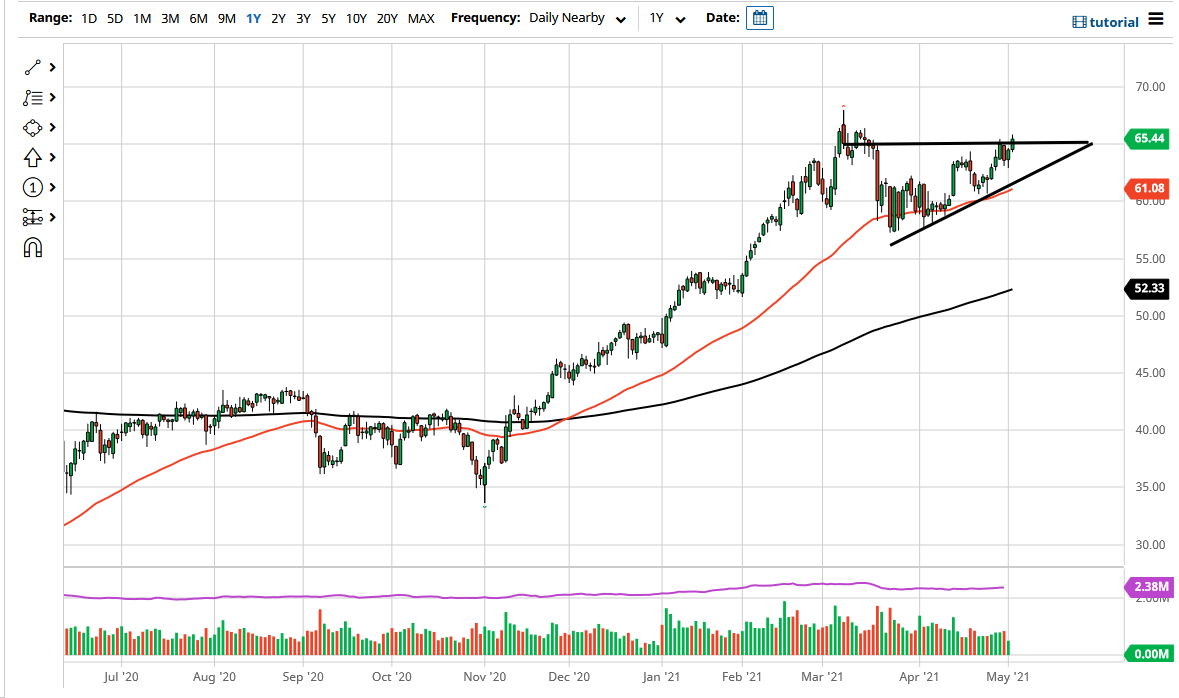

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Tuesday as we are pressing the top of a huge ascending triangle. That being said, market participants continue to see this market as one that is bullish, and even though we are trying to break out of the triangle, it should be noted that there is a lot of noise just above from early March. With that being the case, I think that you need to find short-term dips in order to pick up bits and pieces of value.

At this point in time, if we do pull back, I think there should be plenty of support near the $63.50 level where we have seen buyers jump in during the past. Ultimately, the market is likely to continue to go higher, but given enough time, we will have the occasional pullback. If you look at the overall attitude of the market, I think that we are trying to build up the pressure to the upside, and it is likely that we could then go to the $67.50 level. If we can break above there, then it is likely that we could go looking towards the $70 level. The $70 level would be a large, round, psychologically significant figure, and an area where I would expect to see a little bit of a pullback.

Underneath, the 50-day EMA is climbing the previous uptrend line, which is part of that triangle that I mentioned earlier. If we break down below there, then the market is likely to see more downward pressure, but right now it does not seem likely to happen. At this point, I have no interest in shorting this market until that happens at the very least, which could open up a move down to the $57.50 level, possibly even the 200-day EMA after that. We are in an uptrend and that is the only thing that really matters, so simply look for value as we play the “reopening trade” and the increased demand for energy overall. If the US dollar continues to fall, that could also drive this market much higher, as barrels of crude oil are priced in those same greenbacks. I have no interest in shorting anytime soon and I think the rest of the market feels the same way.