This journal is the beginning of my attempt to become a consistently profitable trader. I look forward to posting more regularly and hope that I can be of help to some of you and also hope that opening this thread and posting my trades helps me be more disciplined.

Background

I have a mechanical engineering degree and worked my first three years out of college as a product engineer. Not too long into that job I realized that was not what I wanted to do with my career. After months of debating I left in March 2009 to pursue a full time trading career. I've now been trading from home for over a year, with mostly inconsistent results. Thus far I have not been able to master the discipline aspect needed to be successful. So that is what I am trying to do with this thread. Improve my discipline and eliminate account crippling trades.

Strategy

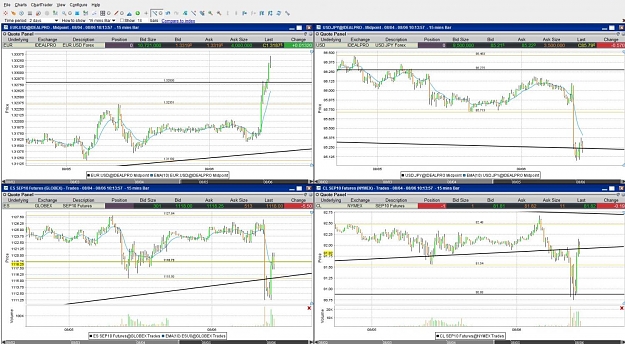

I am a day trader and rarely leave positions open overnight. I mainly trade the EU and UJ as well as E-mini and Crude oil futures. I will chart the four of those instruments each morning and develop a trading plan. In addition to technical analysis I use macroeconomic data to supplement my trade plans.

Technical Analysis

I start my technical analysis with daily charts. Then I move down to hourly charts. Finally I move to 15 minute charts. I plot support, resistance, and trendlines. I do not typically use any other indicators. Sometimes I fine tune entries and exits on 1 or 5 minute charts.

Fundamental Analysis

I use all news, macroeconomic data, earnings data, etc. to form an opinion of which direction I feel the market is headed. I try not to jump on momentum and trade during important releases, rather, I use the data to help form longer term views.

Background

I have a mechanical engineering degree and worked my first three years out of college as a product engineer. Not too long into that job I realized that was not what I wanted to do with my career. After months of debating I left in March 2009 to pursue a full time trading career. I've now been trading from home for over a year, with mostly inconsistent results. Thus far I have not been able to master the discipline aspect needed to be successful. So that is what I am trying to do with this thread. Improve my discipline and eliminate account crippling trades.

Strategy

I am a day trader and rarely leave positions open overnight. I mainly trade the EU and UJ as well as E-mini and Crude oil futures. I will chart the four of those instruments each morning and develop a trading plan. In addition to technical analysis I use macroeconomic data to supplement my trade plans.

Technical Analysis

I start my technical analysis with daily charts. Then I move down to hourly charts. Finally I move to 15 minute charts. I plot support, resistance, and trendlines. I do not typically use any other indicators. Sometimes I fine tune entries and exits on 1 or 5 minute charts.

Fundamental Analysis

I use all news, macroeconomic data, earnings data, etc. to form an opinion of which direction I feel the market is headed. I try not to jump on momentum and trade during important releases, rather, I use the data to help form longer term views.