- The BTC/USD pair replicates a pattern already seen in the bullish breakout of 2018.

- A detailed analysis reveals that price compression is an illusion.

- The BTC/USD pair enjoys strong support for its bullish project.

The BTC/USD is in a period of technical agony, trapped between multiple technical hurdles.

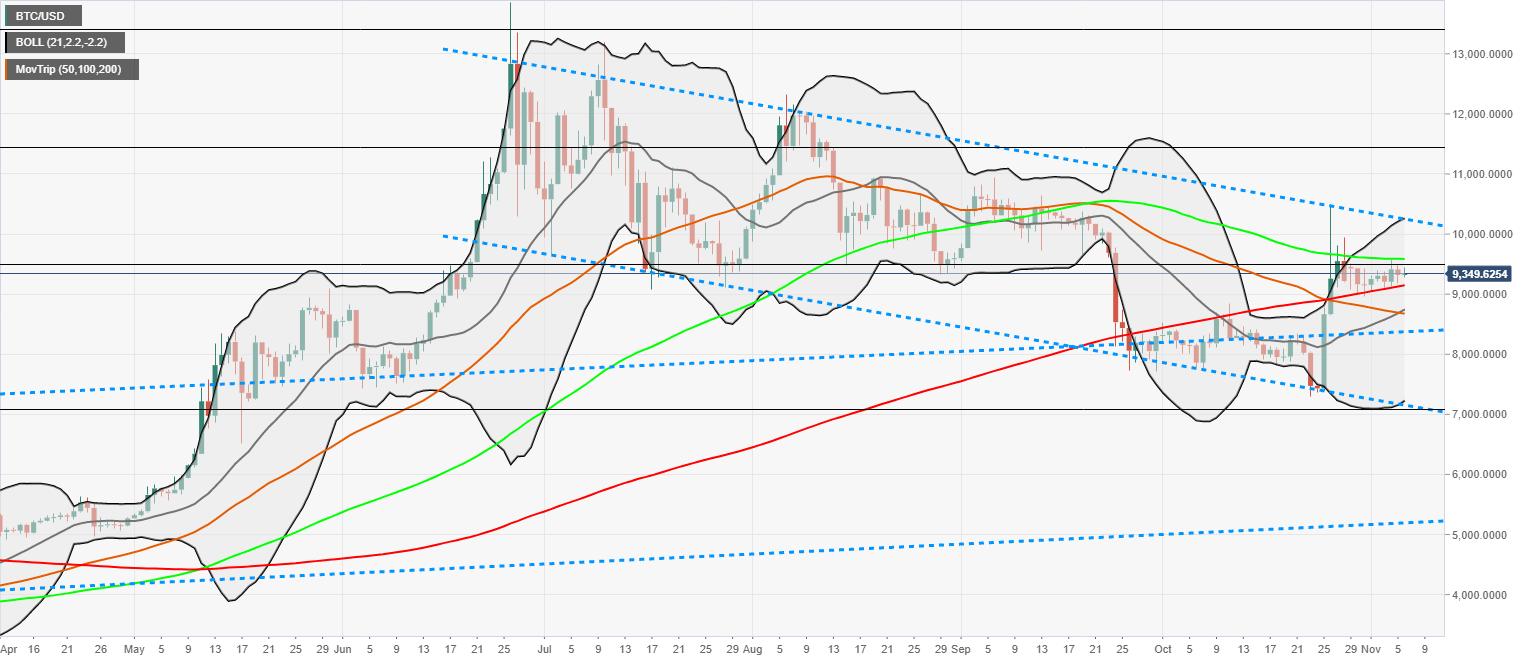

Since late June, when the BTC/USD pair set the relative maximum at $13,000, the Bitcoin has been sliding down a medium-term bearish channel.

The current scenario is a small-sized replica of the situation seen by the BTC/USD pair from the late 2017 highs to the December 2018 lows. On this occasion, the break was on the rising side.

Short-term volatility and ATR levels are at higher levels than one might expect, which keeps away the chance of a violent break. If it does occur, it will not have its origin in a price overcompression.

In a bullish scenario, the BTC/USD pair target for breakage of the bear channel is at $10,280. To reach this level, it must first pass the SMA100 which is currently at $9,585.

Conquered the bullish scenario above $10,280, the next target would be at $11,448 (50% level of the Fibonacci retracement system), then at $13,400 (61,8% level of the Fibonacci retracement system) and finally, the third one at the relative maximums of $19,811. Above is the Moon.

In a bearish scenario, the Bitcoin price supports are substantially more robust. First of all, the SMA200 at $9,148 as the first strong support. Then, the second at $8,692, confluence level of the SMA50 and the middle-band of the Bollinger Band system.

If the BTC/USD lost the second support level at $8,692, then the third support would stand at $8,414 in the form of an ultra long term bullish channel ceiling.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Grayscale has withdrawn its 19b-4 application for an Ethereum futures ETF. SEC Chair Gensler says several crypto assets are securities as he waives off ETH classification question. Ethereum could sustain horizontal movement in the coming weeks.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

98% of creditors receive at least 118% of allowed claims within sixty days of effectiveness, others get billions in compensation. Plan would resolve disputes with government and private stakeholders without costly and protracted litigation.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana FireDancer validator has debuted, meant to replicate Solana’s functionality but with higher performance. Built from the ground up for performance, FireDancer advertises speed, security, and independence.

Bitcoin price may see further upside, Standard Chartered says, citing looser regulation and US spot ETFs

Bitcoin could benefit from US fiscal dominance and Trump winning, Standard Chartered says, citing loser regulation and spot ETF approvals. Hong Kong issuers told WuBlockchain that the government prohibits sale of virtual asset-related products to mainland Chinese.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.