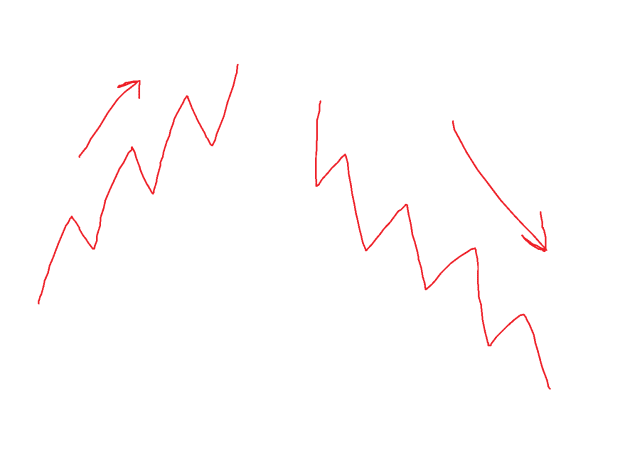

Disliked{quote} What you so aptly described is very typical of market behavior and as you have noted, it occurs right before the very move you wish to catch. Since you are only watching the DOM and even that has only 5 ticks above and below the last transaction, it is difficult to know if the market might be preparing for a reversal or a continuation...on such a micro level these clues are very hard to find. I would humbly suggest you that using some from of charting might help you "bias" your entries with additional data. So what happens in your description...Ignored

Thanks for the time!

A trade should be based on an assumption based on facts