In many ways the UK is the best prepared European power market for rapid decarbonisation. It has a large renewable resource base (particularly offshore wind) and an effective CfD support mechanism. It also has a well established & transparent regulatory framework, with a capacity market that has delivered substantial volumes of new flexible capacity.

“While security of supply maths works in theoretical calculations… it does not necessarily work in reality”

However there are some UK market stability warning signals that are flashing orange after the impacts of the 2020 Covid demand shock and a tight current winter. Flexibility lies at the core of the UK market’s problems.

Signs of stress

The UK market operator National Grid has issued 6 Energy Market Notices (EMN) this winter (formerly known as NISMs), a sign of acute system tightness. To put this in perspective there has not been one of these notices since Winter 2016, at the height of the French nuclear outages.

Tight system margins have resulted in surging wholesale and Balancing Mechanism prices. Day-ahead prices surged to over £1400/MWh in mid-January, and system prices reached their highest level since 2001, when two of the West Burton units had offers accepted at £4000/MWh. This system tightness led January to have one of the highest average monthly system prices on record, reaching £77.47/MWh.

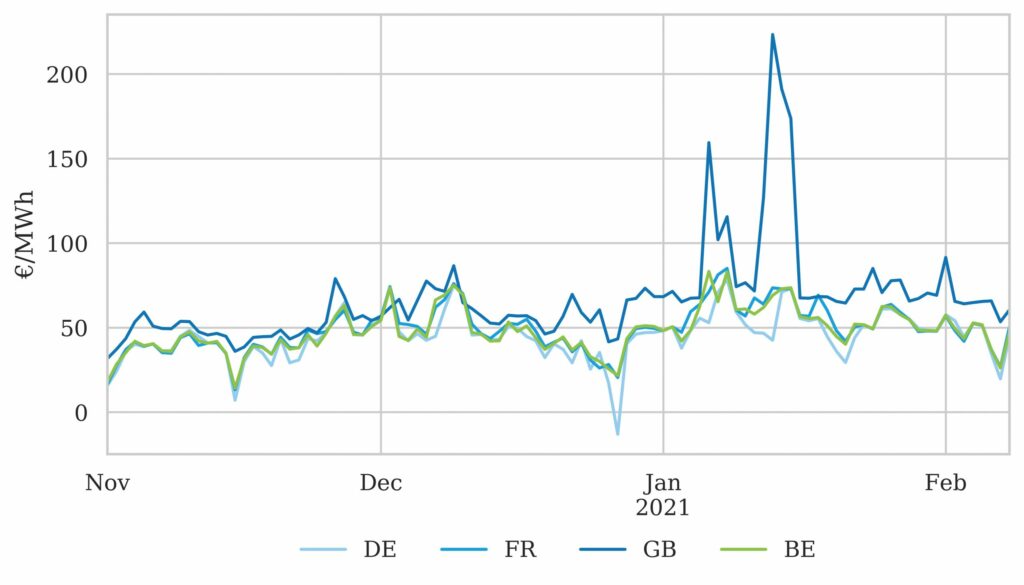

Chart 1 illustrates how tightness this winter in the UK market has created significant price divergence versus Continental power markets. This is both in the form of structurally higher average prices and substantial price spikes during periods of more extreme system stress.

Source: Timera Energy

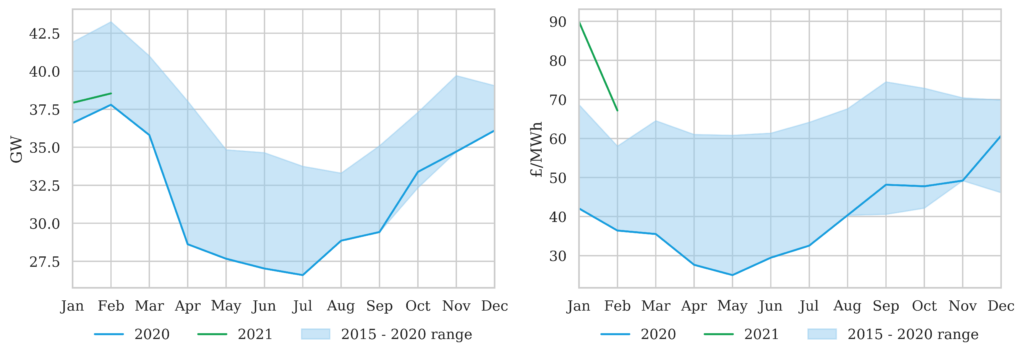

Although it has been relatively cold this winter, UK demand has not been high by historical standards. Chart 2 shows:

- Total demand in 2020-21 versus the range over the last 5 years

- Average delivered baseload day-ahead prices in 2020-21 versus the last 5 year range.

Demand is sitting at the bottom end of the 5 year demand range, while prices in Jan & Feb are sitting above the top of the 5 year price range.

System tightness this winter has been more of a supply side than a demand side issue. Periods of low wind output are a particular challenge (e.g. less than 3GW). This has been exacerbated by specific capacity issues over the current winter e.g. nuclear plants offline, mothballing of the Calon CCGTs and a prolonged outage of the BritNed interconnector.

The UK’s flexibility issues

As decarbonisation of the UK power market accelerates, it is facing a structural flexibility challenge with its capacity mix. The UK is rapidly losing large volumes of baseload (nuclear) & flexible (coal & older gas) generation capacity. This is primarily being replaced with:

- Wind & solar capacity, with substantial output swings and some prolonged periods of low generation

- Interconnectors, with flow volume driven by prices & wind/solar profiles in neighbouring markets

- Gas peakers (primarily reciprocating engines), with relatively high variable costs

- Batteries, of relatively short duration to support balancing (e.g. 1 – 4 hours)

- Smaller volumes of genuine DSR (as opposed to batteries/peakers behind the meter).

This shift in capacity mix is acting to steepen the supply stack and increase wholesale & balancing price volatility.

The amount of incremental capacity required going forward is determined by the government’s capacity auction demand targets. These are set at a level that aims to maintain system security of supply (based on theoretical loss of load expectation calculations).

While this security of supply maths works in a theoretical ‘capacity accounting’ sense, it does not necessarily work in reality. Issues arise for example from:

- Derating factors that do not reflect the real time capacity contribution of given asset types e.g. interconnectors with 50%+ derating factors that export instead of import in cold or low wind periods.

- Purchase of a generic capacity service (availability at 4 hours notice) which does not always address underlying system stress issues e.g. inertia, frequency & constraint related issues.

At a headline level, the capacity market is maintaining the government’s security of supply standard. But in practice, some key areas of flexibility deficit are emerging. Price signals are starting to evolve accordingly with:

- Increases in wholesale & balancing market returns for flexible assets, evidenced by higher returns across the current winter.

- New targeted revenue streams emerging to support more specific system flex requirements e.g. the new Dynamic Containment service for rapid frequency response and inertia related reserve contracts e.g. Stability Pathfinder contracts.

So where does this leave the capacity market?

The two upcoming UK capacity auctions

The UK’s next two capacity auctions will be held in early March. These cover the T-1 top up auction for the 2021-22 capacity year and main T-4 auction for the 2024-25 capacity year.

The UK government recently announced a substantial increase in the T-1 target for 2.4GW of capacity, 2.0 GW higher than the 0.4GW target initially set last summer. The official reason given for this change was dealing with a ‘range of non-delivery uncertainties’. Whatever that means, it likely reflects some of the concerns we set out above relating to system flexibility issues.

This is an aggressive increase in T-1 target at relatively short notice, in what is a much less price responsive and less competitive market (with just over 6 months to delivery). It will be interesting to see how much capacity responds and at what price level.

The government has also fiddled with the T-4 auction demand target, marginally increasing the overall 2024-25 volume target, but allocating 2GW of this to the T-1 top up auction. The net impact is to reduce the T-4 auction demand target to 40.1GW, 1.5GW lower than the level initially announced.

The logic behind shifting significant volume into a less responsive top up market is unclear. But it is likely to put downward pressure on the main auction clearing price, at a time when there is mounting evidence of more structural system flexibility issues. And if the government is successful with some of its rapid electrification targets, it may be buying a lot more than 2GW top up at the year ahead stage (in 2024).

With almost 39GW of existing capacity competing for just over 40GW of contracts, the T-4 auction will likely come down to:

- Exit prices of key ageing thermal units (e.g. remaining coal & older CCGTs)

- How low 3.5GW of derated committed interconnector capacity will be prepared to bid

- To what extent 0.9GW of derated battery projects (1.9GW nominal) are capacity price sensitive (vs bidding at or near zero given the dominant influence of other revenue streams)

- The pricing levels of more competitive new build gas plants which should act to cap auction prices (likely to be dominated by gas recip engines).

The absence of a convincing price signal in the T-4 auction would only act to increase pressure on other more targeted mechanisms to maintain system stability. Ultimately wholesale & BM price signals will reflect flexibility related stress issues in a rapidly changing market.