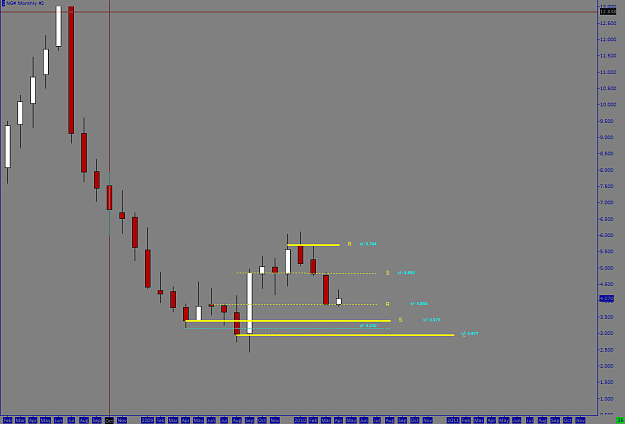

Hallo ! I try to start new post with natural gas. If anyone is trading natgas is wellcome to share experience. I will attach weekly chart with few lines .

- Joined Mar 2010 | Status: Technical Fundamentalist | 11,563 Posts

Pending conversations? PM for a chat...I am mainly in OTM now

- Joined Mar 2010 | Status: Technical Fundamentalist | 11,563 Posts

Pending conversations? PM for a chat...I am mainly in OTM now

- Joined Mar 2010 | Status: Technical Fundamentalist | 11,563 Posts

Pending conversations? PM for a chat...I am mainly in OTM now

- Joined Mar 2010 | Status: Technical Fundamentalist | 11,563 Posts

Pending conversations? PM for a chat...I am mainly in OTM now

- Joined Mar 2010 | Status: Technical Fundamentalist | 11,563 Posts

Pending conversations? PM for a chat...I am mainly in OTM now