DislikedHello Old friend How are you? Very insteresting the Thread, a lot of opportunidades on the Uranium market for sure! Can you tell me which broker is the best to trade ASX or TSX being foreign? Best regardsIgnored

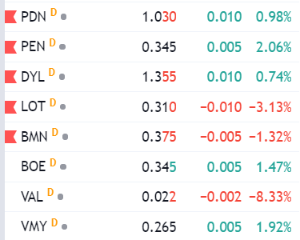

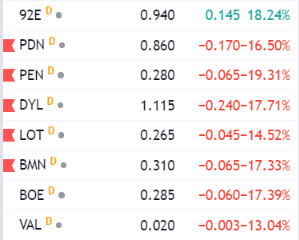

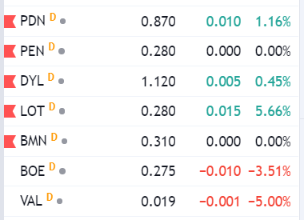

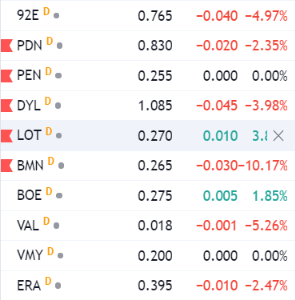

If you are after some companies that are on the exchanges to look at let me know and I can put some down for you.