The West Texas Intermediate Crude Oil market has shown itself to be slightly bullish, as we continue to grind overall to the upside. At this point, the market shows signs of buying on the dips, but at this point in time we just do not have any momentum. We are in the midst of vacation season, so we are going to see a lot less momentum when it comes to a lot of markets, not just the crude oil markets. That being said, there are a handful of things that could move this market, but right now we are focusing on just a few things.

The first thing of course is the fact that the US dollar continues to drop in value, and therefore it will push commodities higher overall. The crude oil markets are one of the places people go to buy “assets” when the greenback loses value. After all, crude oil is a major market and of course is priced in US dollars. Furthermore, with the Federal Reserve flooding the market with greenbacks, it makes sense that we will continue to see the US dollar lose value. That should continue to push this market higher and eventually towards the $49 level.

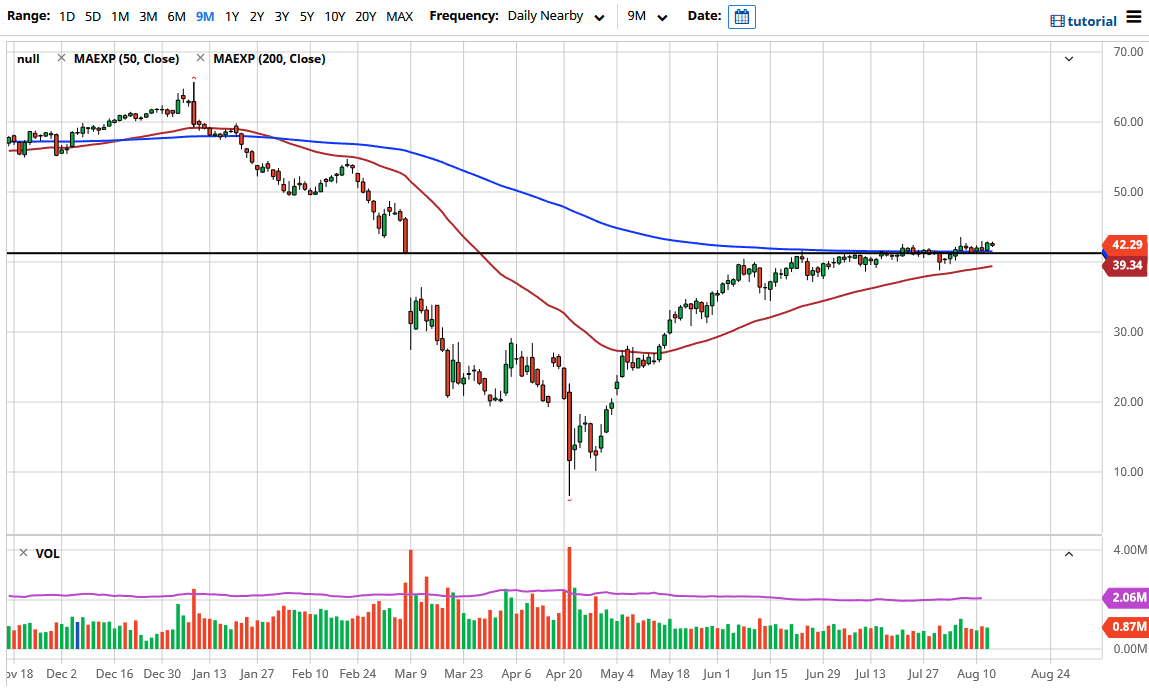

Ultimately, to the downside I think there is significant support in the form of the $40 level, especially now that the 50 day EMA is sitting just below there and rising. Overall, I think it is only a matter of time before we break out to the upside but we are going to need to see some type of catalyst for that to finally happen, or at the very least we are going to need to see more volume come into play, as a lot of the big players simply are not here. There are a lot of moving pieces beyond that, with the OPEC production cuts been bullish but at the same time we have to worry about whether or not there is significant demand. Because of this, I do not expect a major move in the short term. However, I do like the idea of buying short-term pullbacks for short-term trades. Given enough time, I do think that we reach that $49 level which should extend as resistance all the way to the $50 level. However, if we were to break down below the 50 day EMA then we could make a move towards the $35 level, maybe even the $30 level but that is the least likely of outcomes.