A recent Liberty Street Economics post discussed who is borrowing and lending in the federal funds (fed funds) market. This post explores activity in two other markets for short-term bank liabilities that are often perceived as close substitutes for fed funds—the markets for Eurodollars and “selected deposits.”

The Eurodollar and Selected Deposits Markets

Eurodollars are unsecured U.S. dollar deposits that are booked at bank offices outside of the United States. A central function of Eurodollars is that they can be used by banks to meet their dollar funding needs. U.S.-based banks—U.S. depository institutions or U.S. branches and agencies of foreign banks—can accept Eurodollars, typically with an overnight maturity, in offshore branches and then transfer the funds onshore. Selected deposits are unsecured U.S. dollar deposits that also tend to have an overnight maturity, similar to Eurodollars. However, unlike Eurodollars, but like fed funds, selected deposits are booked at bank offices in the U.S.

Historically, Eurodollars and selected deposits have played a role similar to fed funds as a source of short-term wholesale unsecured funding for banks, but there have been differences in how regulation has treated these dollar deposits. For instance, fed funds were historically exempt from reserve requirements; Eurodollars also became exempt in 1990. It was only in 2020 that selected deposits became exempt, when the Federal Reserve eliminated all requirements to hold reserves against certain types of deposits and other bank liabilities, including selected deposits. Additionally, prior to the repeal of Regulation Q in 2011, banks were not permitted to pay interest on demand deposits, including selected deposits.

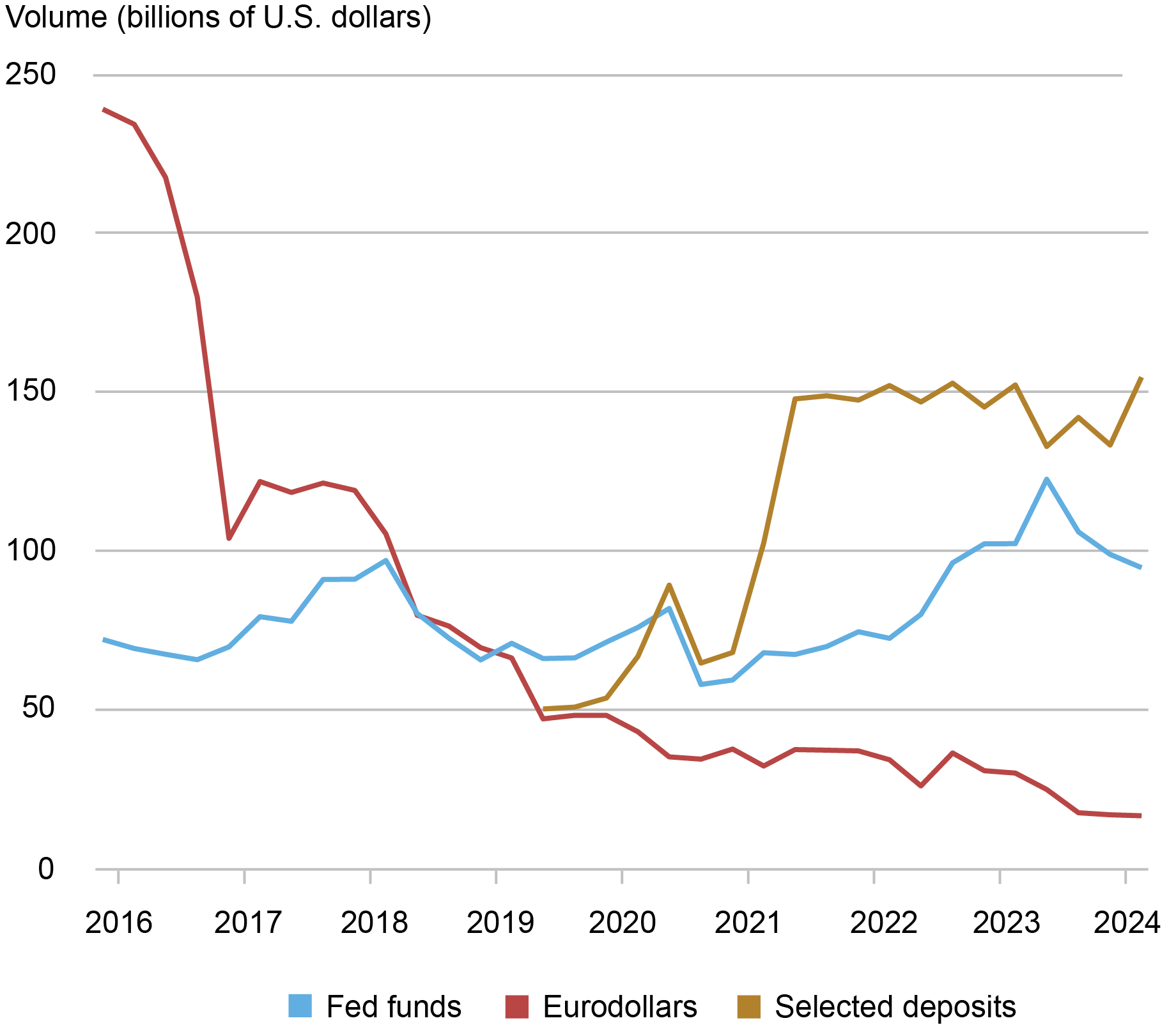

The Federal Reserve collects data on the Eurodollar and selected deposit transactions of U.S.-based banks. As shown in the chart below, since 2019, the daily volume of overnight Eurodollar and selected deposit transactions has averaged $150 billion, compared to $80 billion for overnight fed funds. Over this period, the composition of Eurodollars and selected deposits has shifted notably. In 2019, Eurodollars and selected deposits each accounted for roughly half of their combined overnight volume, but since 2022 selected deposits have accounted for 85 percent of total volume.

There are a number of potential reasons for this shift toward selected deposits. For example, as discussed in this post, the introduction of resolution plans or living wills, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, created an incentive for banks to simplify corporate structures, including by eliminating offshore branches where banks accept Eurodollars. Second, prior to the elimination of reserve requirements in 2020, the need to hold reserves against selected deposits—but not Eurodollars—may have slowed the growth in selected deposits. The timing of this elimination coincides with the increase in selected deposit volumes in late 2020. That said, it is important to note that given the level of reserves in the U.S. banking system since the Great Financial Crisis, this cost differential between selected deposits and fed funds/Eurodollars had narrowed prior to 2020, as required reserves became a smaller fraction of total reserves in the U.S. banking system.

The Shift from Eurodollars to Selected Deposits

Note: The chart shows quarterly average Eurodollar, fed funds, and selected deposit volume as included in the Overnight Bank Funding Rate from the 2015:Q4 through 2024:Q1. The selected deposit series begins in 2019:Q2.

Who’s Borrowing?

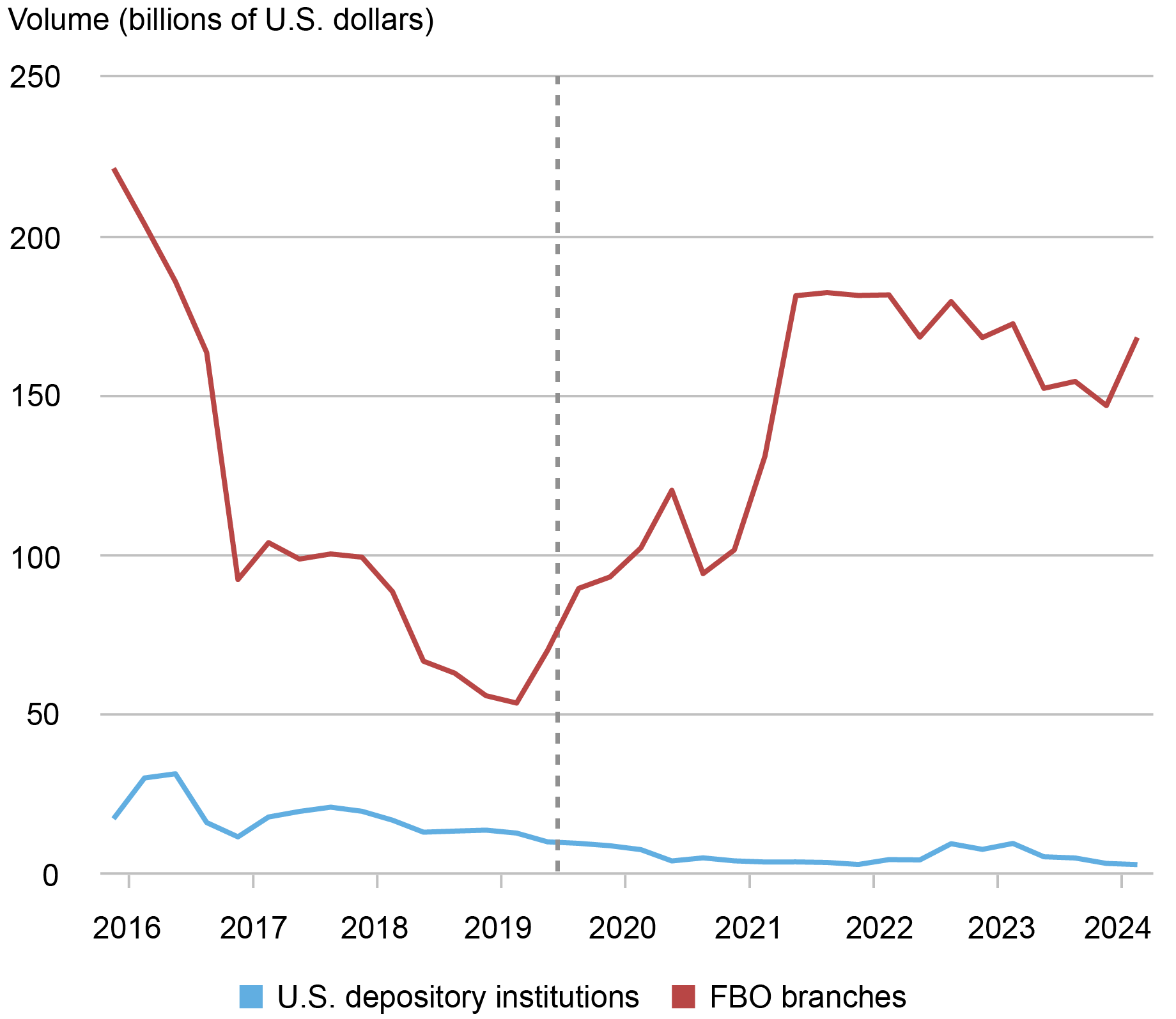

The main borrowers of Eurodollars and selected deposits are the U.S. branches and agencies of foreign banks (FBO branches). On an average day, FBO branches borrow between $50 billion and $200 billion, accounting for over 90 percent of total daily volume since 2016. As we discussed in an earlier post, FBO branches are also the main borrowers in the fed funds market, with a market share ranging between 65 and 95 percent of the total daily volume.

FBO Branches Are the Main Borrowers of Eurodollars and Selected Deposits

Note: The chart shows quarterly average Eurodollar and selected deposit volume by borrower type as included in the Overnight Bank Funding Rate from 2015:Q4 through 2024:Q1. Vertical dashed line corresponds to the beginning of the selected deposit series (2019:Q2).

While FBO branches engage in banking activities similar to those of domestic banks, deposits at FBO branches—with a small number of exceptions—are not insured by the Federal Deposit Insurance Corporation (FDIC). This implies that these FBO branches cannot accept retail deposits, limiting their sources of stable funding and making them reliant on wholesale funding, like Eurodollars and selected deposits. Moreover, since they do not pay the FDIC deposit insurance assessment fee, most FBO branches face a lower effective cost of borrowing, which gives them a comparative advantage relative to insured institutions when borrowing in wholesale funding markets.

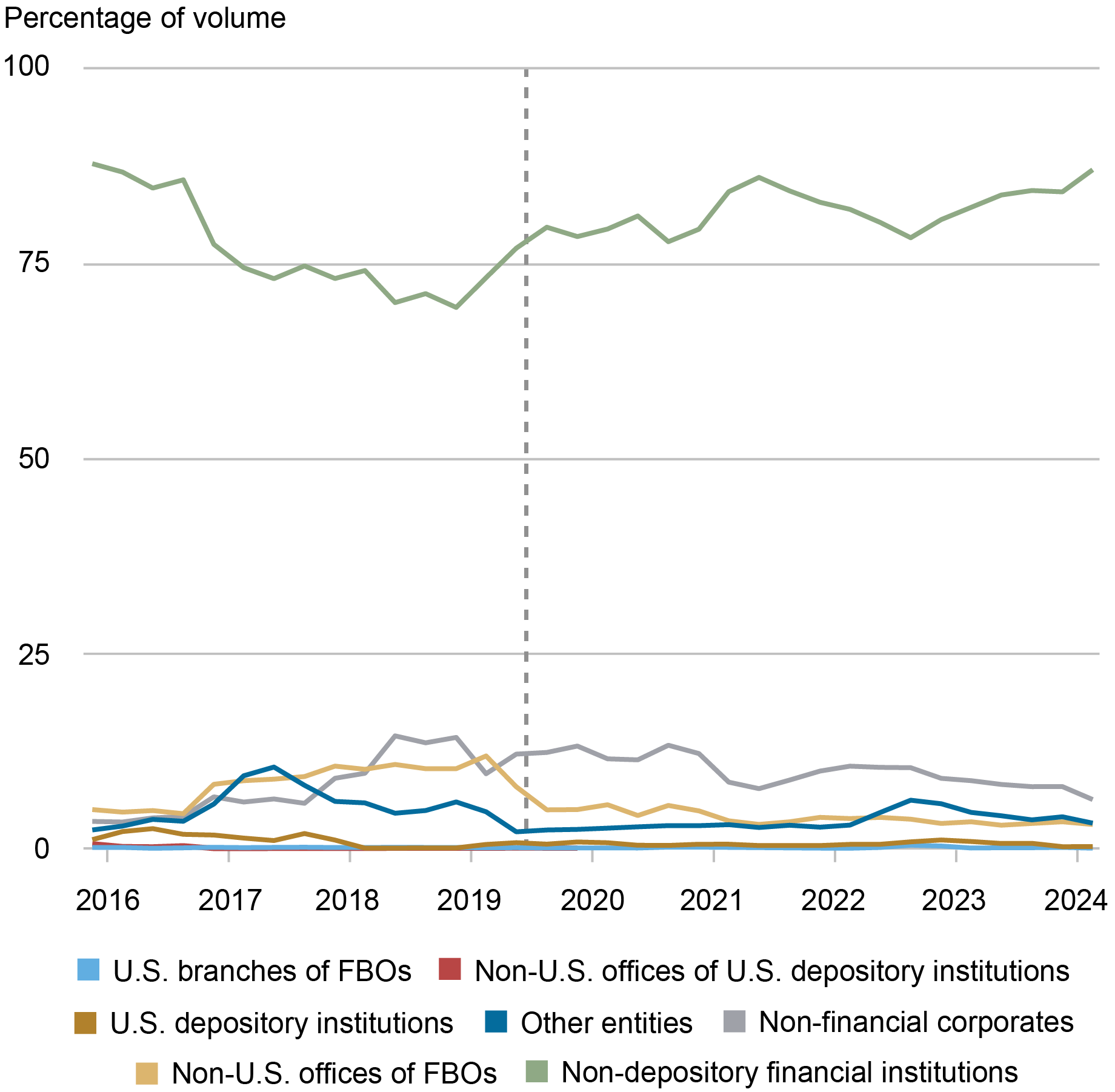

Who’s Lending?

The main lenders in Eurodollars and selected deposits are non-depository institutions that primarily engage in financial intermediation services such as brokerage, underwriting, credit origination, credit card, insurance, and pension services, among others. As the following chart shows, these financial institutions represent 80 percent of the volume lent in the overnight Eurodollar and selected deposit markets.

Non-depository Financial Institutions Are the Main Lenders of Eurodollars and Selected Deposits

Note: The chart shows quarterly average Eurodollar and selected deposit volume by lender type as included in the Overnight Bank Funding Rate from 2015:Q4 through 2024:Q1. Vertical dashed line corresponds to the beginning of the selected deposit series (2019:Q2).

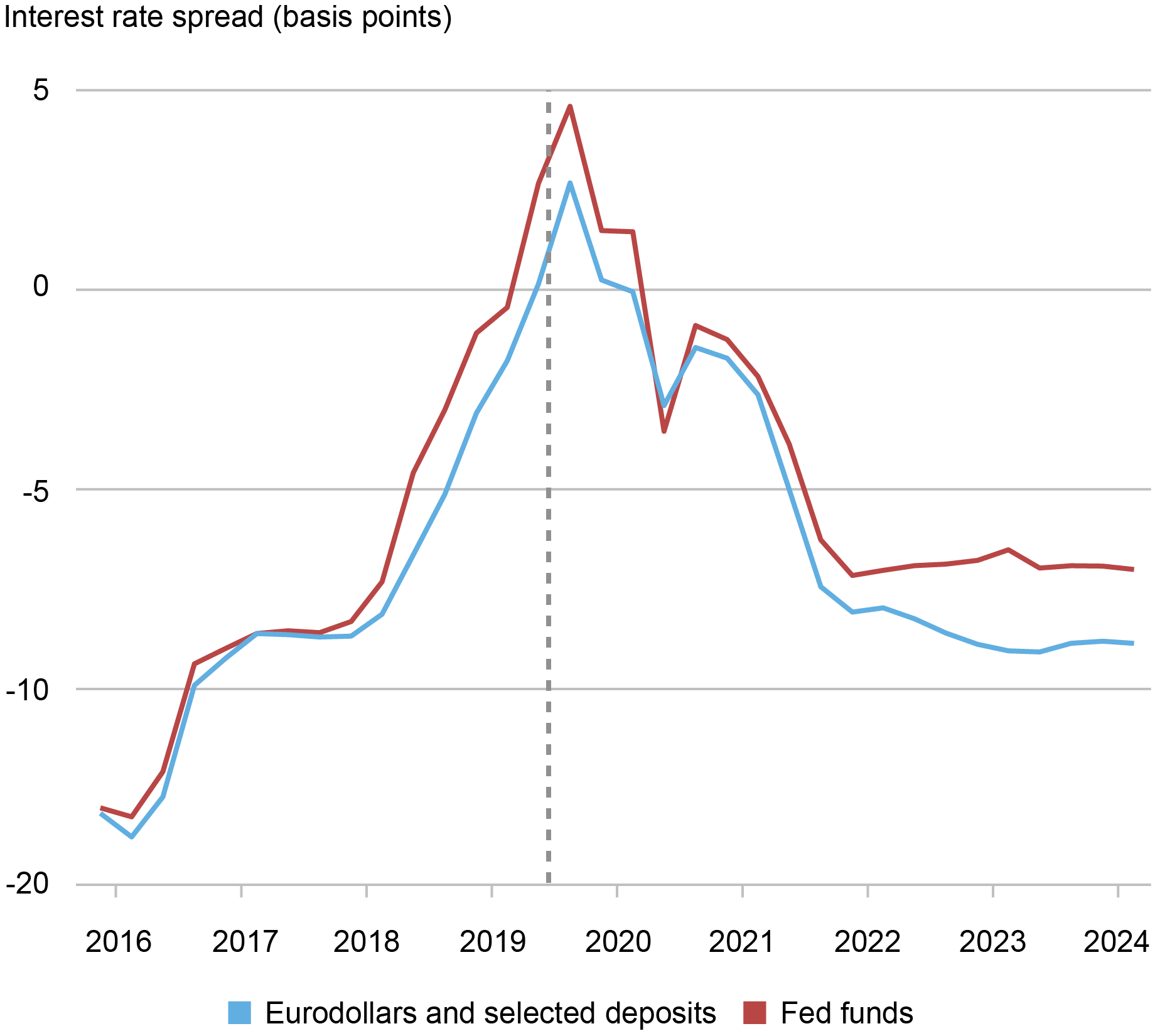

The type of lender is an important feature that distinguishes Eurodollars and selected deposits from fed funds transactions. As we discussed in our earlier post, Federal Home Loan Banks (FHLBs)—government-sponsored enterprises that support mortgage lending and community investments—dominate lending in the fed funds market, accounting for over 90 percent of the total daily volume traded. The Eurodollar and selected deposit markets offer a broader set of lenders. However, borrowing from FHLBs has a favorable treatment in banks’ calculation of outflows for their Liquidity Coverage Ratio (LCR), potentially making fed funds more attractive than Eurodollars and selected deposits (as explained in this article). Consistent with the existence of this regulatory advantage, the chart below shows that banks typically pay higher rates to borrow in the fed funds market relative to Eurodollars and selected deposits.

Higher Rates in the Federal Funds Market than in Eurodollars and Selected Deposits

Note: The chart shows the spread between the volume-weighted mean interest rate and the Fed’s interest rate on reserve balances from 2015:Q4 through 2024:Q1. Vertical dashed line corresponds to the beginning of the selected deposit series (2019:Q2).

In Sum

Changes in regulation and in the economic conditions in the U.S. banking system since the Great Financial Crisis have contributed to the narrowing of the differences between Eurodollars, selected deposits, and fed funds, with selected deposits trading overtaking the Eurodollar market in recent years. Given their lower costs of borrowing, FBO branches are the main borrowers in all these markets. The set of lenders, however, is considerably larger for Eurodollars and selected deposits. The regulatory advantage of fed funds still makes them relatively more attractive, which is reflected in the higher rates at which they trade.

Gara Afonso is the head of Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Gonzalo Cisternas is a financial research advisor in Non-Bank Financial Institution Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Will Riordan is a capital markets trading advisor in the Federal Reserve Bank of New York’s Markets Group.

How to cite this post:

Gara Afonso, Gonzalo Cisternas, and Will Riordan , “Who Is Borrowing and Lending in the Eurodollar and Selected Deposit Markets?,” Federal Reserve Bank of New York Liberty Street Economics, May 13, 2024, https://libertystreeteconomics.newyorkfed.org/2024/05/who-is-borrowing-and-lending-in-the-eurodollar-and-selected-deposit-markets/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics