The Fed meets this week, but don’t get your hopes up for big changes in policy or additional details about the Fed’s new “average inflation targeting” strategy. The Fed’s objective is to maintain policy flexibility rather than to commit to a time frame by which to reach the average 2% inflation goal. For the moment, the Fed remains content to simply entrench expectations that the policy path is locked down at zero for the foreseeable future. There are some risks to this strategy.

This is important, so let’s all pay attention: The Fed’s new “average inflation target” strategy is not really an “average inflation target” strategy. Federal Reserve Chair Jerome Powell described it as “flexible average inflation targeting.” What does “flexible” mean? It means the Fed gets to make up the definition of success as they see fit. There is no fixed time frame associated with meeting the target which means the target really isn’t a target. I know some journalist is going to ask for specific details at this week’s press conference, but I very much doubt they are going to get anything more specific out of Powell.

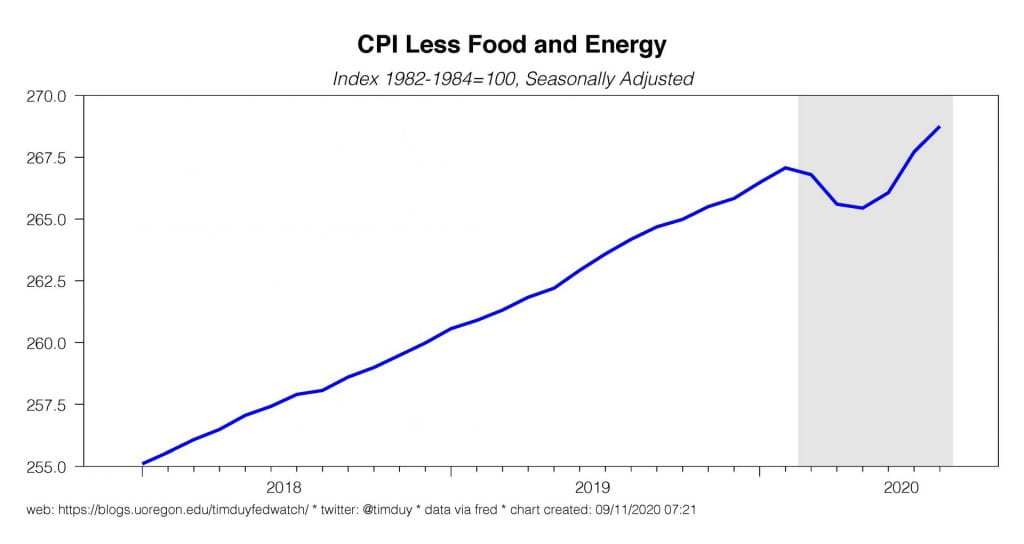

So what then is the benefit of the Fed’s new strategy? It allows the Fed to let inflation run above 2%, something they did not consider an option under the previous inflation targeting strategy. This is an important and meaningful change. It’s particularly important in the context of a recovery that appears more rapid than anticipated. Along with the more rapid recovery is a faster pace of inflation:

And note that the price level looks to be returning to its pre-Covid trend, something you might consider a victory under average inflation targeting:

In the last cycle, we would be looking at those numbers and, in the context of the more rapid than anticipated decline in the unemployment rate, start thinking that maybe the Fed would be shifting into a more hawkish direction. But we aren’t thinking that now. Now we are thinking that there is nothing in the data to prompt a more hawkish reaction from the Fed. We don’t think falling unemployment is by itself meaningful nor do we think inflation at or even modestly above 2% necessarily prompts a hawkish reaction from the Fed. Instead, the Fed is content to allow real interest rates to continue to drop and presumably content to allow them to fall even a notch further than the last cycle:

As long as we all believe this, and the Fed keeps reinforcing it, the Fed doesn’t feel a need to provide more specific details of what exactly is the definition of “average.” There is no point in trying to develop an internal consensus around specifics if you don’t need to.

The Fed’s current strategy is not without risk. I suspect the overarching message from this meeting will maintain the theme that given the loss of fiscal support, the recovery is very fragile and dominated by downside risks such that they laugh at even the idea of thinking about raising interest rates. In other words, the Fed is committed to fighting the last battle, the long, slow recovery experienced in the wake of the Great Recession. The Fed is absolutely unprepared for any outcomes on the right-hand side of the distribution. That opens up the risk that the Fed finds itself pivoting in twelve months or sooner. My general warning is that digging deep into a bearish pit caused many to miss the equity recovery; the same thing could cause us to miss a Fed pivot.

The second risk hanging out there is that the Fed gave itself a “get out of jail free” card by elevating the importance of financial stability in the new strategy guidelines. It and we really don’t know how and when that clause will be enforced. You kind of have to wonder what happens if the Fed’s commitment to maintaining deeply negative interest rates keeps the heat up under risk assets as you might expect it to.

Bottom Line: The odds favor the Fed maintains the status quo at this week’s meeting. It does not appear to have a consensus on enhancing forward guidance nor do I suspect FOMC participants feel pressure to force a consensus on that topic just yet. The general improvement in the data likely removes that pressure. The Fed will likely remain content to use the new strategy as justification for maintaining the current near zero rate path. Powell will continue to lean heavily on downside risks to the economy to entrench expectations that the Fed will stick to that path. The dovish risk this week is that the Fed does surprise with either more specific guidance or an alteration of the asset purchase program to favor longer term bonds. I don’t see a lot of risk for a hawkish outcome unless it was something unintentional in the press conference.