Simple Moving Average Bollinger Band Strategy 15 replies

Developing algo for Modified Bollinger Band Scalping Strategy 3 replies

Let's build together a system which makes 1000%/month 427 replies

Bollinger band binary option strategy 9 replies

Bollinger Band deviation strategy Part I 12 replies

SECTION_C, here you can play with parameters that you like to add as well

See pdf for this Bollinger Band strategy.

QuoteDislikedIndicators derived from Bollinger Bands

QuoteDislikedIn Spring, 2010, John Bollinger introduced three new indicators based on Bollinger Bands. They are BBImpulse, which measures price change as a function of the bands; percent bandwidth (%b), which normalizes the width of the bands over time; and bandwidth delta, which quantifies the changing width of the bands.%b (pronounced "percent b") is derived from the formula for Stochastics and shows where price is in relation to the bands. %b equals 1 at the upper band and 0 at the lower band. Writing upperBB for the upper Bollinger Band, lowerBB for the lower Bollinger Band, and last for the last (price) value:%b = (last ? lowerBB) / (upperBB ? lowerBB)Bandwidth tells how wide the Bollinger Bands are on a normalized basis. Writing the same symbols as before, and middleBB for the moving average, or middle Bollinger Band:Bandwidth = (upperBB ? lowerBB) / middleBBUsing the default parameters of a 20-period look back and plus/minus two standard deviations, bandwidth is equal to four times the 20-period coefficient of variation.Uses for %b include system building and pattern recognition. Uses for bandwidth include identification of opportunities arising from relative extremes in volatility and trend identification.

Disliked{quote} Hi Michael, I'm using MT4 so will have to look i to how to add a H1 BB onto a 5min chart. Im guessing theres an EA/Indicator out there somewhere for this. I think i understand what you mean in that by checking that the price is also within the H1 BB on a 5min chart, this would add strength to the direction price may then go.... NB i'm using the H4 RSI crossover of 50 as my initial trigger to even look at a trade, then applying the BBs to it. I'll have to do some research into Donchian Bands they are totally new to me. As for a trending market...Ignored

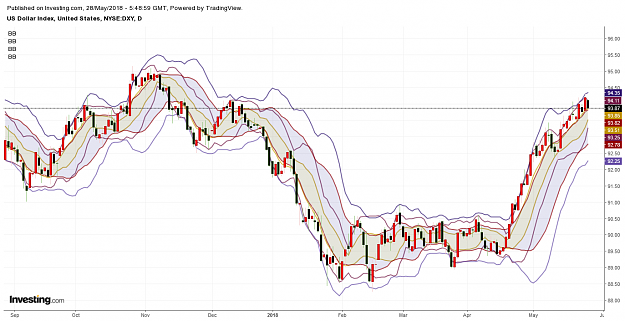

DislikedVisually a good way to represent a multitude of bands . {image}Ignored

DislikedIn this thread we will build our own Bollinger Band strategy by combining our heads together. Let's discuss: DISCUSS: - what do you think is the best way to recognize RANGED and BREAKOUT? - what other indicators complement the Bollinger Band? - what is in your experience the best timeframe for Bollinger Band? - what do you confirm before entry? - what conditions do you think should be met in the higher timeframe (before entry)? - what Price Action do you think is best with Bollinger Band? (HnS, M, doji, other) - what conditions (if/else) for our...Ignored

Most of them you could find for free here in www.

Do you consider the 4:1 law of Bollinger Bands. Use a 1h chart and place within a 4h Bollinger Band and compare it with 1h Bollinger Bands - you will see the significant differences.

Siedways:

- I recommened the BB Trend Flat (look at MQL5 websides)