Could coal and renewables put the squeeze on gas?

Rising gas prices, increased energy security and economic recovery at all costs pose risks to Asia’s power sector gas demand growth

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

View Gavin Thompson's full profileAsia is the engine of global gas demand growth, with consumption expected to rise by an average of just under 3% a year over the next two decades. Gas demand will double in China and India by 2040, with its cleaner burning credentials critical to tackling both countries twin challenges of urban air pollution and carbon emissions.

Power generation is an important part of this, and current low gas prices are supporting demand growth in the sector and encouraging pro-gas policies and infrastructure developments. These range from Japan and South Korea looking to gas to achieve emissions reduction to LNG-to-power projects progressing in emerging markets such as Myanmar, Vietnam and Bangladesh. Shifts in contracting terms are also encouraging gas use, as lower levels of oil indexation reduce gas prices through the medium-term compared to historical averages.

But there are risks. The anticipated recovery in gas prices beyond 2022 will hurt the economics of gas-fired generation. New coal plants continue to be developed across the region, while wind and solar capacity is booming. In China, gas power plants are struggling after tariff cuts intended to improve manufacturing competitiveness as trade tensions rise. India’s consumers are more price sensitive than ever as the country looks to rebuild from the chaos of the pandemic. Given these risks, could power sector gas demand in Asia be squeezed between low cost coal plants and increasingly abundant renewables?

Asia’s power generation capacity boom

The electrification of Asia is underway. From just over 3,000 GW currently, Asian power generation capacity will rise by a further 1,000 GW by 2025. China and India dominate - renewables and storage make up 43% of China’s additions and 64% of India’s new capacity. Competitiveness is key as generation costs for new wind and solar instillations tumble across Asia. India is today the regional leader in renewable competitiveness, with solar at a notable discount to even coal-fired generation. And with renewables generation costs expected to fall by a further 30% by 2030, gas-fired power will continue to cede competitiveness.

But this is only part of the story. Coal capacity across Asia is rising and will make up almost 30% of all Asia’s additions by 2025 compared to only 12% for gas. India’s gas-fired fleet will remain flat over the next 5 years, while its coal capacity will grow by 26 GW. Japan and Korea both increase net coal capacity over the next three years, though notably with a greater focus on clean coal technologies.

Read also: Asia Pacific power generation could attract US$1.5 trillion investments this decade

Rising trade tensions and China’s ‘coal parity’ initiative

As international relations deteriorate, and trade tensions rise, China is increasingly adopting a ‘go it alone’ energy policy. Security of supply is firmly back on the agenda. With the upcoming 14th five-year plan expected to include clear policy goals to advance electrification, coal and renewables tick the energy security box.

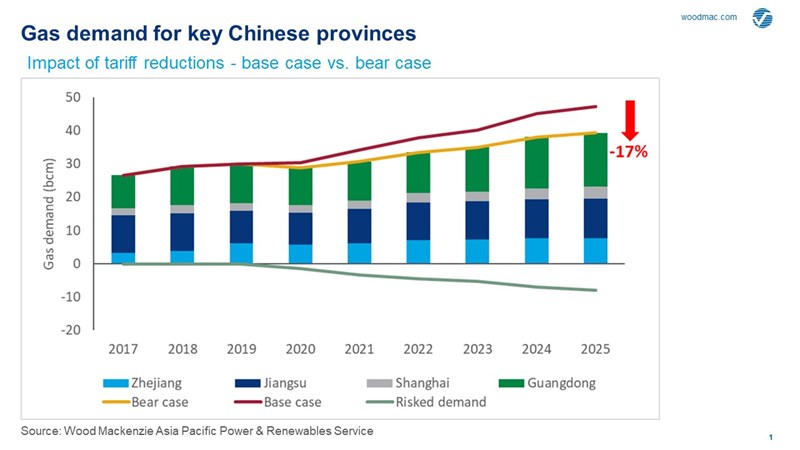

Amidst rising trade tensions, China is seeking to boost manufacturing competitiveness by reducing electricity costs. Regulated gas-fired power tariffs have been cut by up to 28% in key provinces since June. This reduction in tariffs would of course have been less likely without current low gas prices - why give gas-fired power producers extra profits at the expenses of consumers? – but cutting tariffs to levels close to much cheaper coal-fired power is a bold move. China’s ‘coal parity’ initiative is already having a major impact on the economics of the current gas fleet, impacting utilisation and investment decisions for new units. If tariff cuts are maintained, we estimate up to 8 bcm of gas demand from power could be at risk in 2025.

In India, price remains everything

Coronavirus may have sabotaged India's economic growth, but gas generation has increased at the expense of coal in the power sector this year. Low spot LNG prices have done the trick. Can this be maintained? In India’s notoriously price sensitive market, the power sector’s appetite for gas will be at risk as LNG prices begin to recover, and much of the future growth from India’s domestic gas production just looks too expensive for the power sector.

India is a coal-fired nation; over half of all capacity and 70% of electricity generation comes from coal. Investment in new coal-power projects has been hit hard but will recover as reforms deepen and demand improves. India will add a further 26 GW by 2025.

The country has hugely ambitious plans for renewables, targeting 175 GW of solar and wind capacity by 2022. This may have looked unrealistic even before the pandemic, but solar and wind capacity will climb above 110 GW by this time nonetheless.

As for the outlook for growth in India’s gas-fired capacity over the next few years, it is virtually non-existent. A recovery in gas prices therefore risks slowing the progress in power sector gas demand seen in 2020. Price is everything in India, and gas could still feel the squeeze.

The continuing case for gas

Despite concerns, I am cautious not to overplay the risks of a squeeze to Asian gas demand. Gas’ role in emerging Asian economies is irreplaceable in supporting policies to control emissions and air pollution. China and India both recognise this and will look to balance competitiveness with sustainability. Firm targets are being set for gas penetration, policies bolstered to support displacement of coal and emissions trading systems are being developed (albeit too slowly). Gas’ reliability and flexibility is essential to power systems across Asia as renewables penetration increases.

Both policy and investment in support of gas are being directly influenced by the current low prices, more so than just 12 months ago. This gives power sector gas investment a tremendous window of opportunity, particularly as prices are expected to recover beyond 2022. And as prices rise, it will be increasingly critical that Asian governments continue to support gas demand, pursuing economic recovery in parallel with, not in preference to, addressing emissions.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.