- The Brexit deal breakthrough finally hits the wires to support Sterling to conquer 1.3000 after falling to an 11-week low of 1.2698 earlier.

- The Bank of England Governor Mark Carney repeatedly said that no-deal Brexit is not the most likely scenario.

- The Bank of England slightly downgraded the short-term growth outlook while sticking to one rate a year outlook for monetary policy.

- After a strong October US labor market report, the probability of Fed hiking rates in December rose to 81% according to the Fed watch tool.

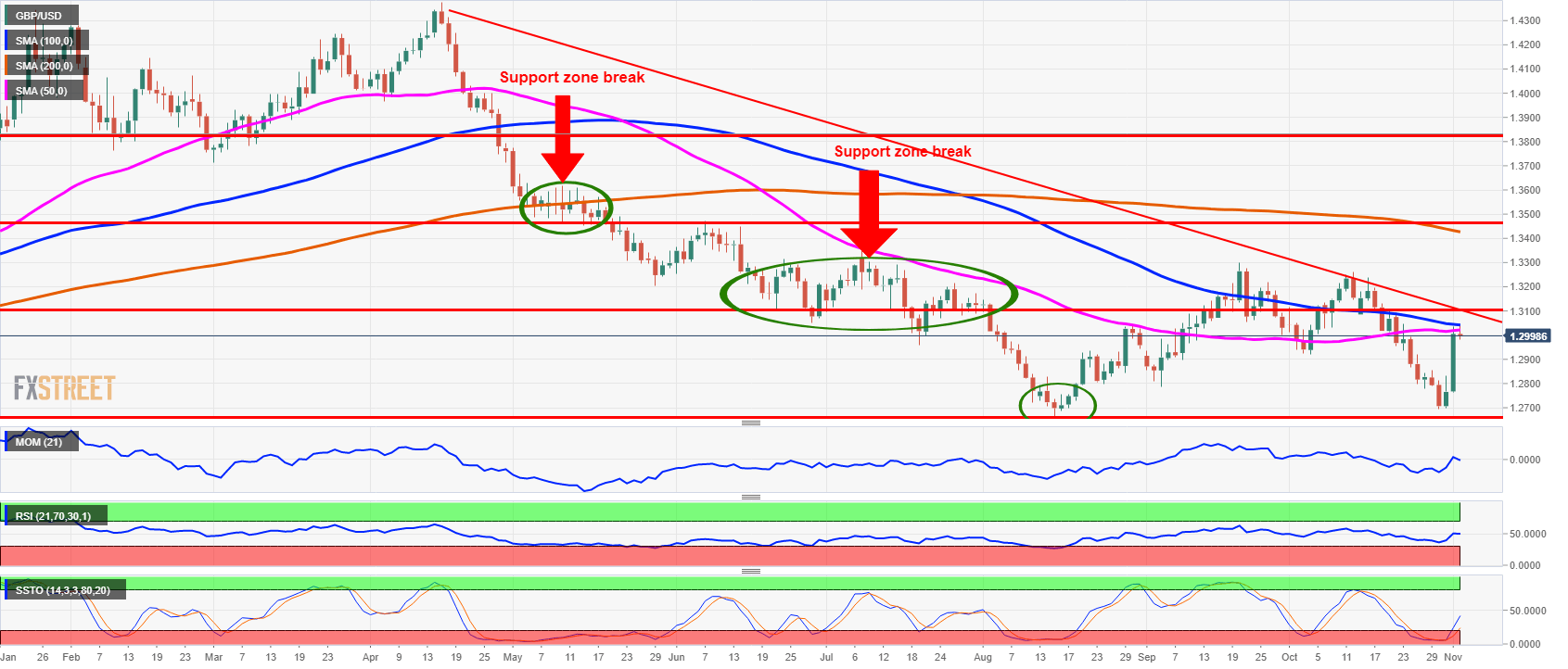

- The death cross of a 50-day moving average and a 100-day moving average is needed to confirm the trend reversal on a daily chart.

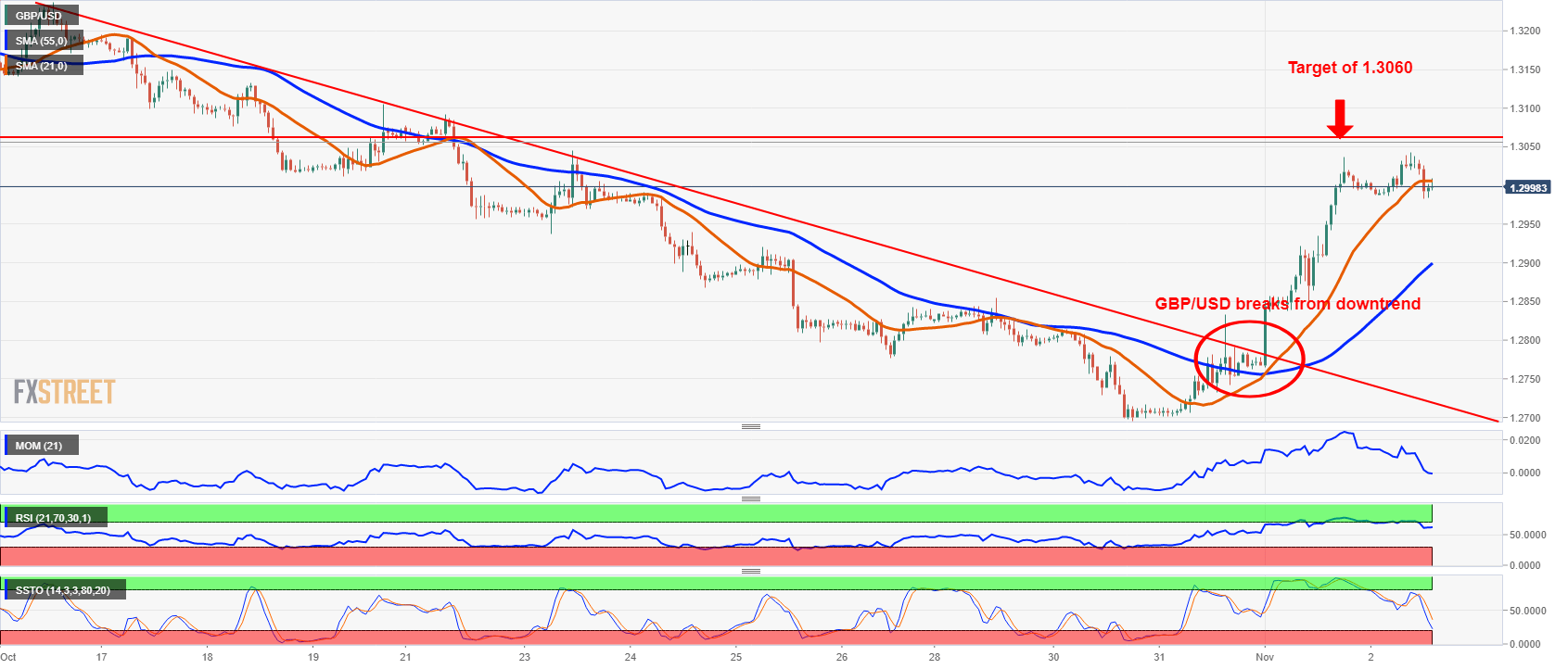

- FXStreet Forecast Poll turned bearish for Sterling for the second week of November, but with the break above 1.3000, the directional move is to the upside targeting 1.3060-1.3100.

While Sterling fell to the lowest level since mid-August over the course of the first week of November, the news of the UK completing a deal on financial services with the EU boosted Sterling to jump strongly above the psychological level of 1.3000 to reach last week’s high of 1.3042.

Since the October Brexit summit failure, the UK macroeconomic fundamentals have a much lower influence of the direction of the FX rate of Sterling with Brexit headlines winning it all. The same applied to currency movement over the first week of November. While GBP/USD fell from Monday open at 1.2826 as low as 1.2698 on Wednesday, the news of the UK Brexit Secretary Dominic Raab saying that Brexit deal will be delivered until the end of November, boosted Sterling to cross over the downward trendline resistance. Further rumors of the UK government signing the financial services with the European Union early on Thursday saw sterling rise almost 2% to 1.3000.

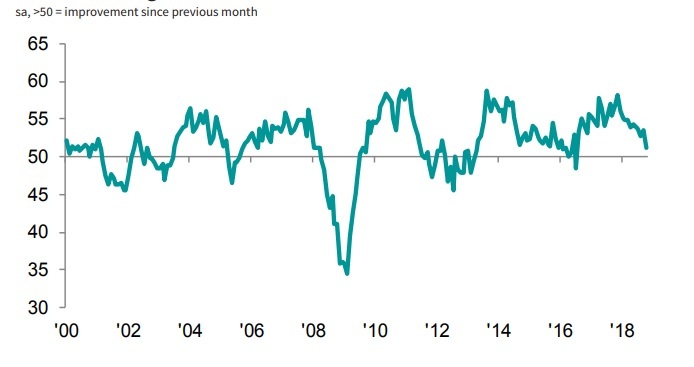

On the macro front, the UK manufacturing sector PMI fell to 51.1 in October, down from a revised 53.6 in September as new orders and employment sub-indices of the PMI both declined for the first time in 27 months.

UK manufacturing PMI

The Bank of England November Inflation Report was the most important event of last week, with the outcome of the Bank keeping the Bank rate and the asset purchasing program unchanged while the Bank of England Governor Mark Carney repeatedly said the no-deal Brexit is a highly unlikely scenario. The Bank of England officials stressed that they are ready to act whatever the Brexit deal outcome to make sure the policy target, the inflation, returns to normal of 2%. While the Bank of England lowered the short-term growth forecast, the policy outlook unchanged with a one-rake-hike-a-year policy.

On the other side of the Atlantic, the US saw a remarkable labor market report for October. The number of new jobs added in October surprised on the upside with 250K jobs compared with 190K expected by the market. Even with a downward revision to 118K for September, the combination of wage growth of 3.1% y/y in October, the highest since May 2009, sets Fed for the additional rate hike in December.

The Federal Open Market Committee is scheduled to meet next Thursday, but the rate hike is set to materialize in December with the Fed funds futures indicating 81% chance of Fed rate hike to 2.25%-2.50% at December 18-19 policy meeting. The CME group's Fed watch also implies 56% chance of Fed raising rates to 2.50%-2.75% at March 19-20 2019 policy meeting.

Related articles

- Manufacturing set to subtract from UK GDP

- November Inflation Report sees Brexit deal sorted soon with no shift from one rate hike a year policy

Technical analysis

GBP/USD daily chart

The GBP/USD daily chart implies that Sterling is still capped in a downward sloping trend. The currency pair leaped off 11-week low of 1.2698 towards a 50-day and a 100-day moving average that now serves as an active resistance, but needs to move higher to see a 50-day moving average crossing a 100-day moving average. With break above psychological 1.3000 level, the directional move based on the technical oscillators is upwards towards 1.3100 level representing 38.2% Fibonacci retracement of the 2018 high of 1.4377 to this year’s low of 1.2662. A death cross of a 50-day moving average and a 100-day moving average is needed to confirm the trend reversal.

GBP/USD 1-hour chart

Given the speed of Sterling’s current appreciation, the immediate directional movement on Sterling should be on the downside with retracement towards 1.2950. This scenario is supported by the fall of technical oscillators like the Relative Strength Index and Slow Stochastics downwards from the overbought territory. Although correction might see GBP/USD retreating to 1.2950 near term, the ultimate target in a corrective move lays at 1.3060 representing 23.6% Fibonacci retracement of Sterling falling from 2018 high of 1.4377 to 2018 low of 1.2662.

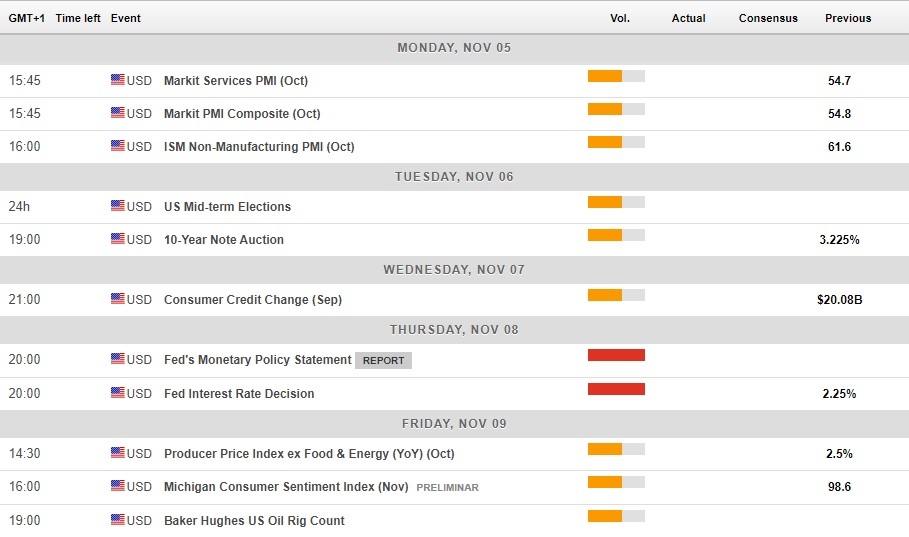

A week ahead

During the second week of November, the major market event is on Thursday with the Federal Open Market Committee (FOMC) meeting. Although no rate hike is expected in November, the FOMC is expected to stick to the script and confirm that the recent labor market strength including solid wage growth set the course for December rate hike. In fact, the chances of Fed raising rates in December to 2.25%-2.50% increased to 81% according to CME’s Fedwatch. The same tool also implies 56% chance of Fed raising rates to 2.50%-2.75% at March 19-20 2019 policy meeting.

Apart from that, the US ISM purchasing manager index (PMI) in services is expected to follow the suit of the manufacturing PMI and to decelerate to 60.0 in October.

US economic calendar November 4-9

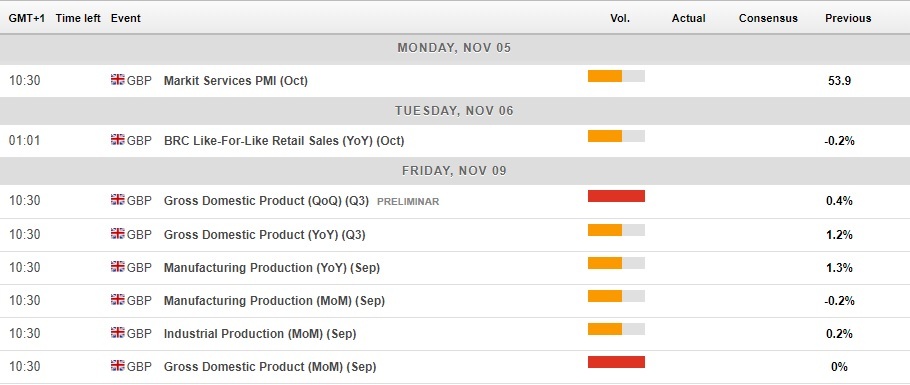

In the UK Brexit remain the most important topic with unscheduled headlines expected to drive the market at any moment, including the weekend. Looking at the fundamental, the UK will see the manufacturing output and the GDP report published next Friday. After the November Inflation Report out last week, the macro data are unlikely to change the present course of monetary policy of the Bank of England that said it will stick to a one rate hike a year plan.

UK economic calendar November 2-9

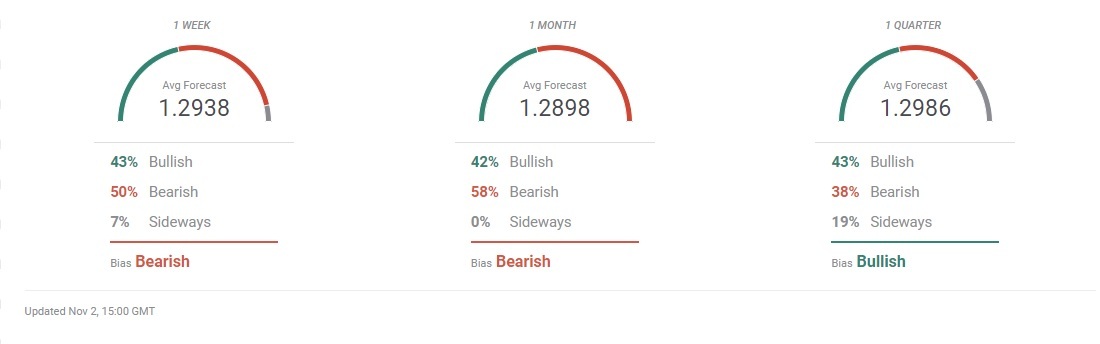

FXStreet Forecast Poll

The FXStreet Forecast Poll estimated the FX spot rate for GBP/USD at 1.2810 this Friday, with reality much more positive for Sterling at 1.2990. For the second week of November, the FXStreet Forecast Poll see the spot to reach 1.2938 with 50% bearish, 43% bullish and 7% sideways trend forecasters.

The share of bearish forecasts dropped to 50% compared with 53% last week and 92% of bearish forecasts two weeks ago.

The bullish-to-bearish distribution now reflects the increased probability of no-deal Brexit being the marginal scenario as indicated by the Bank of England officials during the November Inflation Report press conference.

Forecasts for 1-month ahead expect 1.2898 with the share of the bearish forecasts increasing from 33% to 58% and bullish forecast dropping to 42%.

The FXStreet Forecast Poll remained prevailingly bullish for 3-month time expecting 1.2986, virtually unchanged from last week's 1.2989, down from the forecast of 1.3037 expected two weeks ago. The share of bearish forecast rose to 38% from last week's 30% compared with the drop in the bullish forecast to 43% this week and 57% of bullish forecasts last week.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0850 after US inflation data

EUR/USD trades in positive territory above 1.0850 in the American session on Friday. The US Dollar struggles to preserve its strength following the April PCE inflation data and helps the pair hold its ground heading into the weekend.

GBP/USD retreats from 1.2765, holds on to modest gains

GBP/USD posted a two-day high peat at 1.2765 in the American session, as US data showed that the core PCE inflation held steady at 2.8% on a yearly basis in April. The pair retreated afterwards as risk aversion triggered US Dollar demand.

Gold falls towards $2,330 as the mood sours

US inflation-related data took its toll on financial markets. Wall Street turned south after the opening and without signs of easing price pressures in the world’s largest economy. The US Dollar takes the lead in a risk-averse environment.

Here’s why Chainlink price could crash 15% despite spike in social volume Premium

Chainlink price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Week ahead – ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.