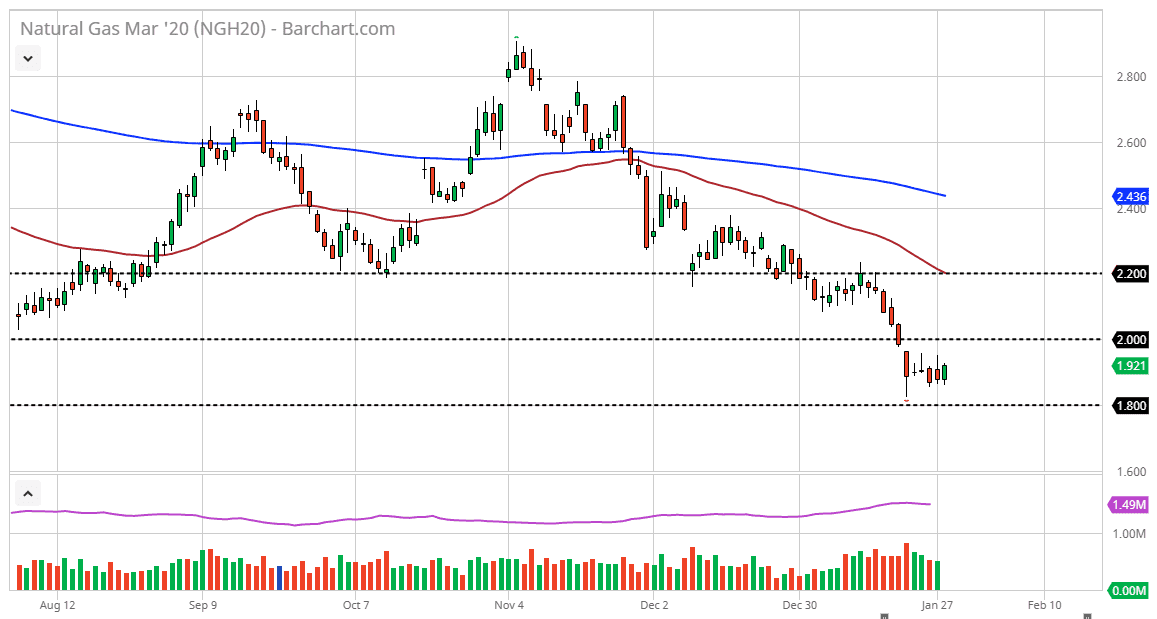

Natural gas markets have rallied a bit during the trading session on Tuesday but still remain very tight as we have been going back and forth in the same area for some time. That being the case, the $1.90 level continues to be a bit of a magnet for price, and it makes quite a bit of sense that we are still in this general vicinity. Ultimately, the markets need to make some type of decision as to where we go next, and that will more than likely be due to some type of winter storm. I expect some type of bounce from here, but that bounce should be a nice selling opportunity before it’s all said and done.

If the market can break above the $2.00 level, it’s likely that the market may go looking towards the $2.20 level above, which is an area where we have seen a lot of resistance, as well as the 50 day EMA dropping below there. The 50 day EMA will probably continue to offer a lot of resistance, so I’m looking for some type of massive bounce like that in order to start fading it. Signs of exhaustion will be plenty of reason to start selling, and therefore continue the overall downtrend.

The alternate scenario of course is that the market breaks down below the $1.80 level, which would be an even more brutal extension of the massive downtrend that we have seen due to the massive amounts of oversupply. At this point, the market will continue to find plenty of reasons to fall apart, so any short-term spike will attract a lot of attention. The Americans have drilled 17% more last year than they did the previous year, so there was a major oversupply of natural gas to begin with. Beyond that, the winter has been very mild so that of course has done nothing to help the overall balance of supply and demand either. With this, you are simply looking for opportunities to short this market on rallies. There will be spikes in price sooner or later, but those are nice opportunities to take advantage of what would be a short-term drop in temperature that market participants may try to take advantage of for the short term. However, the oversupply issue with natural gas is a major problem, and a structural one as well. With this, I have no interest in trying to buy this market.