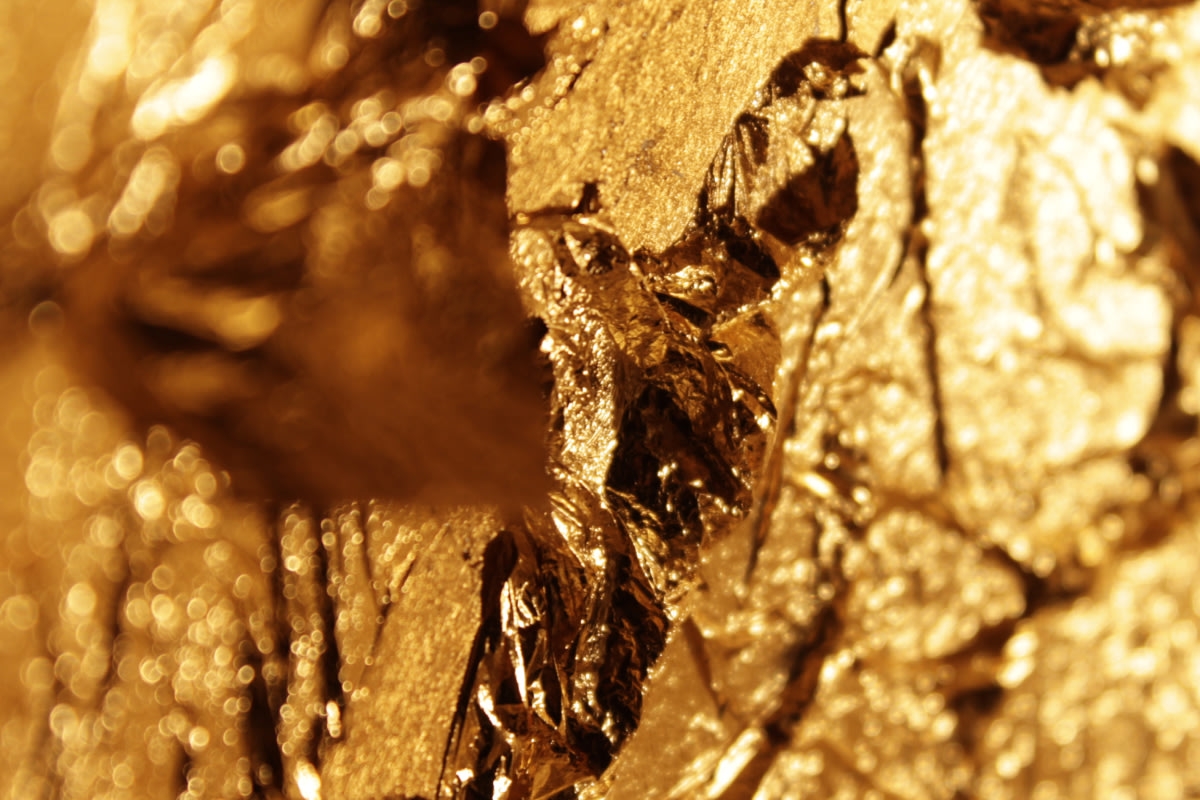

Is the gold rally sustainable?

By Team Exness

10 April 2024

Is the current surge in gold prices sustainable? As the bullion soars to new heights, investors are left pondering the longevity of this remarkable rally. Behind this surge lie several key factors, including shifting dynamics within emerging markets, rising geopolitical tensions, and China's ongoing property crisis, all propelling gold to unprecedented levels.

Central banks, particularly those in Emerging Markets (EM) like China and India, have been steadily bolstering their gold reserves. Despite a slight slowdown in February, this trend remains robust, indicating ongoing confidence in gold as a store of value amidst economic uncertainties. With an increasing number of EM central banks diversifying away from traditional US dollar reserves, gold has emerged as a favored alternative. The ramped-up demand from central banks reflects a preference for gold's independence from the traditional fiat currency system, providing a solid foundation for the rally.

Furthermore, heightened geopolitical tensions across various regions have intensified the demand for safe-haven assets like gold. In times of geopolitical uncertainty, investors seek refuge in assets that are often seen as stable and resilient against market upheavals. Gold, with its long-standing reputation as a store of value, becomes an attractive option for investors looking to safeguard their wealth amidst geopolitical risks.

Simultaneously, the Chinese consumer market, confronted with lackluster performances in the equities market and an ongoing property crisis, is increasingly gravitating towards gold as a hedge for their portfolios. With concerns over the stability of other investment avenues, Chinese investors are turning to gold to seek stability and protection against market volatility.

However, what's most intriguing about this rally is its unexpected resilience in the face of inflation surprises and upbeat jobs data in the United States. Typically, positive inflation indicators and strong employment figures would dampen the appeal of the non-yielding bullion as markets anticipate delayed prospects of Fed rate cuts. Yet, markets remain unfazed by robust jobs and inflation figures as money managers continue to flock to gold, underscoring its enduring role as a safe-haven asset in times of heightened uncertainty.

Despite these bullish fundamentals, the potential for short-term profit-taking and price retracements might occur. The rapid ascent of gold prices within a relatively brief period raises concerns about market overheating, prompting cautious optimism among investors. Therefore, prudent risk management is essential to navigate potential market corrections and capitalize on favorable entry points in the gold market.

This is not investment advice. Past performance is not an indication of future results. Your capital is at risk, please trade responsibly.

Author: