The West Texas Intermediate Crude Oil market has pulled back a bit during the course of the trading session on Monday to show signs of weakness. Quite frankly, the market has been all over the place during the day, as we start to worry about Chinese credit impulse issues as well as bond market problems on the mainland. In other words, the market is likely to see a lot of questions about whether or not growth is going to continue to be a major issue.

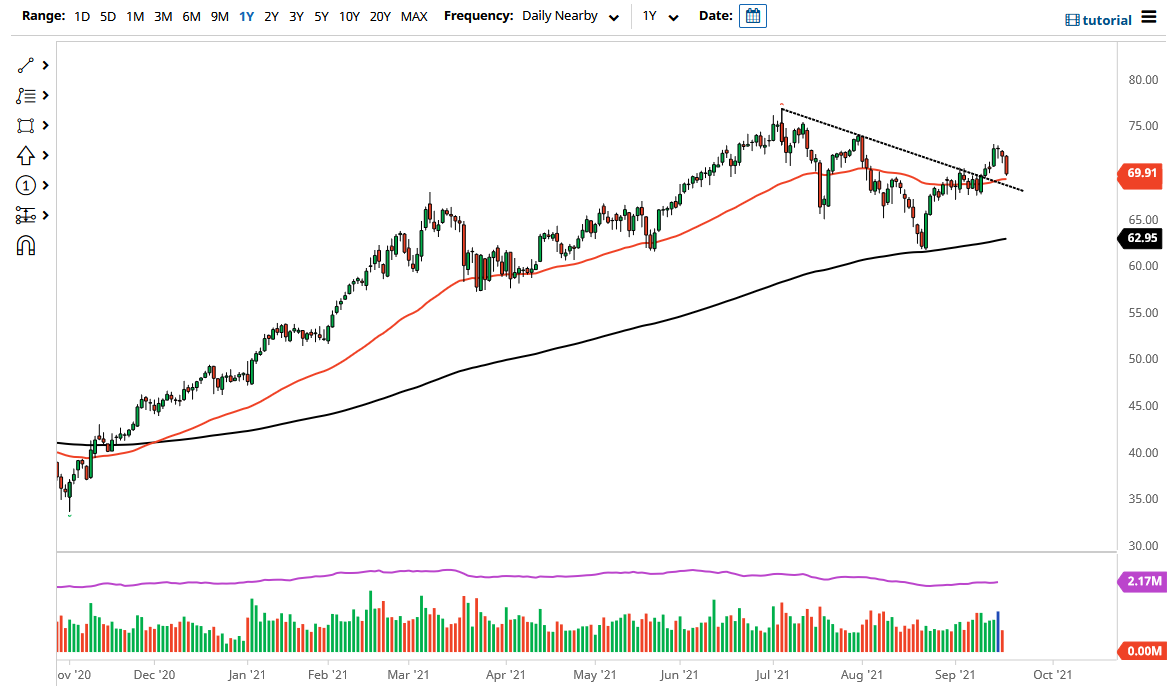

Underneath, the 50 day EMA could offer a bit of support, right along with the downtrend line underneath. The $67.50 level is the bottom of all of that support, so I think it will be worth paying close attention to. If we were to break down below there, then I think crude oil falls apart. That being said, we had recently broken above a major downtrend line and of course the overall trend is going to be worth watching at this point.

All things been equal, this is a market that I think continues to see a lot of questions as to whether or not the demand for crude oil will continue, as there are a lot of concerns about whether or not the pandemic is going to continue to close down economic activity, or if the US dollar is going to strengthen in order to weigh upon the value of crude oil also. Quite frankly, I think there are so many headlines out there flying around right now that it is difficult to imagine how it is going to be easy to simply buy-and-hold, but we are still sitting just above a major support level.

I think you can count on a lot of noisy behavior, but as the market had recently broken through a significant amount of resistance, I do think that it is only a matter of time before we get some type of reason to go higher, because quite frankly that is a major narrative that a lot of traders out there willing to jump into the market. I would expect a lot of noisy behavior, but if you find that your trade is starting to work out a little bit, then building on the position is probably the best way forward.