- The GBP/USD is trading little changed above 1.2800 after falling to the 7-week low of 1.2777 on a mix of Brexit uncertainty and risk-off sentiment.

- The rumors of deep division within Theresa May’s Cabinet and Brexit negotiating team surfaced.

- While the Bank of England Inflation Report is about to voice Brexit uncertainty as a key risk to the economic and monetary policy outlook, the US labor market is set to flex its muscle.

- The FXStreet Forecast Poll GBP/USD turned less bullish for the 1-month and 3-month time.

The GBP/USD is trading little changed around 1.2800 after falling to fresh October low and the lowest level in the last 7-weeks at 1.2777 on Friday marking the week of declines from 1.3048 Monday open. Global stock market selloff contributed to US Dollar strength as investors preferred the safe-haven assets to uncertainty surrounding Brexit negotiations.

With no important fundamental news scheduled for the UK during the fourth week of October, it was the Brexit related uncertainty that drove Sterling lower, especially after the almighty British media reported that the UK Prime Minister Theresa May is losing control over her own Cabinet as the division among her team members rose.

With Sterling trading at 7-week low near 1.2800, further slides lower towards 2018 low of 1.2662 can be expected should the Brexit uncertainty prevail. The Bank of England super Thursday is unlikely to change to course either as the Monetary Policy Committee is expected to repeatedly voice their Brexit concerns.

Another factor supporting the US Dollar and other safe-haven currencies during the fourth week of October was the equity market selloff with strong and volatile moves of 2%-3% up and down. The equity market volatility did not extend in terms of duration, but it has sent a shock wave across the globe and saw the typical safe-haven currencies like US Dollar and Japanese Yen rising.

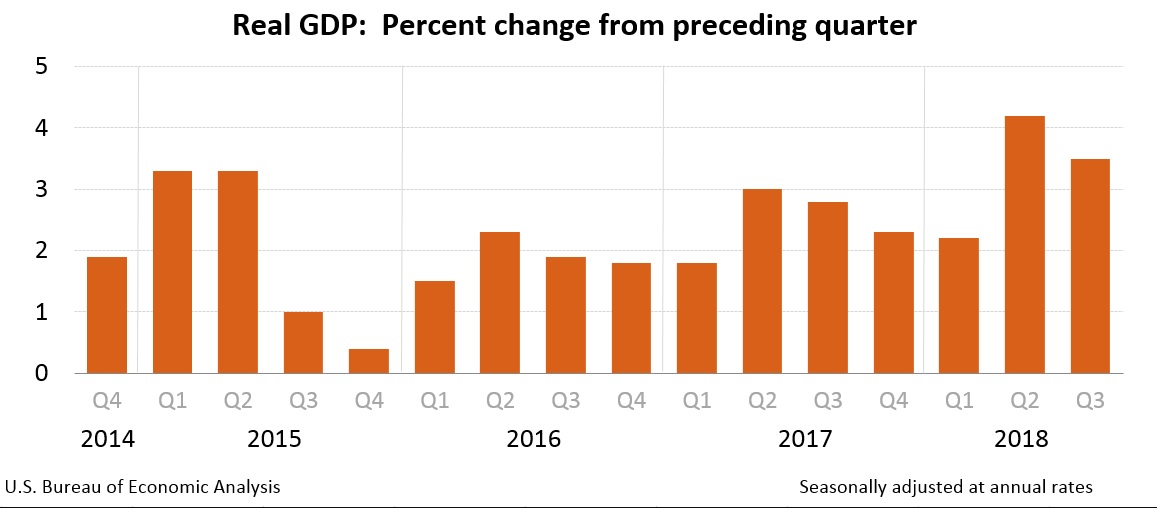

The volatility was calmed by the end of the week with the US third-quarter GDP rising above expectations by 3.5%.

With the Bank of England expected to remain dazed and confused with Brexit uncertainty and to hold back in terms of action, the US economic development is expected to support the US Dollar further in the upcoming week with the US labor market report expected to see another solid number of new jobs created in the US in October and with unemployment stuck to the lowest levels since early 1970s.

The combination of lack of fundamental drivers in the UK, the economic growth divergence between the UK and the US and mounting political risk is likely to weigh on Sterling.

US GDP growth rate

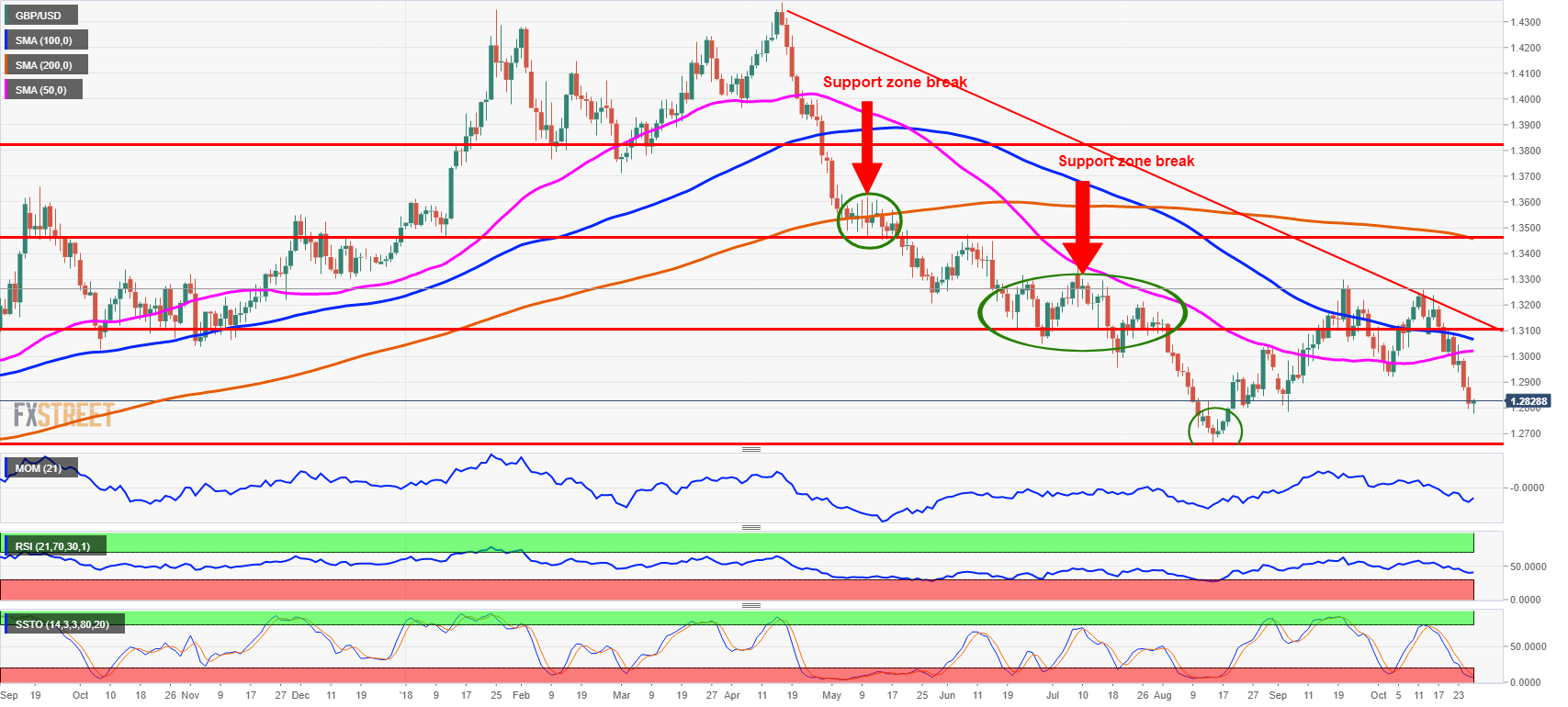

Technically, the GBP/USD is moving in a downward sloping trend framed by last week’s high of 1.3238 and Monday’s high of 1.3091. After falling sharply on Monday towards 1.2940, the GBP/USD recovered on Brexit optimism on Tuesday just to fall back to October lows on Wednesday and fell further down on Thursday and Friday. The technical oscillators including Momentum and the Relative Strength Index both turned higher in the neutral territory on a daily chart. The Slow Stochastics made a move deeply into the bullish territory with swing upwards being the most probable move. After the GBP/USD fell past price target of 1.2920 and fell below 1.2800 to reach a 7week low, the pressure on falling further towards 2018 low of 1.2662 will mount.

Related stories

- Why the US Dollar is not gaining on the GDP beat - 3 reasons

- Brexit: Time is running out? Then just add more a time, a classic EU can-kicking exercise, GBP/USD could rally

The economic event next week

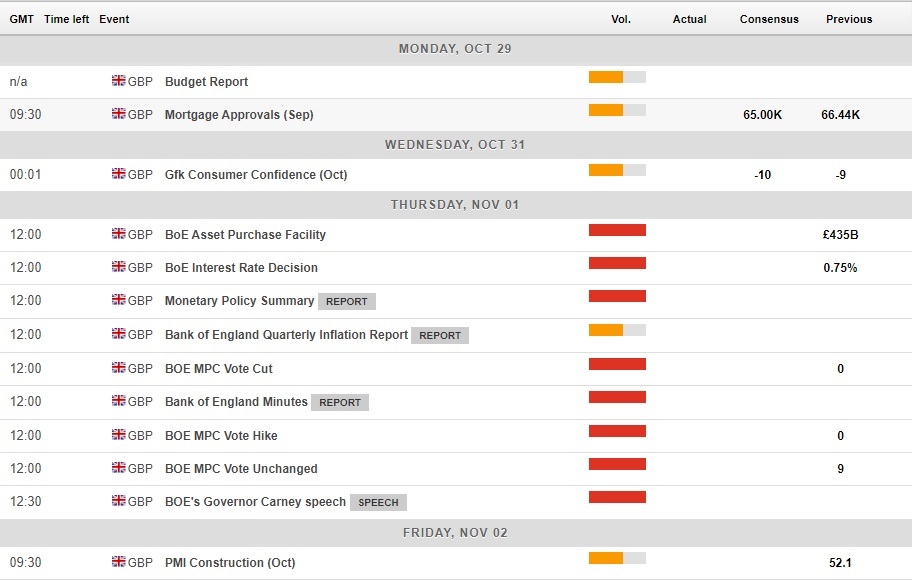

The UK economic calendar features the headline of the beginning of November in the Bank of England November Inflation Report due next Thursday. The Bank of England is not expected to either change the Bank rate or to twist the asset purchasing program. It is expected to repeatedly voice their concern about the Brexit uncertainty as both the European Union and the United Kingdom are still far from reaching the final Brexit agreement although there has been a significant progress on a wide range of issues in the Brexit negotiations.

UK economic calendar for October 29-November 2

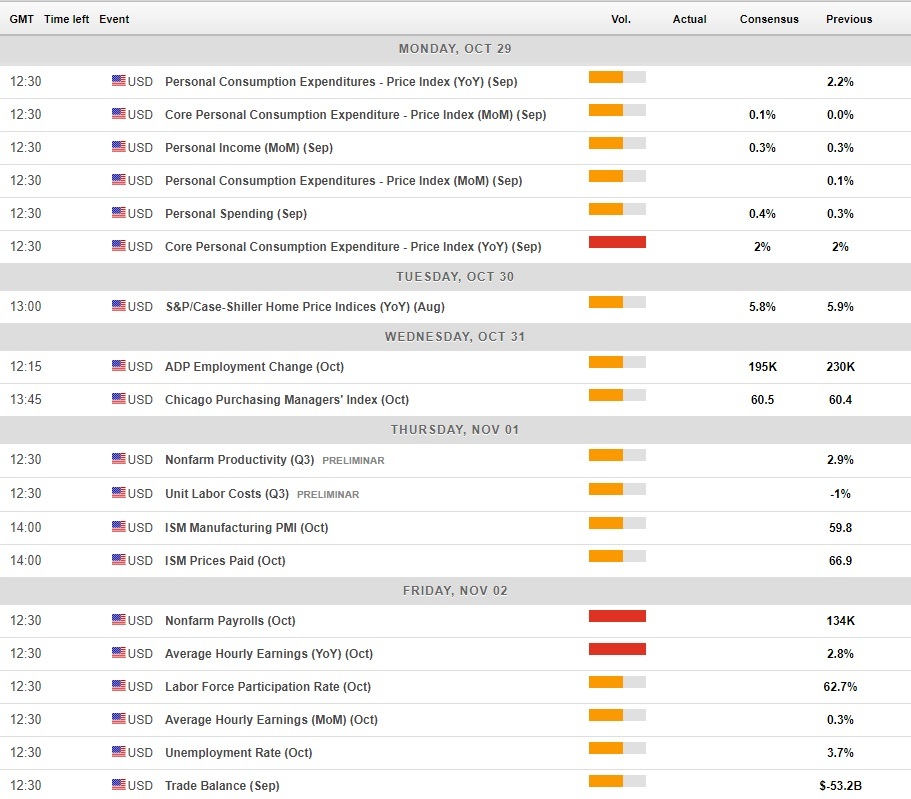

On the other side of the Atlantic, the continuous economic optimism prevails with the US third-quarter GDP coming out better than expected highlighting the mood. Even the policymakers from the US Federal Reserve are optimistic in terms of growth outlook indicating further rate hikes are to be expected, including the December rate hike this year.

Dallas Federal Reserve Bank President Robert Kaplan said on October 24 that he sees rates rising “likely” to 2.75% to 3% range in 2019 with Fed raising rates to “neutral” only gradually and patiently. Kapan also said he will judge in spring or summer of 2019 if rate hikes above neutral are warranted.

As the October US non-farm payrolls report headlines the first week of November, the Federal Reserve officials are optimistic. The Federal Reserve Bank of Cleveland President Loretta Mester said she expects US labor market to tighten further with the unemployment rate dropping to 3.5% by the end of 2019. The US non-farm payroll report is scheduled for Friday, November 21 with the US ADP private report due on Wednesday, October 31.

US economic calendar for October 29-November 2

FXStreet Forecast Poll

The FXStreet Forecast Poll turned completely bearish for the fourth week of October estimating the FX spot rate for GBP/USD at 1.2919. The reality was even darker for Sterling as spot rate was at around 1.2820 after the European market close on Friday.

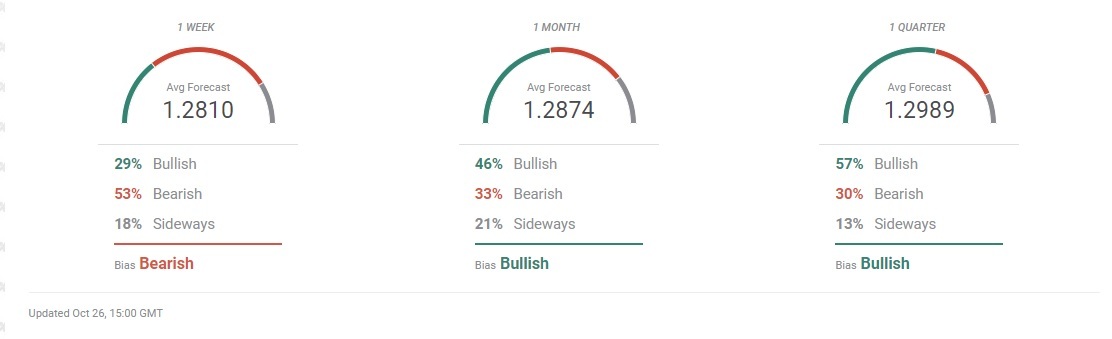

For the first week of November, the FXStreet Forecast Poll t expects GBP/USD to fall to 1.2810 in 1-week time with 53% bearish, 18% bullish and 18% sideways trend forecasters.

The share of bearish forecasts dropped to 53% compared with 92% of bearish forecasts for the week ahead of last Friday.

Forecasts for 1-month ahead turned bullish for 1-month and 3-month forecasts. The share of the bearish forecast for 1-month ahead dropped to 33% compared with 46 bullish forecast with 62% expecting bearish trend and only 29 expecting bullish trend last week. On average FXStreet Forecast Poll is expecting 1.2874 in 1-month time, down from 1.2942 FX rate in 1-month time last week and 1.3172 FX two weeks ago.

The FXStreet Forecast Poll t is also prevailingly bullish for 3-month time expecting 1.2989, down from 1.2967 forecast for a 3-month time last week and 1.3037 expected last two weeks ago. The share of bearish forecast fell to 30% from 47% last week compared with 57% of bullish forecasts.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0850 after US inflation data

EUR/USD trades in positive territory above 1.0850 in the American session on Friday. The US Dollar struggles to preserve its strength following the April PCE inflation data and helps the pair hold its ground heading into the weekend.

GBP/USD retreats from 1.2765, holds on to modest gains

GBP/USD posted a two-day high peat at 1.2765 in the American session, as US data showed that the core PCE inflation held steady at 2.8% on a yearly basis in April. The pair retreated afterwards as risk aversion triggered US Dollar demand.

Gold falls towards $2,330 as the mood sours

US inflation-related data took its toll on financial markets. Wall Street turned south after the opening and without signs of easing price pressures in the world’s largest economy. The US Dollar takes the lead in a risk-averse environment.

Here’s why Chainlink price could crash 15% despite spike in social volume Premium

Chainlink price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Week ahead – ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.