Bank of Canada preview: Still on course for four rate hikes

Omicron's emergence will mean the BoC will tread carefully but strong growth, a booming jobs market and bubbling inflation pressures suggest we remain on course for four rate hikes in 2022. We expect only a limited impact on CAD, which should remain almost solely driven by external factors, at least for now

BoC to tread carefully on Omicron emergence

After the Bank of Canada's October’s announcement that it would immediately end QE and move forward guidance for the timing of the first-rate hike to mid-2022, we changed our forecast to predicting four rate hikes next year – one in each quarter. After all, the economy is growing strongly, employment is at record highs and inflation is soon going to breach 5%. However, the emergence of the Omicron variant is a cause for concern that could result in some consumer caution that negatively impacts the near-term growth profile.

Consequently, we expect the BoC to tread carefully this week and leave policy unchanged. They will also likely announce a continued reinvestment of maturing assets on their balance sheet, emphasising that time is needed to assess the scientific data on the potential implications of the new Covid strain.

Our base case is that Omicron is a scare rather than the catalyst for another round of lockdowns that would derail the recovery story. If correct, the arguments for a swift tightening of the bank’s monetary policy stance will look justified.

Inflation on the rise and jobs are surging

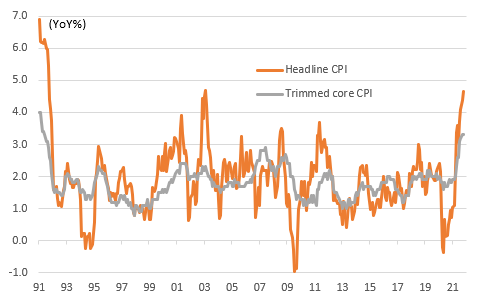

Inflation is already at 30-year highs and is set to rise further with the BoC having acknowledged that price pressures have been "stronger and more persistent than expected". BoC Governor Tiff Macklem has already admitted that supply chain strains and production bottlenecks “are not easing as quickly as we expected” which means that inflation is “probably going to take a little longer to come back down”.

Canada consumer price inflation (YoY%)

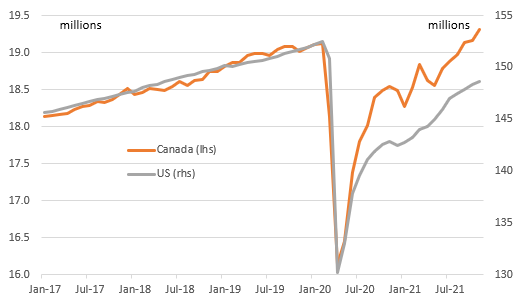

At the same time, Canada has been far more successful at job creation than the US with employment already above pre-Covid levels. The November jobs report saw employment surge 153,700, a gain four times larger than the 37,500 consensus, which underscores the confidence that employers have in the economic outlook. Given less spare capacity than most other economies, we continue to forecast a 25bp rate hike at the March policy meeting with three further moves in 2022.

Canada versus US employment levels (millions)

Inflation target set to be left unchanged

The BoC is also mulling changing its inflation target that could be more explicit about tolerating inflation overshoots in a move that would follow the US, i.e. average inflation targeting. An announcement could accompany Wednesday's policy statement but we suspect it will be delayed until a slightly later point.

Our view is that the BoC already has a framework that is well understood with inflation overshoots already accommodated given the central 2% target has a tolerance range of 1-3%. Yes, inflation is above that and is likely to stay above 3% for much of next year, but these are highly unusual times with a large proportion of the overshoot resulting from pandemic related dislocations. We don't see any need for a radical shift in the target given these circumstances. The current degree of flexibility should easily cope in more "normal" times.

CAD: Expecting a limited impact

CAD has recovered some of its recent losses at the start of this week, as a rebound in risk appetite and oil prices generated some squeezing of short positions. With market sentiment on the risks associated with the Omicron variant changing quite rapidly, it is hard to predict whether the loonie will still have a good tailwind into tomorrow's BoC policy announcement.

We believe that a cautious approach this week by the BoC given the lingering uncertainty around the risks and economic impact of the new variant should not surprise the market and hit CAD as long as policymakers do not go as far as signalling there are risks of a deviation from current policy plans. At the same time, the bar for a hawkish surprise seems quite high too; the market is back to pricing five rate hikes next year as strong jobs data on Friday helped to fully revert the dovish re-pricing initially triggered by the Omicron variant.

All in all, we think the BoC won't surprise markets and that CAD will be only marginally impacted by the policy meeting this week, leaving the currency almost solely driven by external factors for now. Barring a major setback to the global economy due to the Omicron variant, we still expect USD/CAD to consistently trade below 1.25 in 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more