Oil Price Talking Points

The price of oil struggles to retain the advance from earlier this week amid signs of a prolonged US-China trade war, with crude facing a greater risk of a bear market as US production hits a fresh record high.

Oil Price Forecast: Record US Crude Output to Fuel Bear Market

Oil prices may give back the advance from the monthly-low ($50.99) as fresh updates from the US Energy Information Administration show crude inventories climbing another 2927K in the week ending October 4 after expanding 3104K during the previous period.

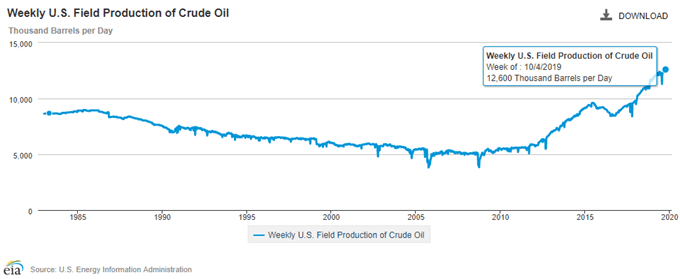

At the same time, weekly field production climbed to a fresh record high, with US crude output climbing to 12,600K from 12,400K in the week ending September 27. Signs of waning demand paired with growing supply may push the Organization of the Petroleum Exporting Countries (OPEC) to ramp up its efforts in balancing the energy market especially as the US and China, the two largest consumers of oil, struggle to reach a trade deal.

It remains to be seen if OPEC will unveil more measures to shore up oil prices ahead of its next meeting starting on December 5 as the group signs a Memorandum of Understanding (MoU) with the Gas Exporting Countries Forum (GECF), with OPEC Secretary GeneralMohammad Sanusi Barkindo pledging to “undertake joint work and actions, in the interest of our members, entire industry, and the global economy.”

OPEC and its allies appear to be on track to regulate production beyond this year as the most recent Monthly Oil Market Report (MOMR) warns of lower consumption in 2019, but it seems as though Russia is in no rush to pursue additional measures to curb production as Energy Minister Alexander Novak expects oil prices to float “around $50” in the medium-term.

With that said, the weakening outlook for global growth may continue to drag on oil prices, with crude facing a renewed risk of a bear market as US production climbs to a fresh record high in October.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups.

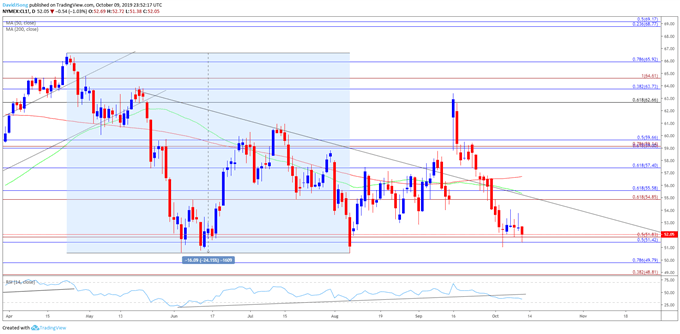

Crude Oil Daily Chart

Source: Trading View

- The broader outlook for crude oil remains tilted to the downside as a ‘death-cross’ formation took shape in July, with recent developments in the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the upward trend from June.

- However, the flattening slopes in the 50-Day ($55.67) and 200-Day SMA ($56.60) warn of range-bound conditions as the moving averages converge with one another, with decline from the September-high ($63.38) failing to produce a test the 2019-low ($50.52).

- In turn, the lack of momentum to close below the Fibonacci overlap around $51.40 (50% retracement) to $51.80 (50% expansion) may generate range-bound conditions, but the monthly opening range may bring the downside targets back on the radar as the recent rebound fails to spur a run at the October-high ($54.84).

- Need a close below the $51.40 (50% retracement) to $51.80 (50% expansion) region to open up the overlap around $48.80 (38.2% expansion) to $49.80 (78.6% retracement).

For more in-depth analysis, check out the 4Q 2019 Forecast for Oil

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.