as much as i would love to jump on the bear band wagon because i think a correction is due after a 2 month rally. there seems to be bulls buying to stop every bearish run. at this point its 50:50

2

Reliable broker for Crude Oil trading 20 replies

making money intraday CL/WTI/OIL - no overnight holds 13 replies

WTI Crude Oil (TRENDSURFING - with the help of the model) 634 replies

Trading Oil WTI to get back all! 18 replies

Hedge WTI and Brent Oil 1 reply

Dislikedas much as i would love to jump on the bear band wagon because i think a correction is due after a 2 month rally. there seems to be bulls buying to stop every bearish run. at this point its 50:50 {image}Ignored

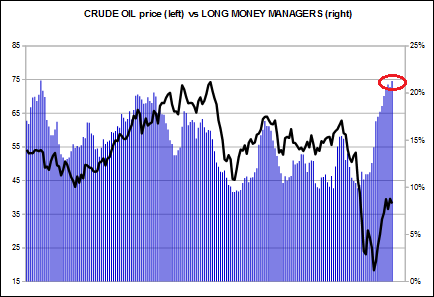

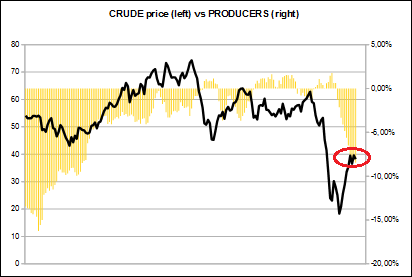

DislikedMoney managers long side are going all in Don't be in front of them when they start closing them.... {image}Ignored

DislikedMoney managers long side are going all in Don't be in front of them when they start closing them.... {image}Ignored

DislikedAnticipating a lot of fake break outs, fake moves to trap traders and overall markete noise. As long as it isnít trending it will probably be a messIgnored

Dislikedthey're currently squeezing anyone who went short this morning. i will continue to stay out and observe. i'm expecting a rejection and sharp pullbackIgnored

Dislikedthey're currently squeezing anyone who went short this morning. i will continue to stay out and observe. i'm expecting a rejection and sharp pullbackIgnored

Disliked{quote} Volume is still so low and both London and NY session are the same, lure traders into shorts at the start, have a moment of indecision and then spike up.Ignored

Dislikedmorning horseshit continues. This market completely refuses to drop even to daily pivot. Again another trap for short traders.Ignored