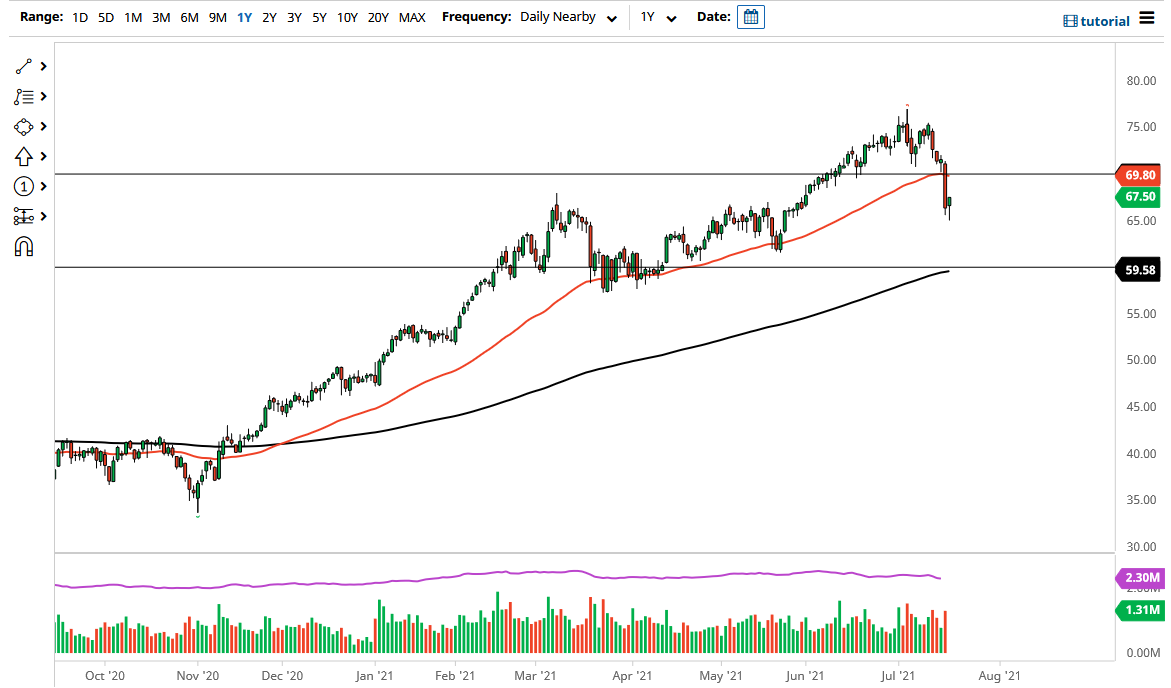

The West Texas Intermediate Crude Oil market pulled back rather significantly during the trading session on Tuesday but then turned around to form a bit of a hammer as we closed just below the $67.50 level. This is an area that has been important in the past, so I think it is very likely that we will get a bit of a bounce from here, perhaps reaching towards the $70 level. The $70 level is a large, round, psychologically significant figure, and I think a lot of people will be paying close attention to it. Furthermore, there is also the 50-day EMA in that same general vicinity as well.

If we do break down below the bottom of the hammer, then it could cause the market to break below that psychologically significant $65 level, opening up the possibility of a move towards the $60 level, where the 200-day EMA sits. I think at this point we are more likely than not to get a bit of a bounce, but I do not necessarily think that the market is going to be able to break out above the $70 level without some type of catalyst. The most recent noise has been due to options markets being levered to the bullish side far too much, and as a result it is likely that we would see quite a bit of shaking out in the process. That being said, OPEC+ has come to some type of an agreement when it comes to the idea of production, which is something that the market desperately needed.

There have been a lot of concerns when it comes to global demand, and it should be noted that we lost about 8% during the trading session on Monday, which is something worth paying attention to because those dates very rarely happen in the midst of a vacuum. Short term, I would anticipate some type of recovery, but it is not until we break above that nasty candlestick from the Monday session that I would be convinced that the longer-term uptrend is going to continue. I expect a lot of noise, and you should probably keep your position size relatively small.