Technical Analysis – WTI oil futures capped by 50-day SMA

WTI futures bounce off the lower end of the Ichimoku cloud

But their rebound is being held down by the 50-day SMA

Momentum indicators got rejected before entering bullish territories

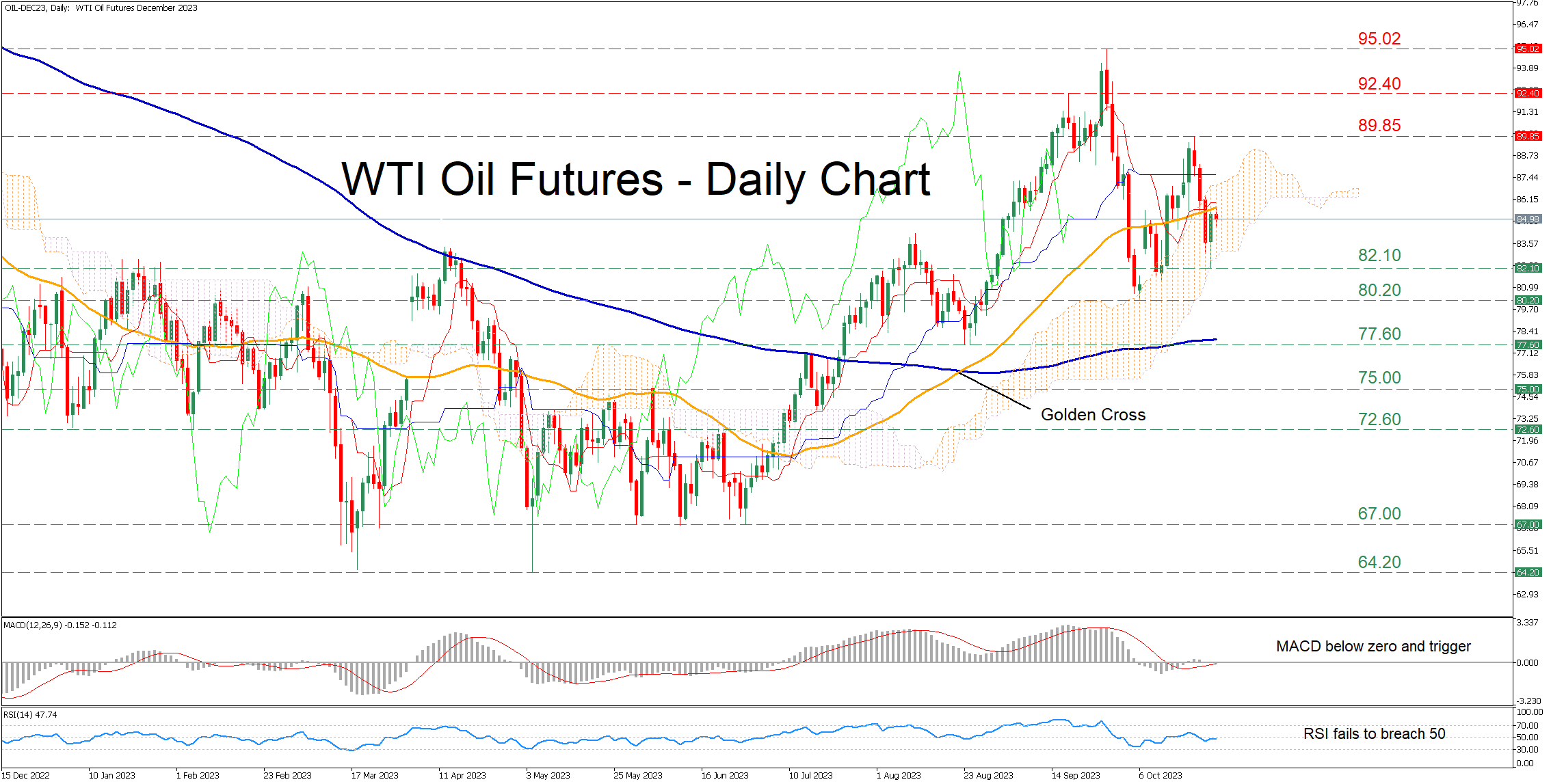

WTI oil futures (December delivery) had been in a steady advance since their October bottom of 80.20 before experiencing a pullback. Although the commodity managed to halt its latest retreat and recoup some losses, the 50-day simple moving average (SMA) has been acting as a strong ceiling.

Should the price conquer the 50-day SMA, there is no prominent resistance zone before the October high of 89.85. Piercing through that wall, the price could test the September resistance of 92.40. A violation of that territory could open the door for the 2023 high of 95.02, which is also a 13-month peak.

Alternatively, if the price reverses lower, the recent support of 82.10, which overlaps with the lower boundary of the Ichimoku cloud, could act as the first line of defense. Sliding beneath that floor, WTI futures could challenge the October bottom of 80.20 ahead of the August low of 77.60. Even lower, the June resistance of 75.00 may provide downside protection.

In brief, WTI oil futures managed to pause the latest retreat, but their recovery seems to be faltering near the 50-day SMA. However, the neutral technical picture remains intact for the commodity as long as the price keeps hovering within the Ichimoku cloud.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.