Let's start with a standard introduction.

ME

I made my first trade about 20years ago (22btw). It was before the 9/11.

OVer the time I was not trading every single day, and I also left many times with some years away for many reasons. In total let's say I spent 40% of this time in trading and 60% in doing something else.

This, of course, isn't really important since I believe that everyday there is something new happening out there. Experience in trading matters maybe only in better understanding if a market is more likely to go in a direction or in the other, based on many informations.

MY PLATFORM

I trade using JForex (Dukascopy) since many years. Reason is simple: I like the functionality it gives me.

There are many platforms and many other good brokers of course.

MY TRADING

My main difficult in trading was and still is about finding a strategy.

I guess I reached a good level but in the same time I suspect there is still some adjustments required.

I like clean charts.

I personally believe the main thing to do in trading is to know what concerns an instrument. I need to know what the world consider as important news to trade that instrument. So if the world considers important a war to blindly buy OIL no matter what the price, I will probably doing the same otherwise I will be selling somenthing that the whole world keeps buying.

LESSONS LEARNT

1. Market is always right

There is no such a simple and straightforward thing out there in life. Remember.

Market will be moving up and down and what really matters is knowing what is moving an instrument and understanding where are the main important areas where buy or sell.

2. A chart is a visual representation of a market

Reading a chart means reading what are price moves over a period of time. That's it. You can decide to read whatever calculation and trasformation you prefer, but this is not gonna change the meaning of a chart.

3. You guess, you die

Really, I lost thousands $ by following a guess, because of an idea, because of bias. Stop guessing what could happen next, we are nobody to know. Yes... you can guess it right sometimes but that's not what makes the money and worst of all if you keep guessing and following your guess, you will only be able to read what confirms your idea. (There is a lot of studies confirming this).

4. What matters to me, doesn't really need to matter also to you.

If you pick any chart and show it to 10 persons and ask them “what would you do?” you will probably receive 10 different views. Sometimes it is good if someone has your same view, but that's just chance and doesn't make your idea better indeed you could be both wrong.

Now that introduction is done let's move forward.

Edit 03/02/2024

Starting from today I am going to reactivate this thread.

I need a place where post my study, my plans, my trades. Anyone is allowed to post in here, as long as the study is based on volumes/price action/S&D or call it whatever you prefer (SMC…).

The idea of this thread is to share analysis about where are main levels to look for a trade, on any instrument and timeframe.

I mostly trade Cable and Oil.

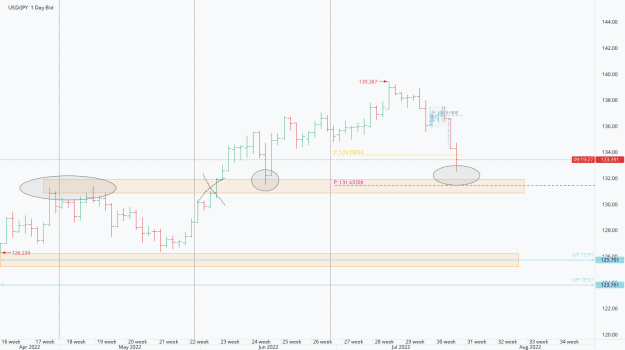

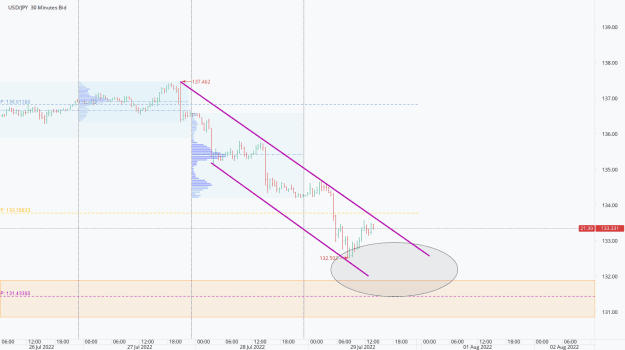

Sometimes Usd Jpy

over the times I could trade other instruments depending on markets develops.

First 4 pages are old. There could be some interesting info but my new treading concept starts from page 4

https://www.forexfactory.com/thread/...-levels?page=4

ME

I made my first trade about 20years ago (22btw). It was before the 9/11.

OVer the time I was not trading every single day, and I also left many times with some years away for many reasons. In total let's say I spent 40% of this time in trading and 60% in doing something else.

This, of course, isn't really important since I believe that everyday there is something new happening out there. Experience in trading matters maybe only in better understanding if a market is more likely to go in a direction or in the other, based on many informations.

MY PLATFORM

I trade using JForex (Dukascopy) since many years. Reason is simple: I like the functionality it gives me.

There are many platforms and many other good brokers of course.

MY TRADING

My main difficult in trading was and still is about finding a strategy.

I guess I reached a good level but in the same time I suspect there is still some adjustments required.

I like clean charts.

I personally believe the main thing to do in trading is to know what concerns an instrument. I need to know what the world consider as important news to trade that instrument. So if the world considers important a war to blindly buy OIL no matter what the price, I will probably doing the same otherwise I will be selling somenthing that the whole world keeps buying.

LESSONS LEARNT

1. Market is always right

There is no such a simple and straightforward thing out there in life. Remember.

Market will be moving up and down and what really matters is knowing what is moving an instrument and understanding where are the main important areas where buy or sell.

2. A chart is a visual representation of a market

Reading a chart means reading what are price moves over a period of time. That's it. You can decide to read whatever calculation and trasformation you prefer, but this is not gonna change the meaning of a chart.

3. You guess, you die

Really, I lost thousands $ by following a guess, because of an idea, because of bias. Stop guessing what could happen next, we are nobody to know. Yes... you can guess it right sometimes but that's not what makes the money and worst of all if you keep guessing and following your guess, you will only be able to read what confirms your idea. (There is a lot of studies confirming this).

4. What matters to me, doesn't really need to matter also to you.

If you pick any chart and show it to 10 persons and ask them “what would you do?” you will probably receive 10 different views. Sometimes it is good if someone has your same view, but that's just chance and doesn't make your idea better indeed you could be both wrong.

Now that introduction is done let's move forward.

Edit 03/02/2024

Starting from today I am going to reactivate this thread.

I need a place where post my study, my plans, my trades. Anyone is allowed to post in here, as long as the study is based on volumes/price action/S&D or call it whatever you prefer (SMC…).

The idea of this thread is to share analysis about where are main levels to look for a trade, on any instrument and timeframe.

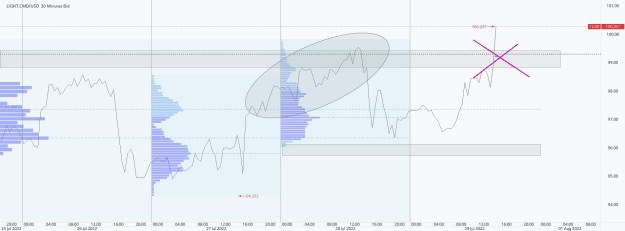

I mostly trade Cable and Oil.

Sometimes Usd Jpy

over the times I could trade other instruments depending on markets develops.

First 4 pages are old. There could be some interesting info but my new treading concept starts from page 4

https://www.forexfactory.com/thread/...-levels?page=4

Yesterday was the past