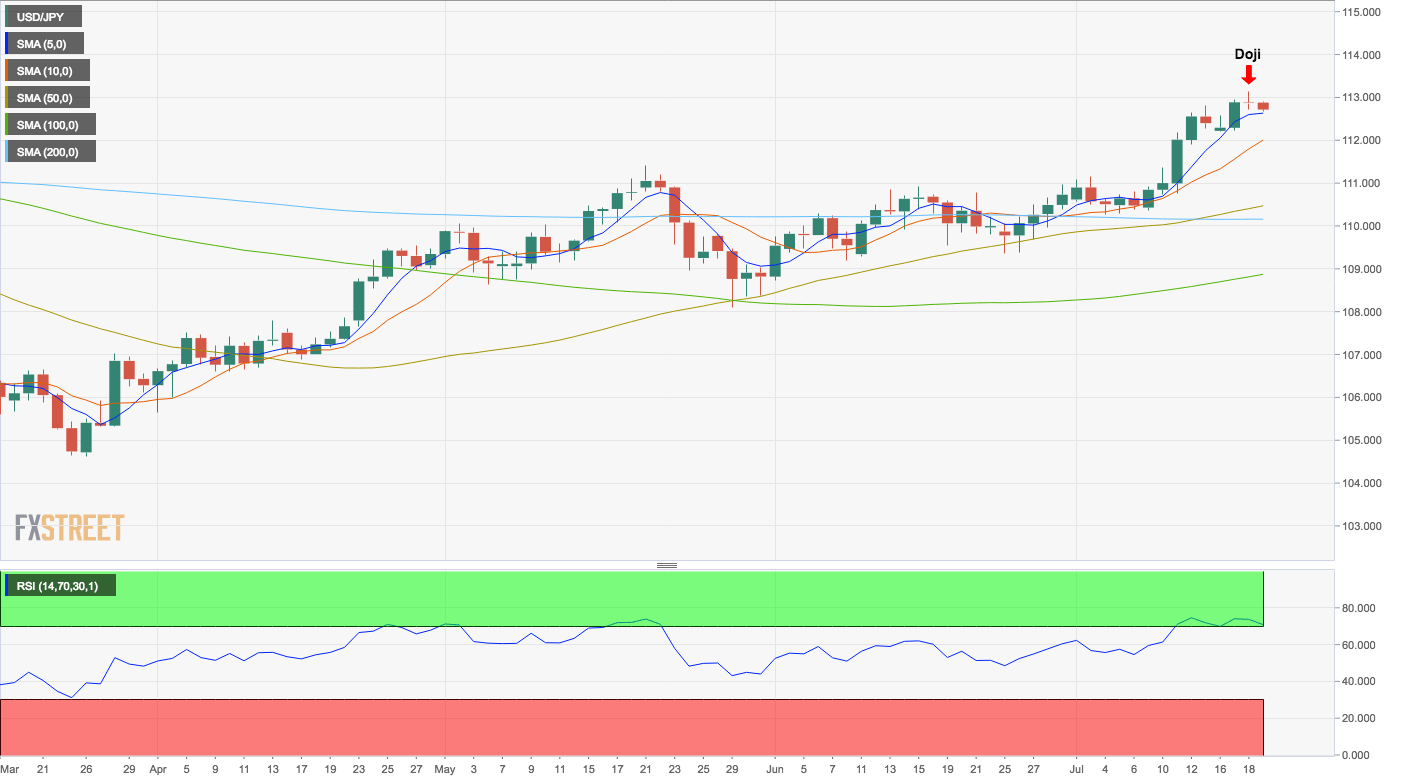

- Previous’ doji candle makes today’s close pivotal.

- Bearish doji reversal likely as 4hr chart shows a negative divergence of the RSI.

The much-needed technical correction in the USD/JPY pair will likely gather pace today, technical charts indicate.

At press time, the currency pair is trading at 112.70 - down 0.13 percent on the day, having clocked a six-month high of 113.14 yesterday.

The pullback from 113.14 to 112.70 indicates the bulls are keen on booking profits and is likely the beginning of a deeper correction, technical charts indicate.

Daily chart

The pair created a doji candle yesterday, which usually represents indecision in the market place. However, when viewed against the backdrop of 8 percent rally from the March 26 low of 104.63, the doji candle indicates bullish exhaustion (or indecision among the bulls as the bears are already on the back foot).

Hence, the focus is on today’s UTC close. A bearish doji reversal, i.e. a short-term bullish-to-bearish trend change would occur if the spot closes below the previous day’s doji candle low of 112.71. If the reversal is confirmed, then the pair will likely revisit 111.40 (May 21 high).

On the other hand, a close today above 113.14 (previous day’s doji candle high) would signal continuation of the rally, although with the 14-day relative strength index (RSI) reporting overbought conditions, the upside could be capped around 113.27/28 (200-week moving average + 61.8% of 2017-18 slide).

That said, the short duration charts indicate a bearish doji is more like to occur than not.

4-hour chart

The bearish divergence of the RSI and the head-and-shoulders breakdown on the RSI, as seen in the above chart, indicates the spot could test bids around 112.00, which marks the confluence of ascending (bullish) 10-day moving average (MA) and 50-candle MA on 4-hour chart.

Note that the path of least resistance is to the upside as the 5-day and 10-day MA are trending north. Further, major moving averages (50, 100 and 200) on the 4-hour chart are rising and are located one above the other.

Should the pair pick up a bid around 112.00, then a re-test of 113.00 cannot be ruled out.

View

- The pair risks bearish doji reversal and hence could drop to 111.40 (May 21 high) soon.

- The MAs are biased towards the bulls. Hence, I am unable to rule out the probability of a solid rebound from 112.00.

- A deeper pullback could bode well as it would help recharge the engine for a convincing break above 113.27/28 (200-week moving average + 61.8% of 2017-18 slide).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.

-636675592813582676.png)