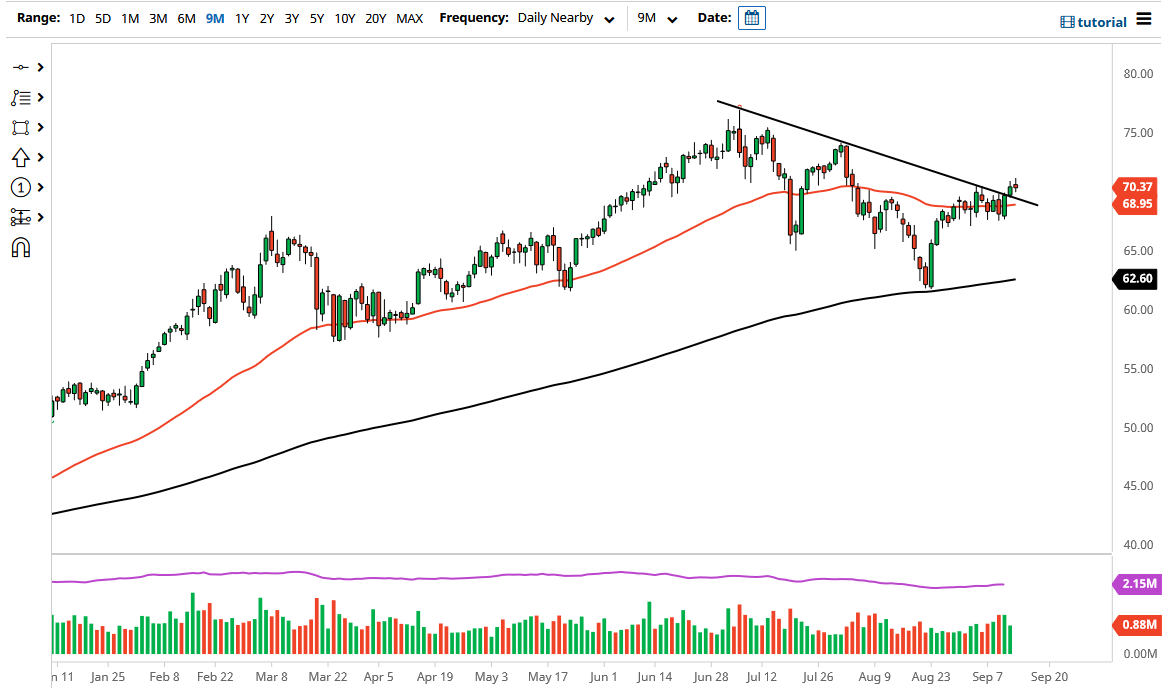

The West Texas Intermediate Crude Oil market showed itself to be a bit flat during the session on Tuesday, despite the fact that we had recently broken above a significant trend line. Now that we are sitting here at the end of the day on Tuesday, it suggests that although we have broken out, it is likely that we will struggle a bit. Underneath, we have the 50-day EMA and the uptrend line coming into the picture, as well as the $70 level. With all of that, it is likely that we will continue to see noisy behavior.

I do believe that eventually the buyers will probably try to pick this market up, but to think that we are simply going to shoot straight up in the air and go racing towards $74 is probably a little unrealistic. The market has seen a lot of selling pressure in that general vicinity previously, so I think it makes sense that we would see even more pressure. Breaking above that obviously would be extraordinarily big for the market to the upside. Having said that, you should also keep in mind that there are lot of questions as to whether or not the market will take off as far as demand is concerned going forward. After all, OPEC has suggested that there is going to be a lot of demand in the next several months, but at the same time inventory numbers are not necessarily mashing with that idea.

If we do break down to the lower levels, I think the $67.50 level has to be paid close attention to, because it is very likely that we would see a lot of selling pressure there due to the break of short-term support. Breaking down below that level opens up the possibility of a move down to the $65 level, and then eventually the 200-day EMA which is sitting just above the $62.50 level. The previous downtrend line being broken is a bullish sign, but there is also the possibility that this has been a bit of a “throw over”, or what is also known as a “false breakout.” We will know this in the next couple of days, so pay close attention to what happens next. If we turn around and break above the top of the candlestick for the session on Tuesday, that means the buyers have taken over again.