Disliked{quote} the graph only shows operating expenditure. with offshore, drilling equipment cost is very high (which is capital expenditure not shown in your graph) and could amount to as much as 90% of an oil producer's total investment.Ignored

- 2016 data, for ballpark/ratios from WSJ.. http://graphics.wsj.com/oil-barrel-breakdown/

- 2020 data https://knoema.com/vyronoe/cost-of-o...ion-by-country

- Wiki data https://en.wikipedia.org/wiki/Price_..._of_production

As you see some countries are definitely not happy with this, specially since some were thinking about being self-efficient and be profitable at the same time ![]()

While other countries can play this standoff as they like, because they have reserves, power and their people might be much more used to lowering the standards...

Make your own conclusions... Also, for some downgrading from Benz to BMW might be a sign of trouble and they would do anything to keep the previous style... While others do not mind eat every second day without much panic. Just my thoughts and food for your thoughts ![]() And yes, that also affects SUPPLY, RESERVERS etc...

And yes, that also affects SUPPLY, RESERVERS etc...

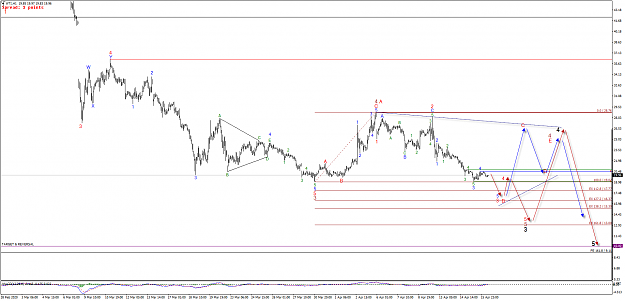

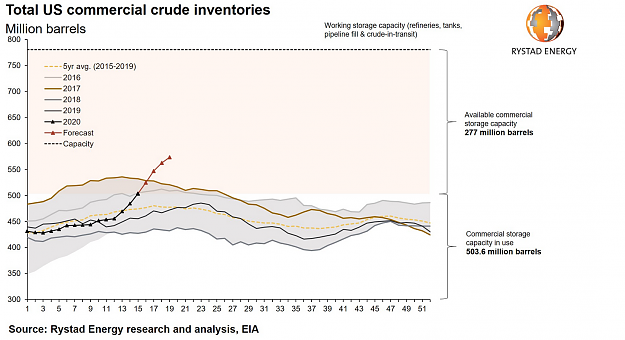

For DEMAND.. I concur with some previous that we might see (much) improvement in MAY when things might improve (much)... But let's see what happens... Will be focusing on smaller timeframes in the meantime and will wait for longer picture to present itself... might be within a week!