'It's Not Over Til I Say It's Over' - GameStop's 'Roaring Kitty' Returns, Sends Shares Skyrocketing

Update (1155ET): An interesting additional tweet: "It's not over until I say it's over..."

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

* * *

Update (1000ET): GME is now up 110% on the day, back to its highest since August 2022...

Earlier, we cited a note from Goldman Sachs flow of funds guru, Scott Rubner, who told clients, "I am starting to see some real FOMO start to develop based on incomings last week. Roaring Kitty is back, the message boards are going crazy this am. It is time for a thread."

Read the note here.

* * *

"My god it's him, he's really back. To give a hedgefund bitch a heart attack. To make a million apes insomniac. It's the guy... who's not a cat ;-)," wrote one user on Reddit's GameStop message board on Sunday evening following an X post from 'Roaring Kitty.'

Roaring Kitty, also known as Keith Gill, led an army of 'meme-traders' against hedge funds shorting GameStop (Melvin Capital) in 2021. He returned to X last night, posting a meme that suggested he's back after going silent on X since June 2021.

The X post has gone viral. It has been viewed more than 8.5 million times, with 14k retweets and 51k likes.

— Roaring Kitty (@TheRoaringKitty) May 13, 2024

X users are beyond ecstatic for his return:

— TaraBull (@TaraBull808) May 13, 2024

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 13, 2024

I NEVER SOLD 💎🙌 pic.twitter.com/sX3tO9OEkZ

— greg (@greg16676935420) May 13, 2024

In markets, GameStop shares jumped 38% in premarket trading in New York to the $24 handle.

Just a matter of time...

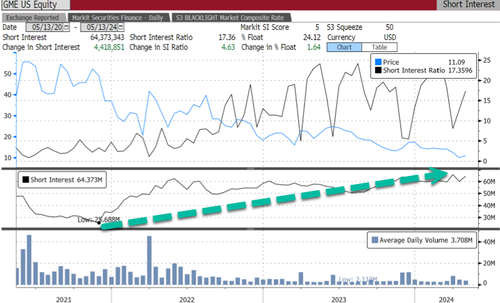

Today's squeeze has anyone shorting the stock panicking. They are also left in disbelief that one tweet from a meme trader can spark so much volatility. This adds to the 57% monthly gains already recorded as of Friday's close.

Roaring Kitty's return comes as the short percentage of GameStop shares outstanding has surged, doubling from 25 million in late 2021 to 60 million as of days ago, equal to about 24% of the float short.

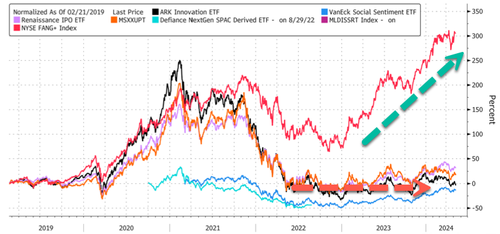

After meme stocks and other profitless companies have been dormant since 2022 collapse, primarily because of tightening financial conditions surrounding Fed Powell's rate hiking cycle. The one big question we ask: Are the meme stocks back?

It's unlikely, given that rates are in higher for longer mode. However, a cutting cycle will open up some sort of revival.