Ok, I'm not talking about Red Bull

I 'invest' in a few stocks, and have had a few sparring sessions with some around FF in calling 'up' on the house building sector a few years back.

I have just called 'end' on the house building sector, mainly because the possible returns have shrunk to mediocre.

So to the next prospect, the most recently crashed must-have commodity - and particularly any parts of the supply or servicing industry.

Over supply is pushing down raw prices, that is the most touted explanation.

What about geopolitical risk in places such as Kurdistan or other parts of eastern Europe?

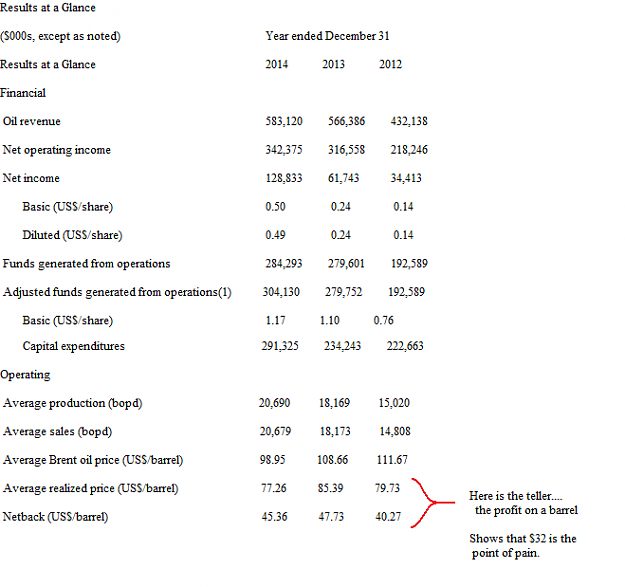

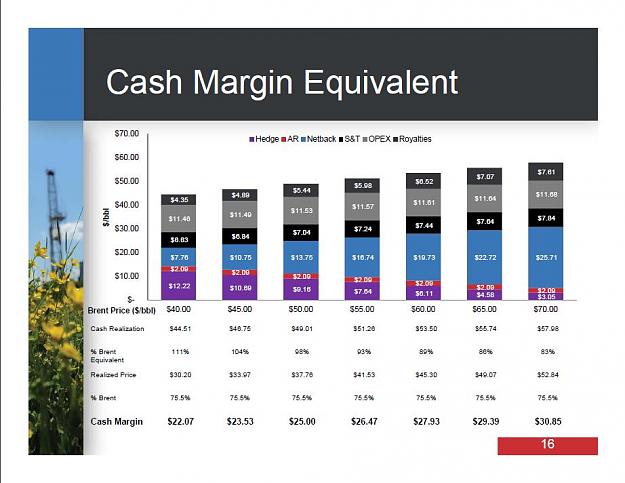

Where is the catastrophe point for American or Canadian shale producers?

Eventually the market will balance and the panic will subside.

There is going to be some blood in the water, but afterwards will be the survivors and the money makers.

So to open a discussion here, how might you spot a diamond amongst the basket cases?

I 'invest' in a few stocks, and have had a few sparring sessions with some around FF in calling 'up' on the house building sector a few years back.

I have just called 'end' on the house building sector, mainly because the possible returns have shrunk to mediocre.

So to the next prospect, the most recently crashed must-have commodity - and particularly any parts of the supply or servicing industry.

Over supply is pushing down raw prices, that is the most touted explanation.

What about geopolitical risk in places such as Kurdistan or other parts of eastern Europe?

Where is the catastrophe point for American or Canadian shale producers?

Eventually the market will balance and the panic will subside.

There is going to be some blood in the water, but afterwards will be the survivors and the money makers.

So to open a discussion here, how might you spot a diamond amongst the basket cases?

Carbon-Dioxide: the gas of life!