Carbon price surge triggers UK ‘cost containment’ market mechanism - https://on.ft.com/3ou0DUU

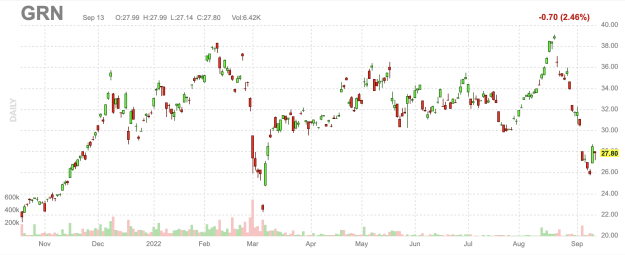

Interesting development here. GRN only holds EU futures, but they apparently have a similar mechanism to the UK. Although it sounds like total supply remains the same and they would just issue planned credits early. Maybe bearish short term if they do take action but long term impact is probably minimal.

Interesting development here. GRN only holds EU futures, but they apparently have a similar mechanism to the UK. Although it sounds like total supply remains the same and they would just issue planned credits early. Maybe bearish short term if they do take action but long term impact is probably minimal.