So guys, many people confuse curve fitting with optimization and I get pissed off when I hear things like "you are just curve fitting!" bla bla bla.. so I wanted to share my views about this interesting subject: is my model actually predictive or plain stupid ?

this question drove me nuts until I came up with an answer no it's not plain stupid...

no it's not plain stupid...

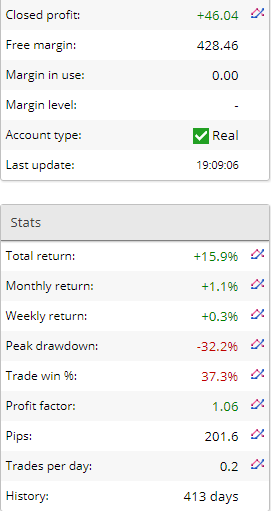

My conclusion is that checking if a system works with different parameters (e.g. entry / exit points) is a must before proceeding with optimization.... but this is not enough, it has to work in the "future"..

SO, what I do:

-I backtest the system with different parameters from 2000 to 2014.

-I optimize the parameters

-I backtest from 2014 to 2019 to see if I get consistent results...

what do you think, share your thoughts.. just show some respect... thanks.

this question drove me nuts until I came up with an answer

My conclusion is that checking if a system works with different parameters (e.g. entry / exit points) is a must before proceeding with optimization.... but this is not enough, it has to work in the "future"..

SO, what I do:

-I backtest the system with different parameters from 2000 to 2014.

-I optimize the parameters

-I backtest from 2014 to 2019 to see if I get consistent results...

what do you think, share your thoughts.. just show some respect... thanks.