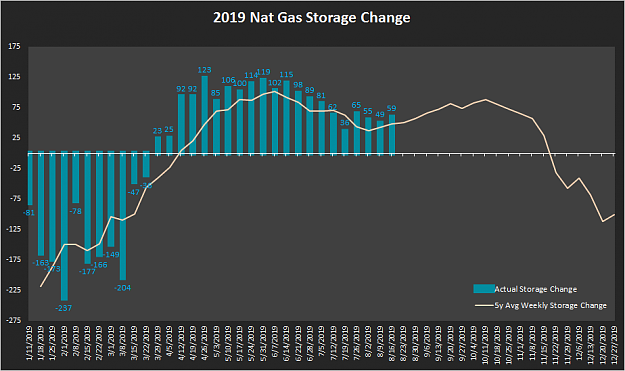

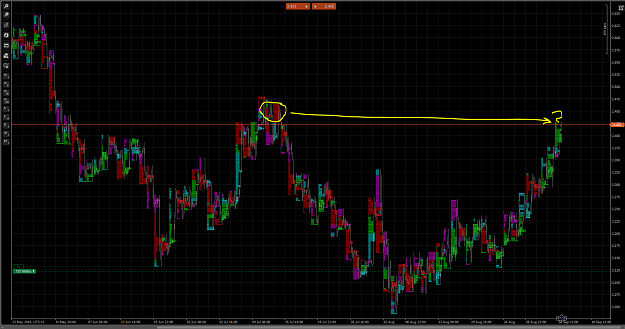

Hello all, starting this new thread on trading natural gas. I don't know if any of you out there are interested in this commodity but I have found it on my current broker (CFD broker) so I image it is spot prices. While I do have access to this on my futures account I don't (can't afford) to trade futures contracts. I have very similar tools that I use to trade this intrument so I thought I'd open this thread to see if there is any interest here...anyone?

Do more of that which succeeds and less of that which does not - Dennis Gar