The October WSJ forecast survey is out. The mean forecast is for no downturn (no 2-quarter negative growth). It’s also a lot higher than three months ago.

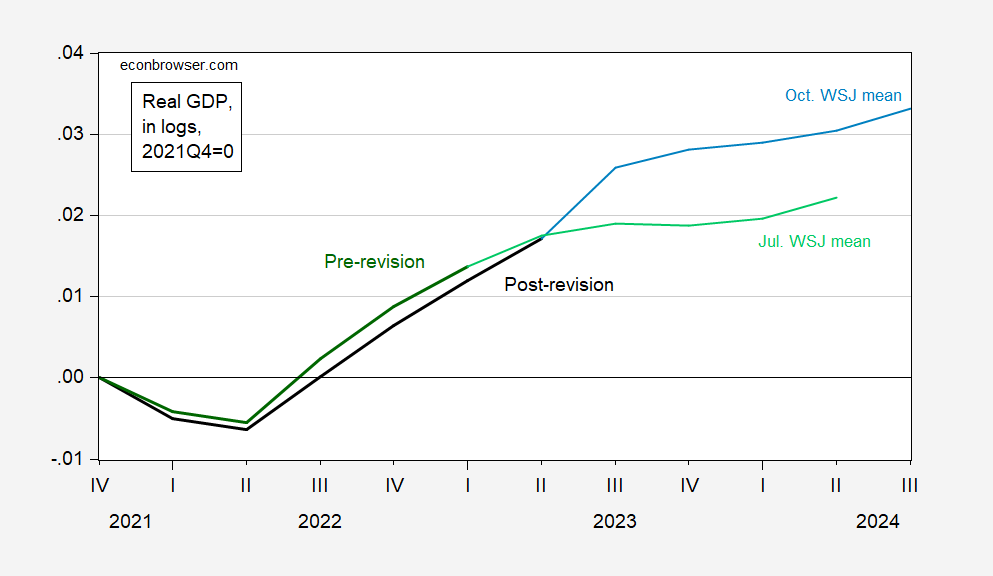

First, here’s the forecast compared to three months ago, in levels.

Figure 1: GDP as of 2023Q1 3rd release (bold green), WSJ July mean forecast (light green), GDP as of 2023Q2 3rd release/comprehensive revision (bold black), WSJ October man forecast (sky blue), all in logs, 2022Q4=0. Source: BEA via FRED, ALFRED, WSJ (various), and author’s calculations.

The upshift in levels is partly due to GDP higher than forecasted for Q2. But Q3 and Q4 GDP growth is also forecasted to be higher than 3 months ago — by about 1 ppt (annual rate), while 2024Q1 growth is about the same (0.36 ppts). 2024Q2 forecasted growth is about halved — from 1.06 ppts SAAR to 0.56 ppts.

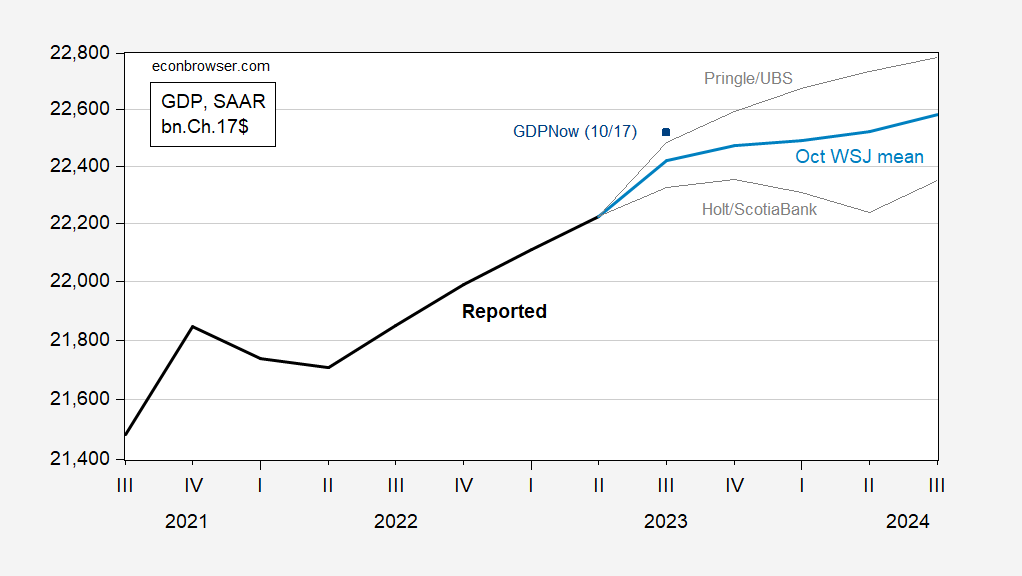

It’s not that there aren’t some forecasting a recession. Figure 2 depicts the mean growth rate, along with the 20% trimmed high/low bands. While mean is all positive growth, median (Panday at S&P Global Ratings) has -1% and 0% growth (SAAR) in 2023Q4 and 2024Q1, respectively.

Figure 2: GDP (bold black), October WSJ survey mean (sky blue), 20% high/low forecasts (light gray lines), Atlanta Fed GDPNow as of 10/17 (blue square), all in billions Ch.2017$ SAAR. Source: BEA 2023Q2 3rd release/comprehensive revision, WSJ (October survey), and author’s calculations.

GDPNow, which uses data up to the 17th, is higher in Q3 than the 7th highest growth rate (out of 65 respondents), so the economy seems to be outperforming what respondents thought in early October.

Jonathan Holt at ScotiaBank forecasts two consecutive quarters of negative growth, in 2024Q1-Q2. Generally, most negative growth quarters are 2023Q4 through 2024Q2. So some people are still forecasting a rule-of-thumb recession (on GDP metric), even as less than half of respondents are now predicting a recession in the next year (specifically, 48%).

Off topic, China’s bad debt and the Belt-and-Road –

How did I miss this? Back in March, a working paper entitled “China as an International Lender of Last Resort” was published:

https://www.aiddata.org/blog/belt-and-road-bailout-lending-reaches-record-levels

The paper examines a largely secret program (naturally, ’cause it’s China) of bailout and roll-over lending to Belt-and-Road borrower countries which are having trouble servicing their debt. Middle-income countries get balance-of-payment support, while lower-income countries are allowed a grace period. In other words, middle-income countries get new lending, but poor countries don’t.

The bulk of China’s recent lending (up to 2019) has been deal with non-performing loans, an effort to protect Chinese banks with exposure to Belt-and-Road projects.

The report covers from 2003 to 2019. The effects on Covid and Russia’s war in Ukraine are missing. Russia has more Belt-and-Road projects than any other country, and most are reportedly unable to keep current on loans since economic sanctions were imposed after the renewal of Russia’s hostilities against Ukraine.

This may not be on the same scale as China’s real estate problem, but with Belt-and-Road lending at roughly 3/4 of a trillion dollars, it ain’t chicken feed.

Never knew about that William and Mary website. Looks rich with interesting stuff. Thanks.

Kind of hard to tell who’s hooking whom on the fish hook here, eh?? My money is on China holding the fishing pole, but will the weight of the fish pull them into the water??

Menzie, the contrast in forecasts (both time-wise and in-between professionals) is very fascinating, and as you sort of note, a more drastic change than laymen might realize. I had a rare day today, with a relatively happy ending, but still rough going most of today, related to home maintenance sanity. Thanks Menzie for giving me ASMR of economic blogs ( a compliment, though I feel you won’t be certain it’s a compliment). You help keep me sane brother (or nearer to sane than I would otherwise be). Two more days until I get sauced. Damn man, I may give a narrative exposition on this later, related to very dumb/lazy people driving trucks for Lowe’s. Pray I’m not drinking when I give my narrative exposition on Lowe’s guys driving small delivery trucks or I may set a new record for F-bombs here on the blog.

For all of the commentary about the US being beholden to China (through Treasury purchases), it seems that Russia may be more indebted to China than the US. In addition, the according to the Harvard Review, the top 20 country borrowers owe more than 15% of their GDP to China. (See https://hbr.org/2020/02/how-much-money-does-the-world-owe-china).

At this point, it seems that Russia is more dependent on China than ever.

Not just Russia:

While China’s role in global trade is highly publicized and politically polarizing, its growing influence in international finance has remained more obscure, mostly due to a lack of data and transparency. Over the past two decades, China has become a major global lender, with outstanding claims now exceeding more than 5% of global GDP. Almost all of this lending is official, coming from the government and state-controlled entities.

Our research, based on a comprehensive new data set, shows that China has extended many more loans to developing countries than previously known. This systematic underreporting of Chinese loans has created a “hidden debt” problem – meaning that debtor countries and international institutions alike have an incomplete picture on how much countries around the world owe to China and under which conditions.

In total, the Chinese state and its subsidiaries have lent about $1.5 trillion in direct loans and trade credits to more than 150 countries around the globe. This has turned China into the world’s largest official creditor — surpassing traditional, official lenders such as the World Bank, the IMF, or all OECD creditor governments combined.

If you owe China a billion dollars, China owns you. If you owe China a hundred billiion…?