-

University of Michigan sentiment preliminary for March 63.4 versus 67.0 last month

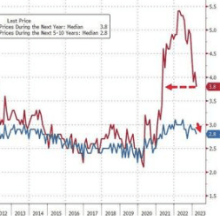

University of Michigan sentiment index for March 2023 (preliminary) • Prior month 67.0% • preliminary index for sentiment 63.4 versus 67.0 estimate • current conditions 66.4 versus 70.0 estimate • expectations index 61.5 versus 64.5 estimate • one year inflation expectations 3.8% versus 4.1% last month. Lowest since April 2021 • five year inflation expectations 2.8% versus 2.9% last month. Lowest since April 2021

-

US: UoM Consumer Confidence Index drops to 63.4 in March vs. 67 expected

Consumer sentiment in the US weakened in early March with the University of Michigan's (UoM) Consumer Confidence Index declining to 63.4 from 67 in February. This reading came in worse than the market expectation of 67. "Year-ahead inflation expectations receded from 4.1% in February to 3.8%, the lowest reading since April 2021, but remain well above the 2.3-3.0% range seen in the two years prior to the pandemic," the publication further read. "Long-run inflation expectations edged down to 2.8%, falling below the narrow 2.9-3.1% range for only the second time in the last 20 months." Surveys of Consumers Director ... (full story)

-

UMich Inflation Expectations Drop To 2-Year-Lows, Overall Sentiment Weakens In March

The most important aspect of the UMIch sentiment survey continues to be 'inflation expectations' which slid further to 3.8% in the next 12 months (lowest since April 2021) and 2.8% for 5-10Y inflation exp... chart However, UMich notes that with ongoing turbulence in the financial sector and uncertainty over the Fed’s possible policy response, inflation expectations are likely to be volatile in the months ahead. The overall headline sentiment dropped more than expected - down for the first time in four months chart Sentiment declines were concentrated among lower-income, less-educated, and younger consumers, as ... (full story)

- Comments

- Subscribe

- Comment #1

- Quote

- Mar 17, 2023 11:33am Mar 17, 2023 11:33am

- jordanvic

- | Joined Jul 2020 | Status: Bro | 908 Comments

- Comment #2

- Quote

- Mar 17, 2023 12:14pm Mar 17, 2023 12:14pm

-

Sahir12

Sahir12 - | Membership Revoked | Joined Feb 2018 | 441 Comments

- Comment #3

- Quote

- Mar 17, 2023 8:50pm Mar 17, 2023 8:50pm

-

Ferna

Ferna - Joined Dec 2022 | Status: Member | 445 Comments