Greetings.

As the thread title says, what's your best money management method? Try to describe as much as possible, image description would be amazing. I will link your post here in this first post, so whoever reading this it will be easy for them to find out from the first post.

Long term, short term, martingale, full margin trading, pyramiding, position developing, position averaging, grid management.....anything that you find is profitable for you please share. No matter if it is even the craziest idea, we would love to read it.

Mine as follows:

Well, i am not a full time trader. I am under 30 & in the quarter way in my career now. I trade small accounts to mainly get myself aquinted at the moment. For now i see this as a secondary source of income & backup for future.

I use few simple strategies to enter trades, which i developed from my past years experiences. IMHO the whole success depends on the risk management or more specificly money management in trading. Not only in trading but also in life, the better risk manager we are the better we are than others. I solely trade forex only, to be specific 7 USD major pairs. Because of spreads, volatility, liquidity etc. I allocate x% of capital at risk, which is combined of two trades primary & emergency backup. So my each trades consist of an emergency backup trade to cover up the loss if the primary trades hit the Stoploss. In plain English which is basically stop & reverse trade. Why i do this because when i did backtest my strategies i saw all the trades that hits Stoploss goes to a minimum certain amount of pips if they hit Stoploss. Not always but most time, so i utilize that opportunity to cover the loss. There are trades where both primary and emergency hits the Stoploss. But as this both trades risk are x% pre-determined, i lose only that x% risk. My RRR is aimed at more than 2.5 times the risk. Hitting that high RRR at high winrate is very difficult. For which, i take partial close of trades at different levels which is calculated based on percent of pips risked for that particular trade. Once a certain percent of pips in profit trade is BE+1 & take first partial profit. This way, i secure optimum profit from the trade. I aim for optimum profit not maximum. If i wait for trade to hit TP it will give me more than 2.5 RRR but if i bank profits at different levels i would be able to make one point something RRR if trade goes to full TP, since it is always uncertain whether trade will hit TP, its always best to bank as much profits possible from the trade IMHO. A pip profit taken or closed is a pip realized profit in your wallet, a floating equity does nothing but giving hope. Its not early closing a trade, its backtested to determine at which levels it will be optimum profit. Using small percentage of risk keeps DD small & reasonable. Most importantly keeps my mind calm & focused. Any particular trade is not important here but as a whole. The law of large numbers play always. I just have to follow the rule of engagement.

The first post will be continuously edited. Please show respect to fellow traders.

Ef5 method - Post 2

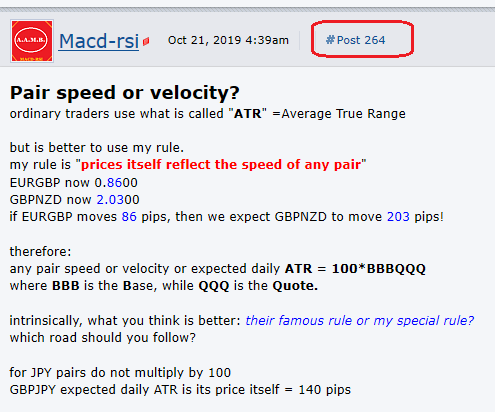

Macd-Rsi method - Post 5

DonPato method - Post 22

Eredribaen method - Post 31

Js3mwtRc method - Post 33

Oldtraderman method - Post 34

Jakub.pajer method - Post 35

FlavioEstev method - Post 36

LeoMarchegi method - Post 37

Best Regards.

As the thread title says, what's your best money management method? Try to describe as much as possible, image description would be amazing. I will link your post here in this first post, so whoever reading this it will be easy for them to find out from the first post.

Long term, short term, martingale, full margin trading, pyramiding, position developing, position averaging, grid management.....anything that you find is profitable for you please share. No matter if it is even the craziest idea, we would love to read it.

Mine as follows:

Well, i am not a full time trader. I am under 30 & in the quarter way in my career now. I trade small accounts to mainly get myself aquinted at the moment. For now i see this as a secondary source of income & backup for future.

I use few simple strategies to enter trades, which i developed from my past years experiences. IMHO the whole success depends on the risk management or more specificly money management in trading. Not only in trading but also in life, the better risk manager we are the better we are than others. I solely trade forex only, to be specific 7 USD major pairs. Because of spreads, volatility, liquidity etc. I allocate x% of capital at risk, which is combined of two trades primary & emergency backup. So my each trades consist of an emergency backup trade to cover up the loss if the primary trades hit the Stoploss. In plain English which is basically stop & reverse trade. Why i do this because when i did backtest my strategies i saw all the trades that hits Stoploss goes to a minimum certain amount of pips if they hit Stoploss. Not always but most time, so i utilize that opportunity to cover the loss. There are trades where both primary and emergency hits the Stoploss. But as this both trades risk are x% pre-determined, i lose only that x% risk. My RRR is aimed at more than 2.5 times the risk. Hitting that high RRR at high winrate is very difficult. For which, i take partial close of trades at different levels which is calculated based on percent of pips risked for that particular trade. Once a certain percent of pips in profit trade is BE+1 & take first partial profit. This way, i secure optimum profit from the trade. I aim for optimum profit not maximum. If i wait for trade to hit TP it will give me more than 2.5 RRR but if i bank profits at different levels i would be able to make one point something RRR if trade goes to full TP, since it is always uncertain whether trade will hit TP, its always best to bank as much profits possible from the trade IMHO. A pip profit taken or closed is a pip realized profit in your wallet, a floating equity does nothing but giving hope. Its not early closing a trade, its backtested to determine at which levels it will be optimum profit. Using small percentage of risk keeps DD small & reasonable. Most importantly keeps my mind calm & focused. Any particular trade is not important here but as a whole. The law of large numbers play always. I just have to follow the rule of engagement.

The first post will be continuously edited. Please show respect to fellow traders.

Ef5 method - Post 2

Macd-Rsi method - Post 5

DonPato method - Post 22

Eredribaen method - Post 31

Js3mwtRc method - Post 33

Oldtraderman method - Post 34

Jakub.pajer method - Post 35

FlavioEstev method - Post 36

LeoMarchegi method - Post 37

Best Regards.

How big can you think!