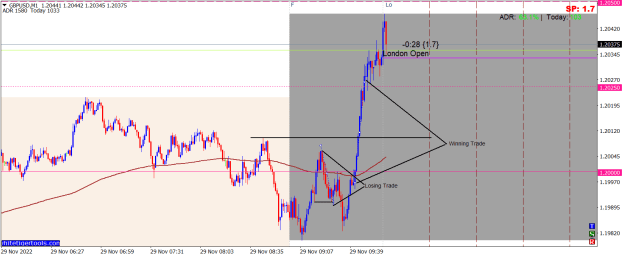

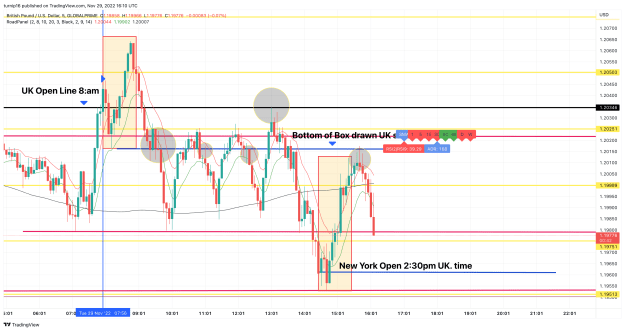

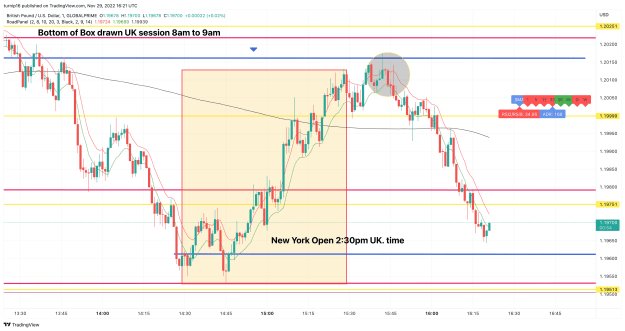

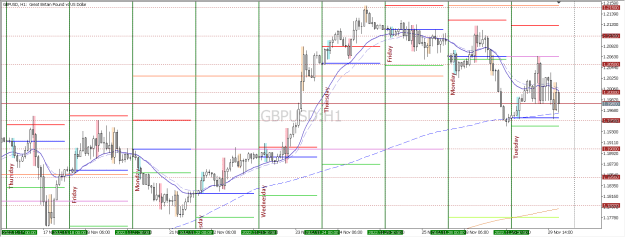

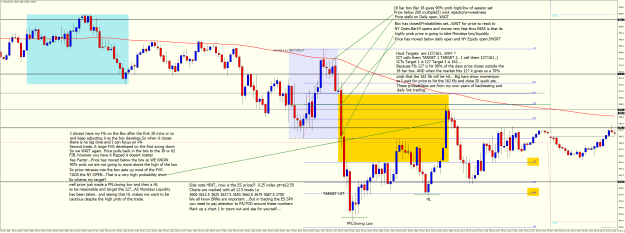

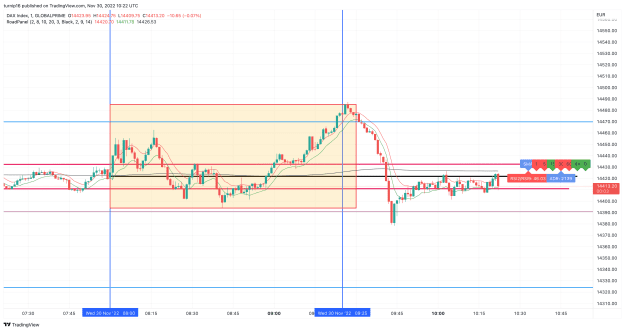

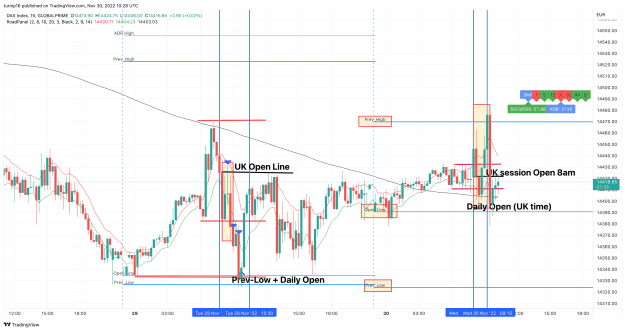

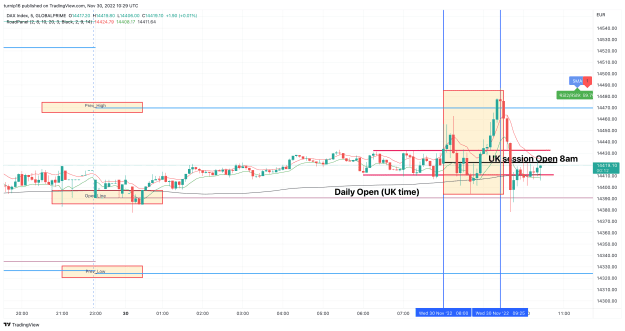

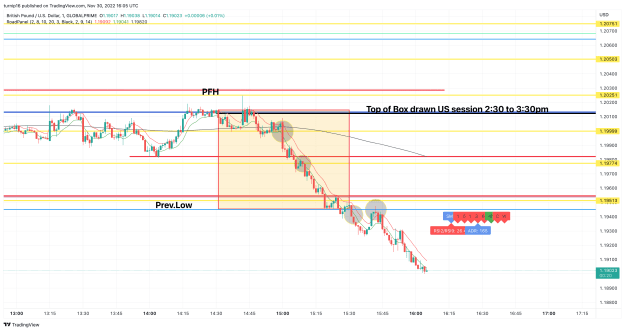

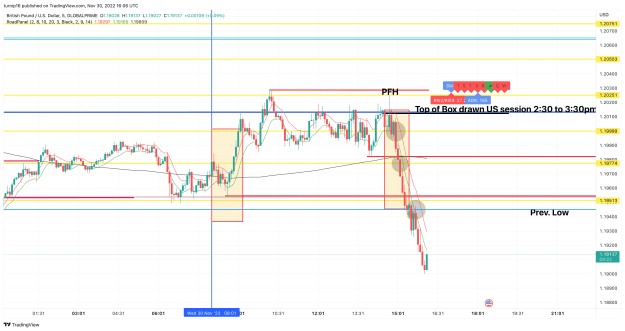

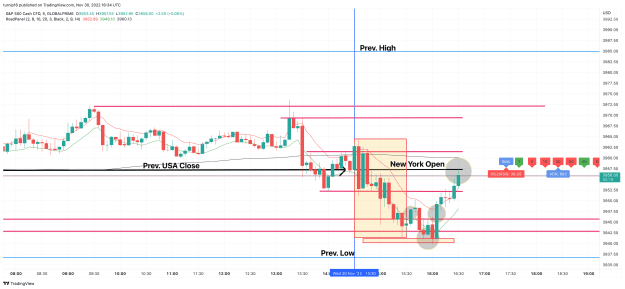

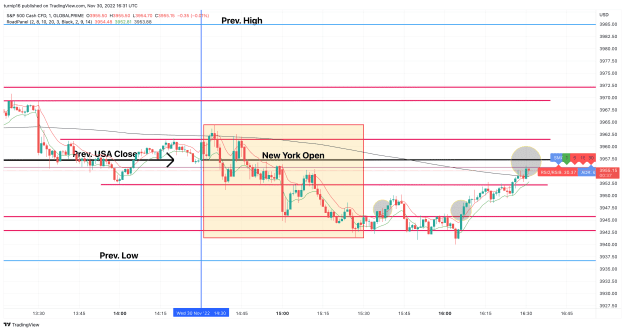

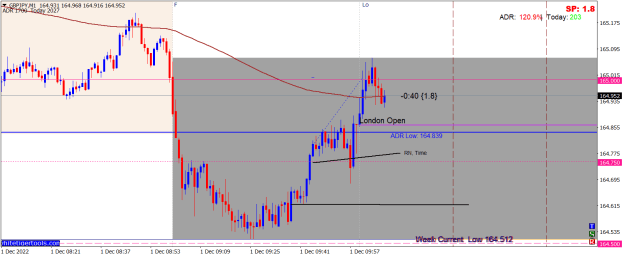

One winning and one losing trade for me today. Both trades had the confluences. RN, Pin, etc. The lesson for this was the timing. The first trade to my understanding was a loss cos i had not given atleast 30 minutes after Frankfurt Open to show me the clear picture as to what the market was trying to do. After around 40 minutes of Frankfurt open the real move showed itself and i got back on the train. So around a gain of 18 pips in total from a losing and winning trade. The lesson to take away was to give market time to show its hand. Had a long day and rushed a little bit. For the losing trade there were all the confluences apart from TIME, which never changes. Always something to learn. Trade Well All.

4