Interesting new site here where I can have my observations on crude in an orderly manner. Lets get down to business and start Crude

As the daily chart below shows, WTI currently locked in a sideways range with roughly $60 on the upside and $50 on the downside.

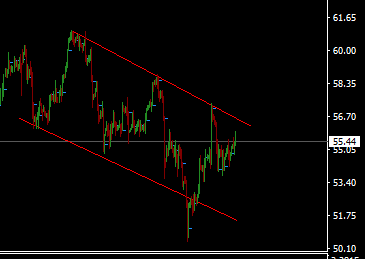

Here is where it gets interesting. Looking at the 60M chart, WTI has broken below its rising trendline which had been in place for nearly 7 days and is now facing resistance at $57 and appears to be headed to the lower end of the range.

As the daily chart below shows, WTI currently locked in a sideways range with roughly $60 on the upside and $50 on the downside.

Here is where it gets interesting. Looking at the 60M chart, WTI has broken below its rising trendline which had been in place for nearly 7 days and is now facing resistance at $57 and appears to be headed to the lower end of the range.