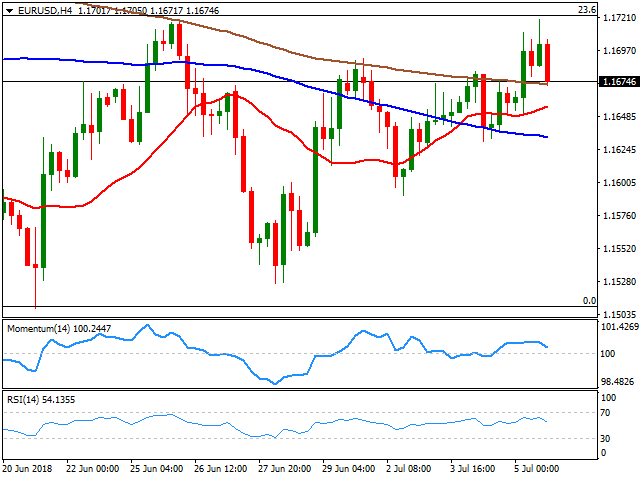

EUR/USD Current price: 1.1674

- US tariffs and Nonfarm Payrolls anticipate a volatile end of the week.

- FOMC Meeting Minutes were less hawkish than anticipated, but the USD managed to recover ground.

The EUR/USD pair edged higher in a day where anxiety was overly clear. The pair surged to 1.1719, getting an early impulse for Wednesday's news that some ECB policymakers believe that raising rates by the end of 2019 would be "too late," helped by the imbalance between macroeconomic data between both economies. Germany Factory Orders jumped in May 2.6% when compared to April when they fall 2.5%. The YoY reading resulted at 4.4% from the previous -0.1% and the expected 1.7% advance. In the US, employment-related figures published at the beginning of the session were discouraging, as Challenger Job Cuts rose 18%, from 31,517 in May to 37,202 in June, while the private sector added 177K new jobs in June, missing expectations of 190K, according to the monthly ADP survey. Finally, jobless claims rose to 231K for the week ended June 30, well above the 225K expected, also above an upwardly revised 228K in the previous week. Upward revisions to activity in the services sector were just enough to halt dollar's decline ahead of the release of FOMC Minutes, with the Markit index revised to 56.2 from 56.0 and the official ISM one up to 59.1 from 58.6 in May.

The FOMC Minutes reaffirmed policymakers commitment to raise rates gradually, as " the economy already very strong and inflation expected to run at 2 percent on a sustained basis." Policymakers also acknowledged that the negative risks to the economy from US trade policy have intensified, but despite less hawkish than anticipated, the dollar found some love after the release.

Investors are in wait-and-see mode ahead of Friday's Nonfarm Payroll report and fresh clues on US tariffs on Chinese goods, and the retaliation measures this last can take. The US economy is expected to have added 195K new jobs in June, the unemployment rate is seen at record lows of 3.8%, while wages are expected to remain subdued, up monthly basis 0.3% and by 2.8% YoY.

Technically, the pair is retreating from the upper end of the last 3-week's range, finding sellers around the 23.6% retracement of the April/May weekly decline, and in the shorter term, the pair presents a neutral stance, as it recovered above all of its moving averages, while technical indicators hold within positive territory, now turning south. The market will likely wait for the US employment report and the developments around tariffs to decide where to go next, with high chances of the second overshadowing the first.

Support levels: 1.1660 1.1620 1.1590

Resistance levels: 1.1720 1.1755 1.1790

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.