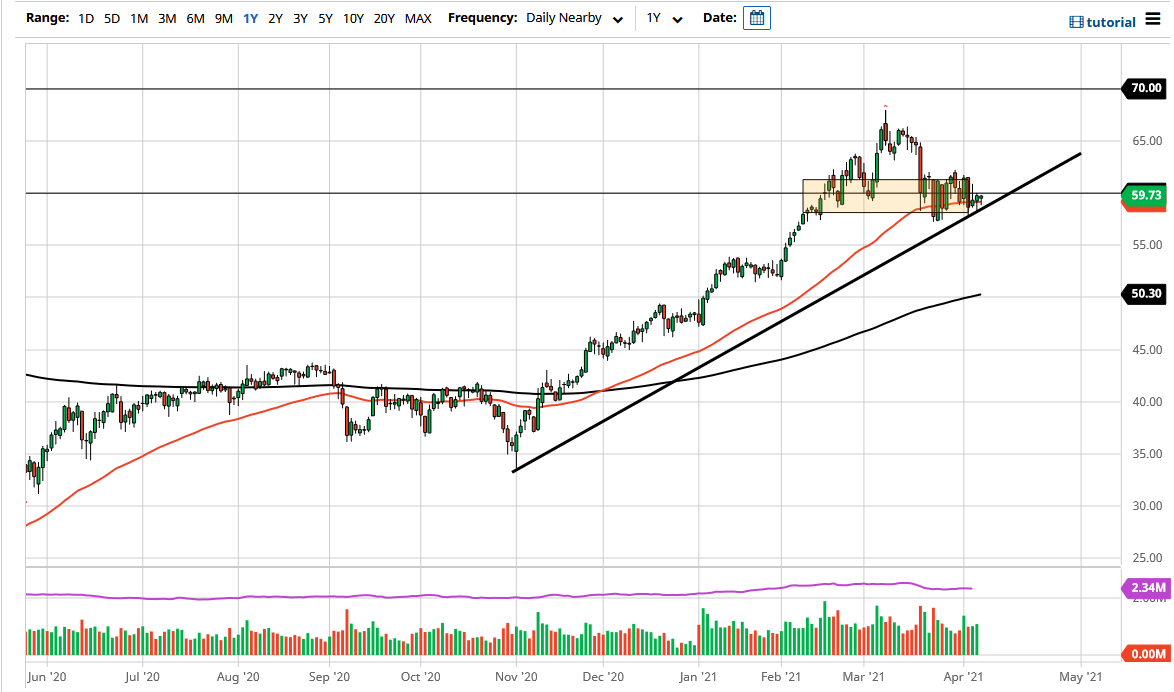

The West Texas Intermediate Crude Oil market has gone back and forth over the last several sessions, but during the Thursday session showed a certain amount of support. At this point time, the $60 level of course is a large, round, psychologically significant figure and it attracts a certain amount of attention. The market is still in the middle of the overall consolidation area. The consolidation area extends from $57.50 level to the $62.50 level.

The 50 day EMA going sideways in the same general vicinity also suggests that we are going to see a lot of choppy and noisy behavior. Beyond that, we also have the uptrend line sitting underneath, and so far, it is likely that we will continue to see that level be respected in the short term. However, if we were to break down below the lows, then it is likely that the market could go down to the $54 level. The $54 level of course has seen an explosive move previously, so I think it would attract a lot of attention in and of itself.

If we break above the $62.50 level, that could send this market looking towards the $65 level, perhaps to the $67.50 level. I do not necessarily think that happens easily, and of course there are a lot of questions when it comes to what is going to happen with crude oil in general, because we have had a recent pullback from inventories in the United States, but at the same time we have seen both gasoline and distillates gain inventory. That shows that there is a severe lack of end-user demand at the moment, but a lot of people are betting on crude oil going to the upside due to the reopening trade

I think at this point it certainly looks as if it is slowing down and it could see a lot of downward pressure at the first signs of trouble. You could also make an argument for a little bit of a small head and shoulders, which could lead to a nice pullback towards the 200 day EMA underneath. Even if that happen, it would not necessarily in the uptrend, but it would help the market work off some of the ridiculous froth that we had seen over the last several months.