The EU’s 14th round of sanctions against Russia are reportedly considering a ban on the trans-shipment of Russian LNG via EU facilities. This measure would primarily impact shipping operations from the 17.5 mtpa Yamal LNG facility.

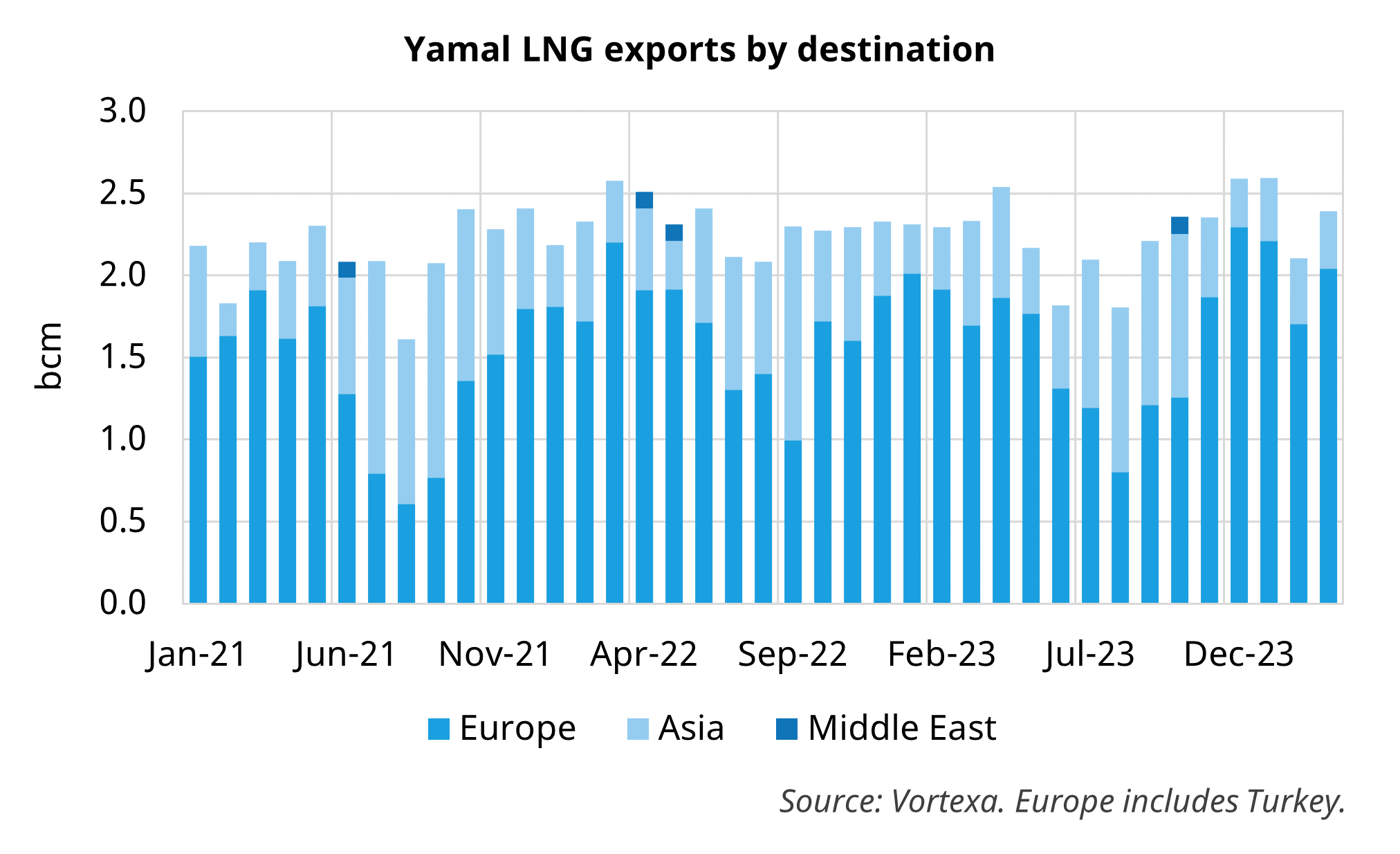

In 2023, 19.2 bcm (~71%) of Yamal LNG’s loadings were delivered to a European terminal (including Turkey), with 7.6 bcm (~28%) delivering directly into Asia. However, estimates suggest upwards of 4 bcm of volume delivered into Europe was not actually sent into the European grid, but instead transhipped (primarily at Zeebrugge and Montoir) to markets further afield.

The following provides background to assess the potential impact of sanctions:

- Yamal LNG uses 15 specialised Arc7 ice-class carriers to load LNG. Most deliveries go to Northwest Europe (~9 days one way trip). From here, gas is distributed into the grid or transhipped onto conventional LNG carriers for transit further afield.

- An EU ban on transhipment would force longer journeys for Arc7 carriers to NE, via the Northern Sea route (NSR; ~ 17 days) or the Southern Sea route (~ 38 days).

- Tying up Arc7 carriers on longer journeys to Asia could inhibit the ability to sustain a full loading programme. The challenge is particularly acute in winter months, when the NSR is impassable.

- Planned floating storage units (FSUs) to ease logistics in Murmansk and Kamchatka were sanctioned by the US in September 2023, hindering efforts to bypass potential EU restrictions.

While EU sanctions are not presently looking at a complete ban on Russian LNG imports, restricting activity and revenues in the sector is coming into focus. This follows US sanctions on Arctic LNG 2 which have led to a delay in the commissioning of the first train at the Arctic LNG facility and cast uncertainty on broader ambitions for the expansion of Russian export capacity. The risk of disruption to Russian LNG exports is thus growing, adding to price support emanating from the upcoming expiry of the Russia-Ukriane gas transit agreement at the end of 2024 (see earlier snapshot).