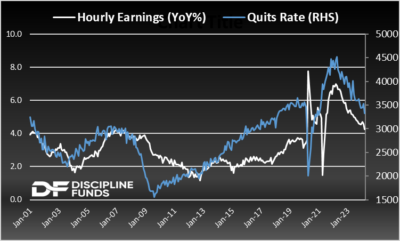

Wednesday’s Fed decision was largely unsurprising. But the most important data point of the day came long before the Fed decision. The latest JOLTS report showed the lowest levels of quits since early 2018 when Core PCE inflation was around 2%. This is an interesting data point because the quit rate has tended to be a good measure of labor market tightness.

As the following chart shows the quit rate tends to lead hourly earnings. The basic logic is that quits are indicative of how much negotiating power workers have. When they are quitting they’re exercising their power to leave one job for another without worry. This tends to lead wage data because those workers are quitting in an environment where labor favors capital in terms of negotiating power. And while the quit rate will be recorded in real-time the labor market contracts reflected by those negotiations should have more of a lagging reflection in actual data. And the data confirms this logic as earnings tend to lag the quit rate.

Why is this all important? Because the disinflationary trend that was dominant in 2023 is still very much intact. Yes, it’s all progressing slower than the Fed would like but the risk here still remains to the downside on inflation and not to the upside.

It’s often believed that the Fed can only bring down inflation by causing a rise in unemployment. But it’s also clear that inflation can come down thru decreased labor market negotiating power even though jobs are still expanding. That’s why there’s so much debate about things like the Phillip’s Curve – Monetary Policy doesn’t have to work thru just one facet of the labor market and the economy. In any case, inflation is proving stickier than expected, but a few months of upside surprises is no reason to think we’re not headed in the right direction. The bigger more dominant macro trends are still very much in place despite some noisy short-term data.