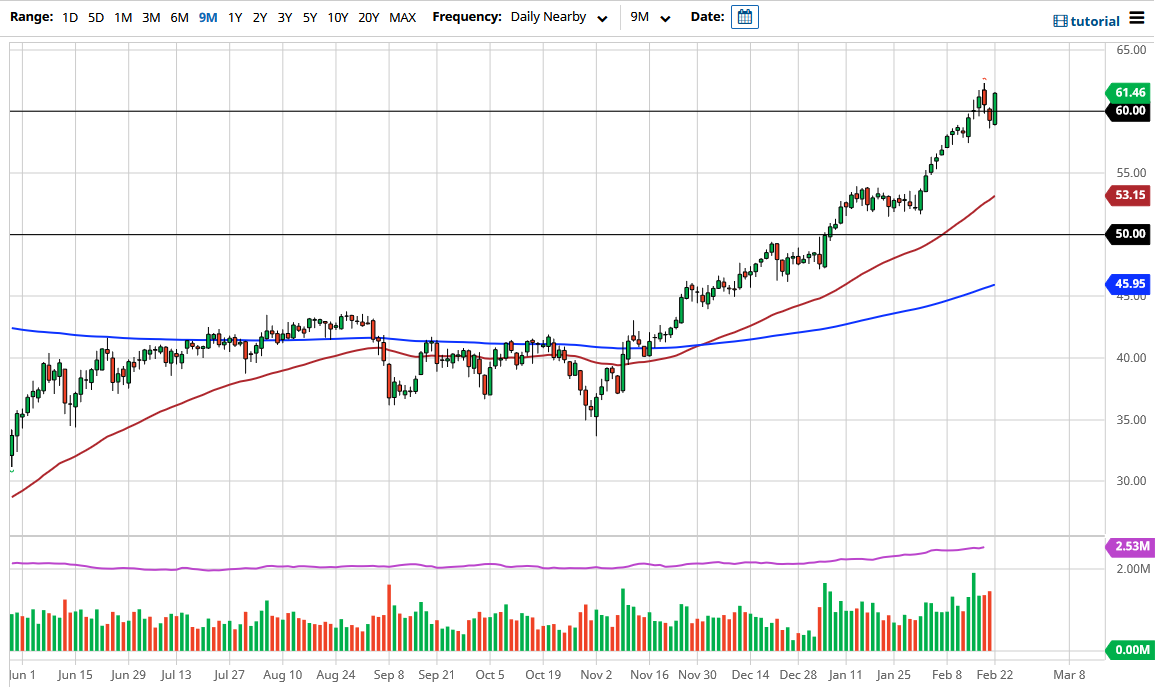

The West Texas Intermediate Crude Oil market had a very bullish candlestick form for the Monday session as it gained 3.8%. This is a huge move to the upside, but what is even more interesting to me is the fact that the weekly candlestick from last week was a shooting star, and we are getting very close to the top of it. Beyond that, we also need to take a close look at the fact that the candlestick closed that the top of the range, which suggests that we could get a bit of follow-through. Ultimately, we could get a breakout in a continued push to the upside in the crude oil market based upon the “reflation trade” that everybody is looking at.

The idea that the economy is opening up soon and that demand for crude oil will be extraordinarily strong is what the market is moving on, but the question now is whether or not it is actually true. In the short term, I do not know that it matters, because it is so obvious that the buyers are firmly in control at the moment. Furthermore, the US dollar has taken a bit of a hit during the trading session, so that helps crude oil as well. I think this is a market that will move on the latest “FOMO story”, but we also have to look at the longer-term picture.

The longer-term picture for crude oil is quite mixed, because demand was falling before the pandemic. Yes, there will be a massive bounce in economic activity, but that will be short-lived. Longer-term, I fully believe that crude oil will have an area above that will cause far too much resistance for traders to push too much further. After all, it is difficult to find traders that are bearish, and eventually the market gets a little too “one-sided” to continue the momentum. Crude oil markets have been somewhat straight up in the air over the last couple of months, so I think that even if we do break out to the upside, the $65 level will be difficult to get above. If we break down below the candlestick from Friday, then it is likely that we could go looking towards the $55 level.