Inc. Anyways - hey, Bernanke is a very smart guy, of course. Sadly he is/was rather loose with his analysis and...Ignored